ENDEAVOUR INCREASES ITY’S M&I RESOURCES BY 17% TO 5.2MOZ

WITH FURTHER INCREASES EXPECTED IN 2023

HIGHLIGHTS:

|

London, 29 November 2022 – Endeavour Mining plc (LSE:EDV, TSX:EDV, OTCQX:EDVMF) (“Endeavour” or the “Group” or the “Company”) is pleased to announce that its exploration programme at its Ity mine in Côte d’Ivoire has resulted in the successful delineation of 0.75Moz of Measured and Indicated (“M&I”) resources, lifting the mine’s M&I resources to over 5 million ounces, as presented in Table 1 below.

Table 1: Ity Mine Updated Mineral Resource Estimate

| PREVIOUS RESOURCE (As at 31 December 2021) | UPDATED RESOURCE (Excluding 2022 mine depletion) | VARIANCE | |||||||

| On a 100% basis. M&I Resources shown inclusive of Reserves. | Tonnage | Grade | Content | Tonnage | Grade | Content | Au Content | ||

| (Mt) | (Au g/t) | (Au koz) | (Mt) | (Au g/t) | (Au koz) | (Au koz) | |||

| Measured Resource | 12.1 | 0.88 | 344 | 11.2 | 0.78 | 283 | -61 | ||

| Indicated Resources | 77.3 | 1.66 | 4,131 | 89.3 | 1.72 | 4,944 | +814 | ||

| M&I Resources | 89.5 | 1.56 | 4,475 | 100.6 | 1.62 | 5,228 | +753 | ||

| Inferred Resources | 27.1 | 1.47 | 1,279 | 15.9 | 1.59 | 810 | -469 | ||

Updated Resource is current as at 31 December 2021, as it excludes 2022 mine depletion. Mineral Resources Estimates follow the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") definitions standards for mineral resources and have been completed in accordance with the Standards of Disclosure for Mineral Projects as defined by National Instrument 43-101. Reported tonnage and grade figures have been rounded from raw estimates to reflect the relative accuracy of the estimate. Minor variations may occur during the addition of rounded numbers. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Resources were constrained by MII Pit Shell and based on a cut-off grade of 0.5 g/t Au and $1,500/oz gold price. Details for the Updated Resource are provided in the Technical Notes section of this press release. For details regarding the 31 December 2021 resources, please consult the press release dated [date] of Endeavour.

In addition to the delineated resources, drilling conducted during the year also confirmed mineralisation at extensions of several known orebodies and at new targets, which will form the basis for the 2023 drilling programme with the goal of delineating further resources.

Sebastien de Montessus, President and CEO, said: “We are very proud of our achievements at Ity following its successful build in 2019. The mine now ranks amongst the highest quality operations within West Africa due to its low-cost production profile and long mine life. This status has been underpinned by our significant exploration success at Ity, which has led to a more than doubling of the resource base since its feasibility study was published in 2016, coupled with a strong operating performance.

We are very pleased to demonstrate that now all three of our flagship assets, Sabodala-Massawa, Houndé and Ity, boast M&I resources above 5 million ounces each, with exploration remaining an integral part of our capital allocation strategy as it underpins our ability to maintain long mine lives and continually optimise our portfolio. Looking ahead, we continue to see significant exploration potential at Ity as we remain on track to achieve our objective of discovering between 3.5 to 4.5Moz of Indicated resources over the 2021-2025 period, with nearly 2.0Moz discovered already. At a group level, we are pleased to also be on track to discovering between 15 to 20Moz of Indicated resources over the same period.

On the operational front, Ity continues to perform well as it is on track to beat its full-year production guidance of 255—270koz and its AISC guidance of $850—900 per ounce.”

Patrick Bouisset, Executive Vice President Exploration and Growth said: “Today’s resource additions are the culmination of several years of exploration efforts which we are extremely proud of. We first discovered the Bakatouo deposit in late 2016, which was soon followed by exploration successes at the Walter and Ity Flat deposits and the West Flotouo discovery. Today, we have successfully proven that all seven of the previously thought independent deposits located around the Ity intrusive are in fact a continuous mineralised system. In addition to the resource delineated, the benefit of this discovery is the creation of a unique resource model which is expected to greatly improve our mine planning capabilities.

Following the work this year to prove mineralised continuity of known orebodies and to identify mineralisation at new targets, we believe that we are well-positioned for continued success in 2023 as we look to delineate further resources. In addition to discoveries made in both the near-mill area and in the Le Plaque area, we are very excited about the discovery made at Gbampleu where several high-grade and thick lenses of mineralisation were identified.”

ITY MINE 2022 EXPLORATION PROGRAM

In recent years, exploration efforts have focused on the PE26 mining permit (which hosts the processing plant and several deposits including Walter, Bakatouo, West Flotouo, Ity-Flat, Verse Est, and Zia NE), on PE49 mining permit (which hosts the Daapleu and Gbeitouo deposits) and on the PE53 mining permit (which hosts the Le Plaque and Yopleu-Legaleu deposits and other targets including Delta South East).

Since the beginning of the year, a total of 51,181 meters of drilling was completed at Ity, mainly within a 20km radius from the plant, as shown in Figures 1 and 2 below. The exploration programme mostly focused on extending resources at several near mine deposits including Walter-Bakatouo, West Flotouo, Delta Extension at Le Plaque and Yopleu-Legaleu, delineating potential deposit extensions at Colline Sud, and on assessing the potential of new greenfield targets including Gbampleu, and Delta South East.

| Figure 1: Endeavour Controlled 120km Ity Mine Corridor | Figure 2: Ity Near Mill Map |

As detailed in Table 2 below, a total of 753koz of M&I resources were delineated since the beginning of the year, with the additions coming from West Flotouo, Yopleu-Legaleu, Ity-Ity Flat, Verse Est, and Walter.

Table 2: Ity Resource Additions

| PREVIOUS RESOURCE (As at 31 December 2021) | UPDATED RESOURCE (Excluding 2022 mine depletion) | VARIANCE | |||||||

| On a 100% basis. M&I Resources shown inclusive of Reserves. | Tonnage | Grade | Content | Tonnage | Grade | Content | Au Content | ||

| (Mt) | (Au g/t) | (Au koz) | (Mt) | (Au g/t) | (Au koz) | (Au koz) | |||

| West Flotouo | |||||||||

| Measured Resource | 0.0 | 0.00 | 0 | 0.0 | 0.00 | 0 | 0 | ||

| Indicated Resources | 9.0 | 2.00 | 582 | 18.7 | 1.80 | 1,083 | +501 | ||

| M&I Resources | 9.0 | 2.00 | 582 | 18.7 | 1.80 | 1,083 | +501 | ||

| Inferred Resources | 7.3 | 1.84 | 430 | 4.7 | 1.73 | 263 | -167 | ||

| Verse Est | |||||||||

| Measured Resource | 0.0 | 0.00 | 0 | 0.0 | 0.00 | 0 | 0 | ||

| Indicated Resources | 0.0 | 0.00 | 0 | 1.1 | 1.80 | 64 | +64 | ||

| M&I Resources | 0.0 | 0.00 | 0 | 1.1 | 1.80 | 64 | +64 | ||

| Inferred Resources | 1.2 | 1.54 | 61 | 0.5 | 1.31 | 21 | -40 | ||

| Walter | |||||||||

| Measured Resource | 0.0 | 0.00 | 0 | 0.0 | 0.00 | 0 | 0 | ||

| Indicated Resources | 8.7 | 1.62 | 451 | 10.2 | 1.56 | 512 | +61 | ||

| M&I Resources | 8.7 | 1.62 | 451 | 10.2 | 1.56 | 512 | +61 | ||

| Inferred Resources | 4.8 | 1.44 | 222 | 2.2 | 1.28 | 90 | -132 | ||

| Bakatouo | |||||||||

| Measured Resource | 0.0 | 0.00 | 0 | 0.0 | 0.00 | 0 | 0 | ||

| Indicated Resources | 7.0 | 2.08 | 467 | 6.8 | 2.14 | 466 | -2 | ||

| M&I Resources | 7.0 | 2.08 | 467 | 6.8 | 2.14 | 466 | -2 | ||

| Inferred Resources | 1.3 | 1.47 | 63 | 1.3 | 1.70 | 73 | 10 | ||

| Ity - Ity Flat | |||||||||

| Measured Resource | 0.0 | 0.00 | 0 | 0.0 | 0.00 | 0 | 0 | ||

| Indicated Resources | 5.2 | 1.82 | 306 | 7.0 | 2.09 | 468 | +162 | ||

| M&I Resources | 5.2 | 1.81 | 306 | 7.0 | 2.09 | 468 | +162 | ||

| Inferred Resources | 5.7 | 1.41 | 255 | 2.8 | 1.80 | 163 | -92 | ||

| Zia NE | |||||||||

| Measured Resource | 0.9 | 2.12 | 61 | 0.0 | 0.00 | 0 | -61 | ||

| Indicated Resources | 7.2 | 1.03 | 238 | 4.2 | 1.47 | 197 | -41 | ||

| M&I Resources | 8.1 | 1.15 | 299 | 4.2 | 1.47 | 197 | -102 | ||

| Inferred Resources | 5.2 | 1.14 | 191 | 3.6 | 1.63 | 187 | -4 | ||

| Yopleu-Legaleu | |||||||||

| Measured Resource | 0.0 | 0.00 | 0 | 0.0 | 0.00 | 0 | 0 | ||

| Indicated Resources | 0.0 | 0.00 | 0 | 1.2 | 1.78 | 69 | +69 | ||

| M&I Resources | 0.0 | 0.00 | 0 | 1.2 | 1.78 | 69 | +69 | ||

| Inferred Resources | 1.0 | 1.61 | 52 | 0.1 | 1.91 | 7 | -44 | ||

| Total Additions | |||||||||

| Measured Resource | 0.9 | 2.13 | 61 | 0.0 | 0.00 | 0 | -61 | ||

| Indicated Resources | 37.1 | 1.71 | 2,044 | 49.1 | 1.81 | 2,858 | +814 | ||

| M&I Resources | 38.0 | 1.72 | 2,105 | 49.1 | 1.81 | 2,858 | +753 | ||

| Inferred Resources | 26.5 | 1.50 | 1,274 | 15.3 | 1.64 | 805 | -469 | ||

Updated Resource is current as at 31 December 2021, as it excludes 2022 mine depletion. Mineral Resources Estimates follow the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") definitions standards for mineral resources and have been completed in accordance with the Standards of Disclosure for Mineral Projects as defined by National Instrument 43-101. Reported tonnage and grade figures have been rounded from raw estimates to reflect the relative accuracy of the estimate. Minor variations may occur during the addition of rounded numbers. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Resources were constrained by MII Pit Shell and based on a cut-off grade of 0.5 g/t Au and $1,500/oz gold price. Details for the Updated Resource are provided in the Technical Notes section of this press release. For details regarding the 31 December 2021 resources, please consult the press release dated [date] of Endeavour.

NEAR MILL EXPLORATION EFFORTS

The resource model 3D views, in Figures 3 and 4 below, illustrate the exploration success and improved understanding achieved in the near-mill area between 2017 (when plant construction was launched) and today. A maiden resource for the Bakatouo deposit was delineated in 2016 and since then several new deposits and extensions have been discovered, including Bakatouo extension, West Flotouo, Walter and Ity-Ity Flat. The area, which spans 7km long by 3km wide, today hosts 2.8Moz at 1.81g/t Au.

The drilling efforts conducted in 2022 successfully demonstrated that all 7 of the previously thought independent deposits located around the Ity intrusive are in fact a continuous mineralised system. This finding has resulted in the creation of a single resource model for the area which is expected to greatly improve mine planning capabilities.

Figure 3: 2017 Grand Ity Resource Model (3D View Looking North)

Figure 4: 2022 Grand Ity Resource Model (3D View Looking North)

As shown in Figure 5 below, lithologies in the Ity area comprise a series of lower Proterozoic (Birimian) volcanosediments and carbonate lenses intruded by a granodiorite. Skarn formations have been developed in the carbonate-bearing units in the vicinity of the intrusion. The different Ity area deposits are distributed all around the intrusion, in both meta-volcanosediments (West Flotouo, Flotouo Extension, Verse East) and skarns formations (Ity, Zia NE, Walter, Bakatouo). Gold mineralisation occurred during a late Birimian orogenic hydrothermal event, within transpressive shear zones that developed at the margin of the intrusion.

The geological contexts of the Le Plaque and Daapleu deposits differ from that of Ity; in the Le Plaque area, gold mineralisation is essentially hosted in granodiorite, which was itself intruded by several generations of diorite; at Daapleu, gold mineralisation occurred at the contact between meta-volcanosediments and a rhyolitic intrusion (different from granodiorite) locally named Daaplite.

Figure 5: West Flotouo map

Junction between West Flotouo and Flotouo Extension (“West Flotouo”)

- Following promising initial results from the 2021 campaign, 76 additional holes amounting to 16,779 meters were drilled in 2022 to increase the resources and to delineate the northeast mineralisation extension in the area called Flotouo Extension.

- The West Flotouo/Flotouo Extension deposit is now the Ity mine’s largest deposit and the mineralisation remains open along strike and at depth.

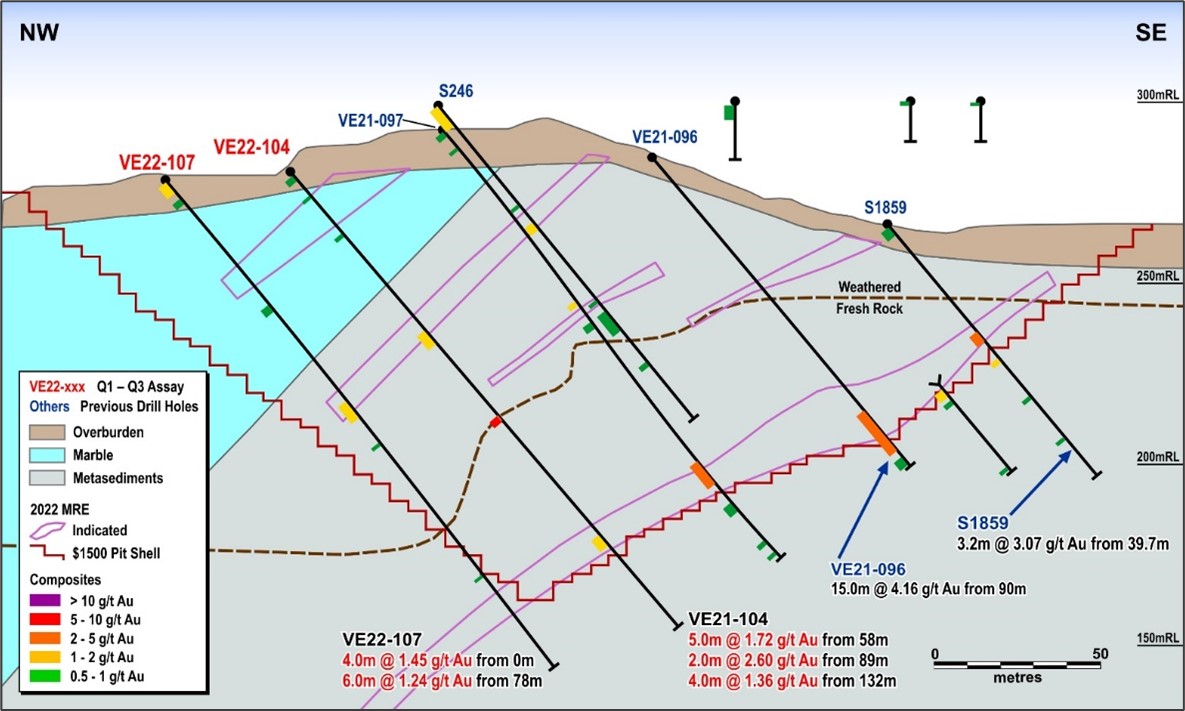

- As shown in Figures 6 and 7 below, the general gold mineralisation of the West Flotouo/Flotouo Extension is overall northeast-southwest trending, moderately dipping to the northwest and has been identified over a 1km strike length. Host rocks comprise sheared clastic sediments in the southern part and skarns in the northern part of the deposit.

- The West Flotouo/Flotouo Extension deposit will be integrated into the mine plan as soon as possible given it is an attractive discovery due to its high grade and very close proximity to the plant.

Figure 6: West Flotouo cross-section

Figure 7: West Flotouo cross-section

Junction between Walter – Bakatouo deposit

- A total of 51 holes amounting to 9,037 meters were drilled in 2022 to convert the Inferred resources to Indicated status and increase the resources at the junction between the Walter and Bakatouo skarn hosted gold deposits.

- As shown in Figure 8 below, the 2022 drill results have returned significant intercepts with large thicknesses and high grades which confirmed the continuity of the deposit.

- Best selected intercepts include:

- Hole WA22-119: 5 meters at 2.48g/t Au from 200m and 7 meters at 34.96 g/t Au from 207 meters

- Hole WA22-134: 14 meters at 5.95g/t Au from 35 meters

- The mineralised lenses are still open at depth and along strike.

Figure 8: Walter – Bakatouo cross-section

Junction between Bakatouo Northwest - Zia Northest deposits

- A total of 8 holes amounting to 1,008 meters were drilled in 2022 at the junction between the Zia Northeast and Bakatouo deposits. The purpose was to confirm the continuity of the mineralisation in this zone which is located in proximity to the Ity plant.

- As shown in Figure 9 below, the 2022 drill results returned significant shallow mineralised intercepts, with best selected intercepts including:

- Hole BK22-337: 14 meters at 1.99g/t Au from 43.3 meters

- Hole BK22-332: 10 meters at 1.24g/t from 26 meters

- The resource additions will be quickly converted into reserves and prioritised in the mine plan given the shallow nature of the orebody and its proximity to the plant.

Figure 9: Bakatouo Northwest - Zia Northest cross-section

Verse Est deposit

- A total of 16 holes amounting to 1,638 meters were drilled in 2022 at Verse Est. The purpose was to follow-up on the positive drilling results from the prior years’ campaign, that identified the 500-meter long, shallow lying, mineralised system, which is located in close proximity to the Ity plant, adjacent to a former mining waste area on the Eastern side of the Mont Ity pit.

- As shown in Figure 10 below, the 2022 drill results confirmed the continuity of the mineralisation with significant shallow-lying intercepts with best selected intercepts including:

- Hole VE22-105: 11 meters at 4.17g/t Au from the surface

- Hole VE22-103: 7 meters at 1.69g/t Au from 37 meters

- The resource additions will be quickly converted into reserves and prioritised in the mine plan given the shallow nature of the orebody and its proximity to the plant.

Figure 10: Verse Est cross-section

LE PLAQUE AREA EXPLORATION EFFORTS

Yopleu-Legaleu deposit

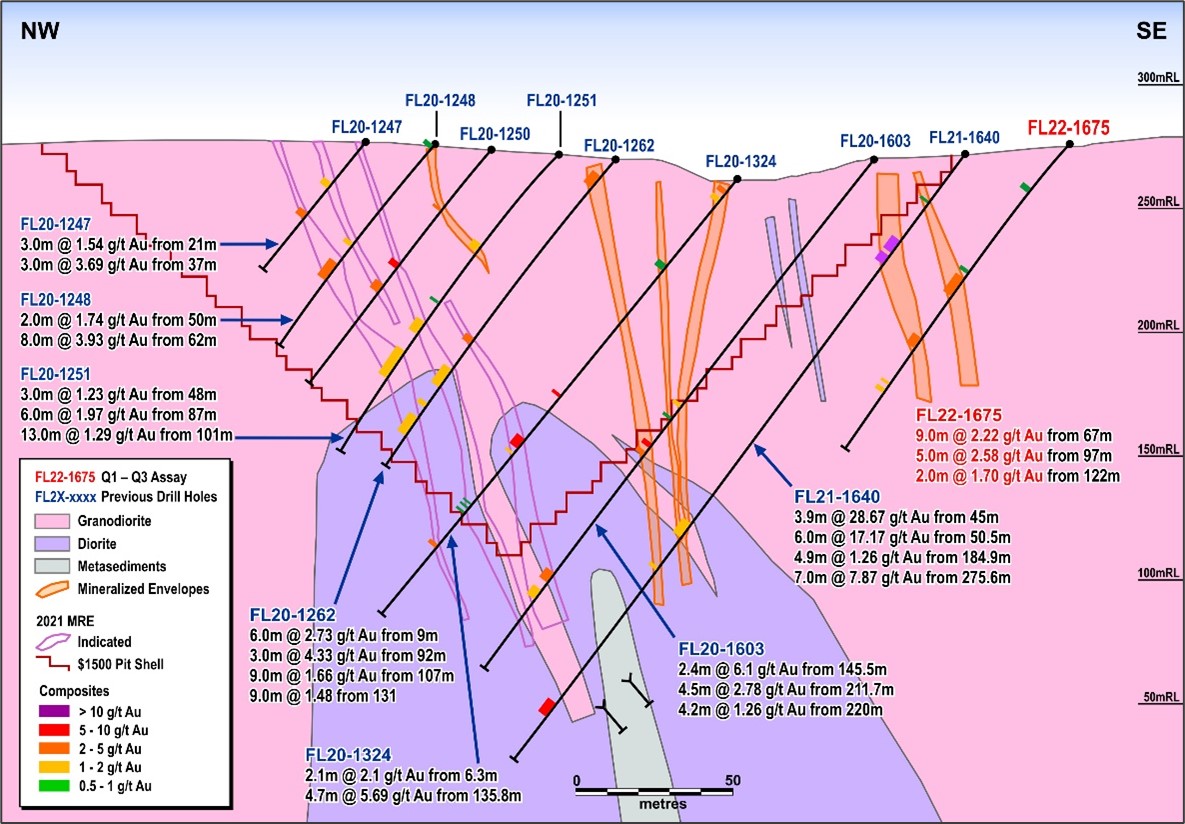

- The Yopleu-Legaleu deposit is located 1km southeast of the previously discovered Le Plaque deposit, where mining activities began in late 2021, and less than 10km away from the Ity plant.

- A maiden Inferred resource was delineated in 2021 while further drilling in 2022, comprised of 85 holes amounting to 10,918 meters, led to the conversion of the Inferred resource into Indicated resource status and further resource delineation.

- The 2022 infill drilling results confirmed the continuity of the mineralisation within the 2021 Inferred resources pit shell and defined significantly enhanced mineralisation potential with the discovery of additional mineralised intervals including higher grade intervals encountered both at depth and laterally. Some of the best selected intercepts include:

- Hole FL22-1746: 24 meters at 3.96g/t Au from 125 meters

- Hole FL22-1765: 23 meters at 2.63g/t Au from 49 meters

- The 2022 step-out drill results also confirmed that mineralisation extends 200 meters along strike to the northeast and 450 meters to the southwest, with high grade thick intercepts such as:

- Hole FL22-1689: 14.0 meters at 2.49g/t Au from 81 meters and 9.0 at 6.83 g/t Au from 160 meters

Delta Extension at Le Plaque deposit

- The Delta Extension deposit was delineated along a sub-parallel south-eastern extension of the previously discovered Le Plaque deposit, where mining activities began in late 2021, and is located less than 10km away from the Ity mill. A total of 5 holes amounting to 635 meters were drilled in 2022.

- As shown in Figure 11 below, the drill results confirmed the continuity, at shallow depth, of the Delta Extension mineralised vein system, toward the southeast underneath the 2021 pit shell.

- Best selected intercepts include:

- Hole FL22-1675: 9 meters at 2.22g/t Au from 67 meters

- Hole FL22-1675: 5 meters at 2.58g/t Au from 97 meters

Figure 11: Delta Extension cross-section

Delta Sud-Est new discovery

- The newly discovered Delta Sud-Est target covers a 1km by 700 meter area, located 1km southwest and 300 meters Sout East from the Yopleu-Legaleu and Delta deposits.

- This area had been preliminarily outlined in 2020 with an initial Air Core (“AC”) drilling and in 2021 with 1 RC hole amounting to 152 meters and 4 DD holes amounting to 712 meters with initial positive results. This year, a more systematic drilling campaign with 28 RC holes drilled amounting to 2,753 meters was focussed on Delta Sud-Est.

- The 2022 drill results confirmed the presence of several parallel mineralised veins within granodiorite that seem to be on a trend and possibly continuous with the Yopleu-Legaleu vein system.

- Best selected intercepts including:

- Hole FL22-1710: 7 meters at 3.08g/t Au from 77 meters

- Hole FL22-1723: 3 meters at 10.57g/t Au from 59 meters

- These results confirm the potential of the Delta Sud-Est target and as such a follow-up drilling program is planned for 2023.

OTHER NEAR-MILL DEPOSITS

Colline Sud deposit

- The Colline Sud deposit is located 1 km southwest of the historical Mont Ity deposit, and approximately 5km away from the processing plant.

- Following the results of former exploration AC and grade control drilling programmes, a further 34 holes amounting to 3,544 meters were drilled in 2022.

- The 2022 drill results confirmed the along strike extension of the gold mineralisation over 300 meters to the northeast, in addition to identifying a 300 meter long parallel trend immediately to the southwest, with best selected intercepts including:

- Hole CS22-177: 4 meters at 6.30g/t Au from 77 meters, including 1 meter at 14.75 g/t Au from 79 meters, and 8.0 meters at 8.98 g/t Au from 84, including 1 meter at 25.30 g/t Au from 87 meters, and including 1 meter at 13.80 g/t Au from 89 meters, and including 1 meter at 20 g/t Au from 91 meters

- Hole CS22-187: 9 meters at 1.39 g/t Au from 16 meters and 5 meters at 1.41 g/t Au from 32 meters

Daapleu deposit

- The Daapleu deposit is located approximately 5km from the processing plant.

- A total of 60 shallow depth holes amounting to 4,407 meters were drilled in 2022 with a new mineralised vein system intercepted along the continuity of the Daapleu deposit, over 350 meters to the northeast. Best selected intercepts include:

- Hole DA22-644: 2 meters at 1.00g/t Au from 25 meters and 7 meters at 5.16g/t Au from 41 meters including 1.0 meter at 12.70g/t Au

- Hole DA22-645: 7 meters at 1.30g/t Au from 90 meters and 4 meters at 1.20g/t Au from 106 meters

- These results will be included in the next resource update and will be followed up with the 2023 drilling campaign.

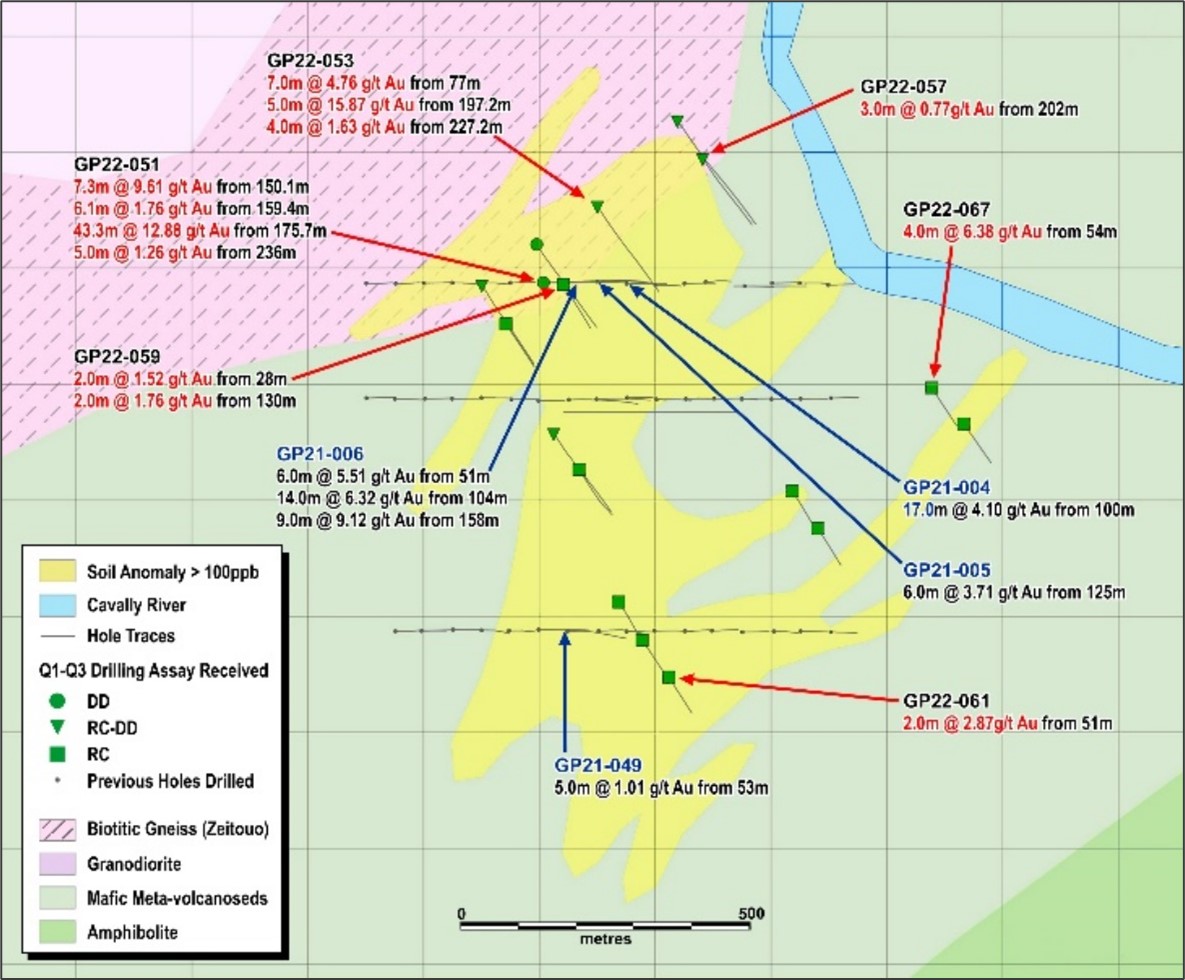

GBAMPLEU NEW DISCOVERY

- As shown in Figure 1 above, the Gbampleu discovery is located in the Toulepleu exploration permit (PR462), located 22km south of the Ity plant. Gbampleu sits in the central part of the Toulepleu-Ity greenstone belt, on the southern border of the Guiamapleu granodioritic mole.

- Gbampleu was ranked as a highly prospective target based on a historic gold-in-soil survey which highlighted a north-south striking, 1.3 km x 0.6km, anomaly (with >100ppb Au), which overlays steeply dipping, southwest-northeast oriented, Birimian rocks composed of meta-volcanic formations (dominantly mafic) and a set of gneissic rocks of more felsic composition (Zeitouo gneiss).

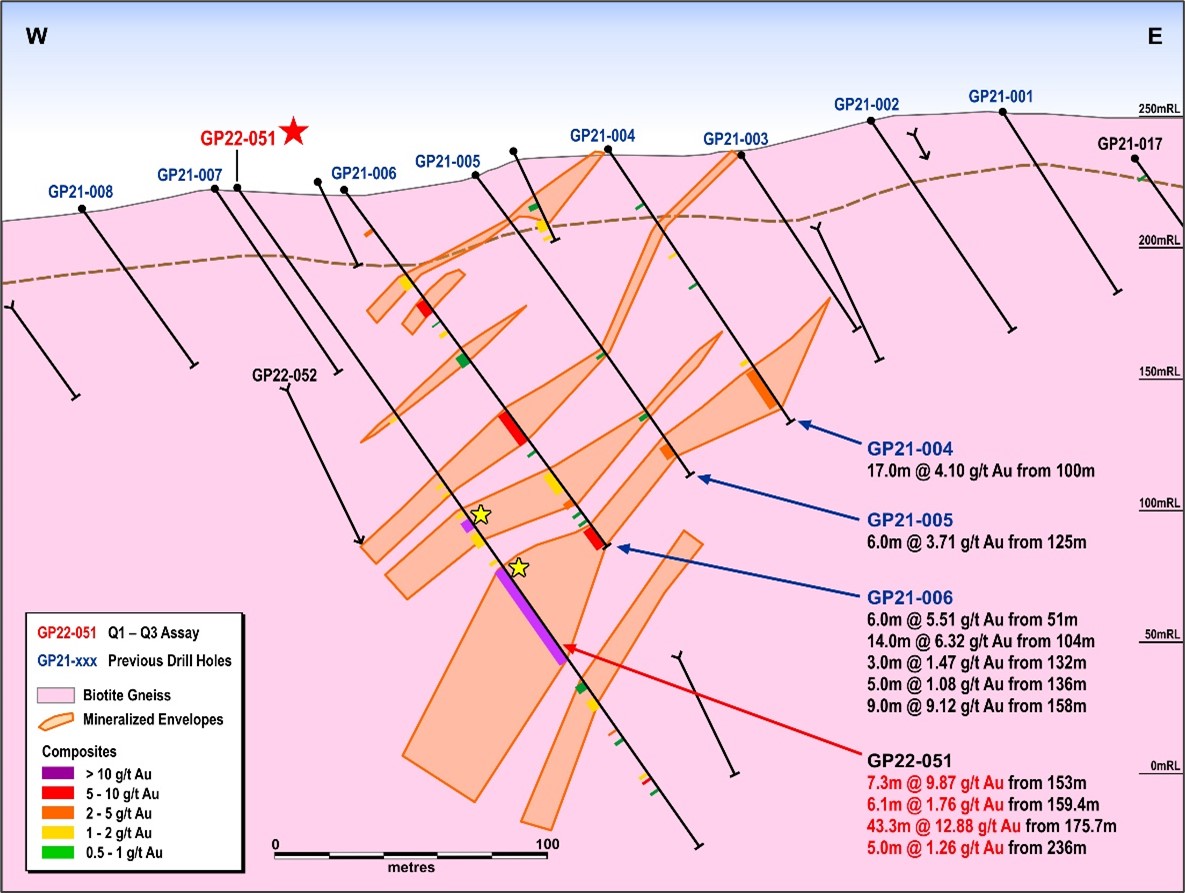

- A first RC drilling program, totalling 50 holes amounting to 4,920 meters was completed in 2021. Following the promising results of this campaign, a combined RC-DD program comprising 17 holes amounting to 3,212 meters have been drilled so far this year, to define the controlling factors of the mineralisation and to delineate the deposit over 450 meters along strike, where drill results have confirmed high grade mineralisation. Drilling is ongoing with the along strike extension remaining to be tested.

- Best selected intercepts include:

- Hole GP22-051: 43.25 meters at 11.32 g/t Au from 175.8 meters, including 4.3 meters at 29.81 g/t Au from 178.75 meters, including 3 meters at 61.68 g/t Au from 185 meters, including 2 meters at 31.18 g/t Au from 193 meters and including 2 meters at 10.95 g/t Au from 206 meters

- As shown in Figures 12 and 13 below, high gold grades (notably with visible gold) have been intercepted in highly silicified zones within Biotite Gneiss characterized by penetrative silicification and abundant quartz pods or strongly deformed quartz-filled veins and breccia. Some of these veins are also filled with chlorite and sulphides (pyrite, sphalerite).

Figure 12: Gbampleu map

Figure 13: Gbampleu cross-section

All intercepts reported above are apparent thickness.

TECHNICAL NOTES

Ity Area Resource Modelling

The statistical analysis, geological modelling and resource estimation were prepared by the Endeavour resource team, under the direction of Kevin Harris (CPG) VP Resources for Endeavour as the Qualified Person as defined by NI 43-101.

The Grand Ity resource update is based upon updated drilling data and interpretations. The Ity Mineral Resource model was developed in Seequent’s Leapfrog Geo and Geovia’s Surpac modelling software. The database used to generate the Mineral Resources comprised some 2,112 drill holes, with a total of 264,788 meters drilled. The updated model is based upon 152 new drill holes totalling 29,034 meters. The drilling data are supported by industry standard quality assurance and quality control systems, with quality control sampling comprising blanks, coarse blanks, certified reference materials, and field and pulp duplicates. The Resource team has reviewed the QAQC data and are confident they are of high standard to be used in resource estimation.

146 mineralisation domains were modelled using geology and grade continuity, by selecting intervals which forms part of each mineralisation lenses; a nominal cut-off of 0.5g/t Au. The Grand Ity deposit was divided into 7 resource areas named: Bakatouo NW, West Flotouo, Verse Est, Walter, Bakatouo, Ity-Ity Flat and ZiaNE. The gold assays from the drill holes were composited to 1.0 meter intervals within the modelled zone. Capping varied depending on the mineralised domain, between no cap and 45g/t Au.

Density measurements from 4,929 samples and covering each of the material types and major lithology were averaged based on the material type. Average density values were applied to the associated portions of the block model as outlined below:

- Laterite/Overburden: 1.80 g/cm3

- Saprolite: 1.50 g/cm3

- Saprock: 2.50 g/cm3

- Fresh: 2.90 g/cm3

Gold grades were estimated using Ordinary Kriging for most of the mineralised domains. Where it was not possible to define a well-structured variogram for the smallest domains with low sample support, an Inverse Distance Squared (“IDW2”) estimator was used. The grade was in multiple passes to define the higher confidence areas and extend the grade to the interpreted mineralised zone extents.

The grade estimation was validated with visual and statistical analysis and comparison with the drilling data on sections with swath plots comparing the block grades with the composites.

The quality and spatial distribution of the data used and the geological continuity of the mineralisation and the quality of the estimated block model for Grand Ity is sufficient for the reporting of Indicated and Inferred Mineral Resources. Indicated Mineral Resources have typically been defined in areas within a search range of 40-45 meters, where there is a reasonable level of confidence in geological and grade continuity. Inferred Mineral Resources have typically been defined in areas outside the first pass estimation range of 40-45 meters and where the continuity and confidence is reduced.

Mineral Resources are reported within a Whittle optimised pit shell using cut-off of grades of 0.5 g/t Au. Optimisation parameters used are as below:

- Mining cost: $2.66 - $3.66/t Oxide; $3.43 - $4.27/t Transition; $3.70 - $4.39/t Fresh

- Processing cost + G&A + Ore cost: Oxide: $16.56 - $20.67/t; Transition $16.81 - 30.05/t; Fresh: $16.92 - $20.80/t

- Selling cost: $9.15/oz Au Transportation and Refining; Royalty of 3.5%

- Mining recovery: 95%

- Mining dilution: 0%

- Processing recovery: Oxide 80.2 - 93.6%; Transition 85.2 - 96.2%; Fresh 84.7 - 96.2%

- Average slope angles: Oxide 33°; Transition 33°; Fresh 42.3°- 58.4°

Yopleu-Legaleu Resource Modelling

The statistical analysis, geological modelling and resource estimation were prepared by the Endeavour resource team, under the direction of Kevin Harris (CPG) VP Resources for Endeavour as the Qualified Person as defined by NI 43-101.

The Yopleu-Legaleu resource update are based upon updated drilling data and interpretations as of October 2022. The Yopleu-Legaleu Mineral Resource model was developed in Seequent’s Leapfrog Geo and Geovia’s Surpac modelling software. The database used to generate the Mineral Resources comprised 357 drillholes, with a total of drilling meters of 29,071 meters. The updated model is based upon 85 new drillholes totalling 10,918 meters. The drilling data are supported by industry standard quality assurance and quality control systems, with quality control sampling comprising blanks, coarse blanks, certified reference materials, and field and pulp duplicates. Resource team has reviewed the QAQC data and are confident they are of high standard to be used in resource estimation.

Sixteen mineralisation domains were modelled using geology and grade continuity, by selecting intervals which forms part of each mineralisation lenses; a nominal cut-off of 0.4g/t Au. The gold assays from the drill holes were composited to 1.0 meter intervals within the modelled zone. Capping varied depending on the mineralised domain, between no cap and 10g/t Au.

Density measurements from 294 samples and covering each of the material types and major lithology were averaged based on the material type. Average density values were applied to the associated portions of the block model as outlined below:

- Laterite/Overburden: 1.70 g/cm3

- Saprolite: 1.58 g/cm3

- Saprock: 2.36 g/cm3

- Fresh: 2.71 g/cm3

Gold grades were estimated using Inverse Distance Squared and Ordinary Kriging for all of the mineralised domains. Generally, it was not possible to define a well-structured variogram models for most of the domains. The two methods produced similar results so the Inverse Distance Squared method was chosen. The grade was in multiple passes to define the higher confidence areas and extend the grade to the interpreted mineralised zone extents.

The grade estimation was validated with visual and statistical analysis and comparison with the drilling data on sections with swath plots comparing the block grades with the composites.

The quality and spatial distribution of the data used and the geological continuity of the mineralisation and the quality of the estimated block model for Yopleu-Legaleu is sufficient for the reporting of Indicated and Inferred Mineral Resources. Indicated Mineral Resources have typically been defined in areas within a search range of 40 m, where there is a reasonable level of confidence in geological and grade continuity. Inferred Mineral Resources have typically been defined in areas outside the first pass estimation range of 40 meters and where the continuity and confidence is reduced.

Mineral Resources are reported within a Whittle optimised pit shell using cut-off of grades of 0.5 g/t Au. Optimisation parameters used are as below:

- Mining cost: $2.80/t Oxide; $3.50/t Transition; $3.69/t Fresh

- Processing cost + G&A + Ore cost: Oxide: $21.85/t; Transition $21.85/t; Fresh: $21.92/t

- Selling cost: $70/oz Au gold

- Mining recovery: 95%

- Mining dilution: 0%

- Processing recovery: Oxide 95%; Transition 93%; Fresh 88%

- Average slope angles: 40°

Drilling, Assay, Quality Assurance / Quality Control Procedures

Reverse Circulation (“RC”) and Air Core (“AC”) drilling delivers material to the surface via percussion hammer pushing pulverized rock into dual tube rods which evacuate the material to the surface via high pressure compressed air. The samples are collected from the cyclone at surface at 1-meter intervals. The cyclone is cleaned after every 6-meter rod by flushing the hole. Additional manual cleaning is required in saprolitic or wet ground, closely monitored by the site geologist / geotechnician to ensure no sample to sample contamination occurs.

Samples are split at the drill site using several different riffle splitters, based on bulk sample weight. 2-5kg laboratory and a second 2-5kg reference sample are collected. Bulk and laboratory sample weights, in addition to moisture levels are recorded. Representative samples for each interval were collected with a spear, sieved into chip trays and retained for reference.

Drill core (PQ, HQ and NQ size) samples are selected by Endeavour geologists and sawn in half with a diamond blade at the project site. Half of the core is retained at the site for reference purposes. Sample intervals are generally 1 meter in length.

All samples are transported to the ALS preparation laboratory at the Exploration office site at the Ity Mine. Each laboratory sample is secured in poly-woven bags ensuring that there is a clear record of the chain of custody. On arrival samples are weighed. Complete samples are crushed to 2mm (70% passing) with 1 kg split out for pulverization. The entire 1 kg is pulverized 75μm (85% passing). A 250 gram final pulp sample is prepared. These 250 gram pulps are packaged in cardboard boxes and shipped to ALS Ouagadougou. At ALS Ouagadougou a 50 gram pulp sample is extracted from the final 25 gram pulp and analysed for gold (Au) using standard fire assay techniques. An Atomic Absorption (“AA”) finish provides the final Au value.

Blanks, field duplicates and certified reference material (“CRM’s”) are inserted into the sample sequence by Endeavour geologists at a rate of 1 of each samples type per 20 samples. This ensures that there is a 5% Quality Assurance / Quality Control (“QA/QC”) sample insertion rate applied to each fire assay batch. The sampling and assaying are monitored through analysis of these QA/QC samples. This QA/QC program was audited by a consultant, independent from Endeavour Mining and has been verified to follow industry best practices.

In February 2022, 1,017 samples from the 2021 drilling program were sent to ALS Ouagadougou for umpire (referee) analysis. Comparison of the Original analysis against the umpire analysis revealed a moderate Correlation Coefficient of 72% for all samples. When the Au data was capped at 20 ppm the Correlation Coefficient increased to a strong 92.8 %. It is not unusual for very high grade samples to show highly variable results even when the same samples are analysed at the same lab a second time. Endeavour accepts these Umpire assay results from ALS Ouaga and have confidence that the original assays provided by are accurate.

Core sampling and assay data were monitored through a quality assurance/quality control program designed to follow NI 43-101 and industry best practice.

Full drill results are available by clicking here.

QUALIFIED PERSONS

The scientific and technical content of this news release has been reviewed, verified and compiled by Silvia Bottero, Professional Natural Scientist, VP Exploration Côte d’Ivoire for Endeavour Mining. Silvia Bottero has more than 20 years of mineral exploration and mining experience and is a "Qualified Person" as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects ("NI 43-101"). The resource estimation was completed by Kevin Harris, CPG, VP Resources for Endeavour Mining and "Qualified Person" as defined by National Instrument 43-101.

CONTACT INFORMATION

| Martino De Ciccio VP – Strategy & Investor Relations +44 203 640 8665 mdeciccio@endeavourmining.com | Brunswick Group LLP in London Carole Cable, Partner +44 7974 982 458 ccable@brunswickgroup.com |

ABOUT ENDEAVOUR MINING CORPORATION

Endeavour Mining is one of the world’s senior gold producers and the largest in West Africa, with operating assets across Senegal, Cote d’Ivoire and Burkina Faso and a strong portfolio of advanced development projects and exploration assets in the highly prospective Birimian Greenstone Belt across West Africa.

A member of the World Gold Council, Endeavour is committed to the principles of responsible mining and delivering sustainable value to its employees, stakeholders and the communities where it operates. Endeavour is listed on the London and Toronto Stock Exchanges, under the symbol EDV.

For more information, please visit www.endeavourmining.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This news release contains "forward-looking statements" including but not limited to, statements with respect to Endeavour's plans for further exploration of the Ity property, the ability of Endeavour to convert Inferred resources into Indicated resources, the integration of the West Flotouo deposit into the mine plan, improvements to Endeavour’s mine planning capabilities, the extent and timing of Endeavour’s drilling campaign, estimation of mineral resources, and the success of exploration activities. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as "expects", "expected", "budgeted", "forecasts", and "anticipates". Forward-looking statements, while based on management's best estimates and assumptions, are subject to risks and uncertainties that may cause actual results to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: risks related to the successful integration of acquisitions; risks related to international operations; risks related to general economic conditions and credit availability, actual results of current exploration activities, unanticipated reclamation expenses; changes in project parameters as plans continue to be refined; fluctuations in prices of metals including gold; fluctuations in foreign currency exchange rates, increases in market prices of mining consumables, possible variations in ore reserves, grade or recovery rates; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes, title disputes, claims and limitations on insurance coverage and other risks of the mining industry; delays in the completion of development or construction activities, changes in national and local government regulation of mining operations, tax rules and regulations, and political and economic developments in countries in which Endeavour operates. Although Endeavour has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Please refer to Endeavour's most recent Annual Information Form filed under its profile at www.sedar.com for further information respecting the risks affecting Endeavour and its business.

Attachment

Attachment