Shares of PayPal Holdings (NASDAQ: PYPL) are up 6% since the company reported better-than-expected second-quarter results earlier this month.

Shares of PayPal Holdings (NASDAQ: PYPL) are up 6% since the company reported better-than-expected second-quarter results earlier this month. Earnings fell 19% from the year-ago quarter to $0.93 per share, while revenue grew 9% to $6.8 billion. The company topped analysts’ expectations, which called for earnings of $0.87 per share on revenue of $6.78 billion.

The company also made two significant announcements.

1) PayPal instituted what it terms “an invigorated capital return program,” which includes a new $15 billion share buyback authorization and a comprehensive evaluation of capital return alternatives.Not coincidentally, this is occurring as a new CFO, Blake Jorgensen, takes the helm of the company’s financial operations.

In its earnings release, PayPal noted that it returned $2.25 billion to shareholders in the form of share repurchases in the first half of this year. The company said this represents about 95% of free cash flow generated in the first half. It added that share repurchases for fiscal year 2022 should reach about $4 billion.

Why are buybacks significant? Companies do this for various reasons, including internal valuations indicating that shares may be undervalued.

With a smaller number of shares available, earnings per share will, of course, increase. So a buyback can increase the value of a share for existing owners.

2) The company also said it conducted a “comprehensive operational review to identify substantial efficiency opportunities and growth initiatives.”In other words, it’s cutting costs and simultaneously seeking higher growth. It announced about $900 million in cuts throughout the company. “

The release went on to say, “On an annualized basis, these FY'22 savings, in conjunction with additional initiatives, are expected to generate savings of at least ~$1.3 billion in FY'23.”

Along the lines of cost-cutting, earlier this year, PayPal announced layoffs and incurred a charge of $71 million in the second quarter, to cover severance payments and related expenses. Ultimately, the layoffs are expected to slash about $260 million in costs in 2022.

The $2 Billion Activist Investor

Additionally, in the release, the company included a statement from Jesse Cohn, managing partner at Elliott Investment Management. Cohn said, “As one of PayPal's largest investors, with an approximately $2 billion investment, Elliott strongly believes in the value proposition at PayPal … Today's announcement highlights a number of steps that have been underway and are being initiated to help realize the significant value opportunity at the Company.”

Elliott is known to be an activist investor, meaning it will have a say in the cost cuts and other operational decisions related to firm profitability.

So how did institutional investors, as a whole, the ones who account for about 75% (or more) of trading volume, greet these moves?

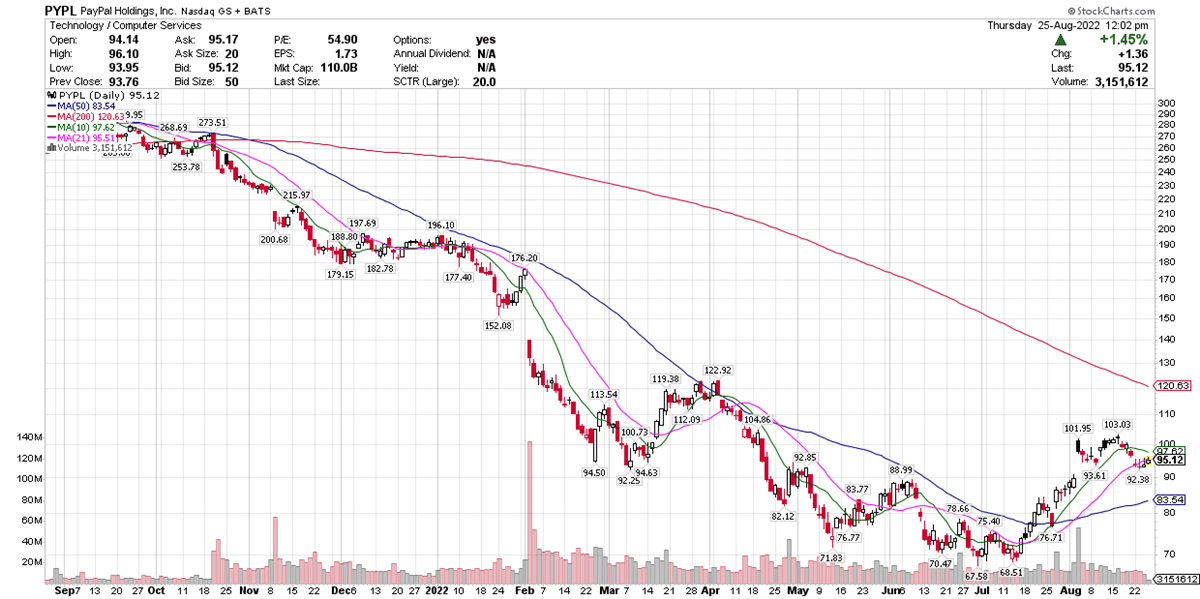

There was certainly initial enthusiasm, as shares gapped up 9.25% immediately following the report. Since then, there’s been some selling, which isn’t unusual.

Some investors see a big price move as an opportunity to take some profits, even when the stock remains well below prior highs, as is the case with PayPal. For example, if a hedge fund had purchased shares when the stock was trading lower in May, June or July, the gap-up would have been an easy place to lock in some gains.

How PayPal Stacks Up

Here is how PayPal and two other prominent stocks within the broader sub-industry of electronic payments have performed in the past month:

- PayPal: +15.68%

- Affirm Holdings (NASDAQ: AFRM): +12.92%

- Block (NYSE: SQ): +1.14

Despite PayPal’s outperformance and some clear signs of renewed institutional buying, there are still some risk factors. In particular, PayPal shares are trading below both their 10-day and 21-day moving averages.

In addition, the 200-day average is above the shorter-term lines, meaning there’s not yet enough momentum in the short term. However, when (not if) the 50-day line crosses above the 200-day, that may be a signal that an uptrend has some staying power.