Profitable customer growth strategy expected to deliver outsized financial growth, including accelerating growth in Service Revenues, a nearly $10 billion increase in Annual Core Adjusted EBITDA by 2027,1 and industry-leading Adjusted Free Cash Flow margin

At its Capital Markets Day event today, T-Mobile US, Inc. (NASDAQ: TMUS) unveiled an ambitious three-year plan that demonstrates how the company will continue its growth momentum to unlock massive value creation into the future. T-Mobile’s senior leadership team shared a clear strategy for how the company will achieve success in the years ahead centered around the Un-carrier’s proven network, value and leading customer experience, including how it will extend its network leadership by continuing its transformation into an AI-enabled, data-informed, digital-first organization. The company expects continued profitable share gains across underpenetrated segments, sees continued industry leading growth in its broadband business, outlined a framework for new future revenue opportunities, and more.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240917928175/en/

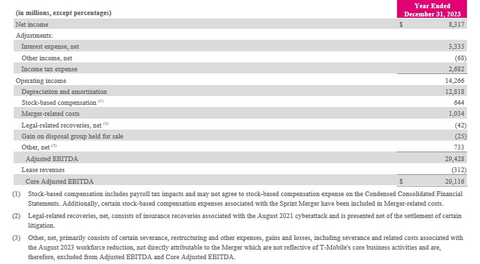

Adjusted EBITDA and Core Adjusted EBITDA are reconciled to Net income as follows: (Graphic: Business Wire)

The plan builds on T-Mobile’s track record of providing value for consumers while delivering phenomenal business results. The company not only met but completely surpassed the ambitious goals it set at its previous Capital Markets Day in 2021 – building America’s best network, expanding its addressable markets, and unlocking $8 billion in run rate synergies from the Sprint merger, all while delivering financial results that exceeded expectations, including over $30 billion of cumulative Adjusted Free Cash Flow2 from 2020 through 2023.

“T-Mobile is a company on the move with tremendous opportunities in front of us to further extend our outperformance in customer growth and translate that into strong top and bottom-line growth that will enable a compelling capital return opportunity over the next few years,” said T-Mobile CEO Mike Sievert. “As the Un-carrier we have always set big goals, and our track record over the last four years shows that we deliver on them. Now we’re tapping into this momentum and dreaming even bigger for the next era of Un-carrier, championing new standards for customer experiences, how networks are built and beyond. The opportunity in front of us is huge and we can’t wait to capture it.”

The next era of T-Mobile’s profitable growth leadership will focus on key differentiators that will collectively unlock outsized financial results and stockholder returns:

- Extending Network Leadership – T-Mobile announced plans to not just defend, but extend its multi-year network leadership position enabled by the company’s industry-best assets, an innovative Customer-Driven Coverage (CDC) approach to network investments, and further technology deployments including Massive Multiple-input/multiple-out (Massive MIMO), Voice over New Radio (VoNR), four-carrier aggregation and the U.S.’s first broad deployment of 5G Advanced - all enabled by the only scaled nationwide 5G standalone network. The company also announced a collaboration with NVIDIA, Ericsson and Nokia to invest in an industry-first AI-RAN (radio access network) Innovation Center focused on bringing RAN and AI innovation closer together to deliver transformational network experiences – all while maintaining its network advantage and laying the groundwork for the future. T-Mobile’s best-in-class spectrum and network resources, customer-first focus, and leadership in deploying the latest network technologies will remain at the core of its growth formula. T-Mobile has the deepest sub-6GHz spectrum holdings and the lowest frequency across each layer of the network including low-band, mid-band and even mmWave. This gives the company propagation advantages that are unmatched across the industry, deployed across a dense network grid, rooted in its mid-band spectrum layer from day one, delivering an unrivaled consistency of experience with the best 5G availability by more than five times that of the closest competitor, according to Opensignal, and speeds that are more than 2 times faster, according to Ookla.

- Transformative Customer Experiences – Leveraging the latest AI technology and digital capabilities, the company will continue transforming its approach to customer experiences. Wireless is one of the remaining industries that is not fully digital, but the company sees an opportunity to change that through tools like its T-Life app, which can effectively tap into customer preferences and radically simplify their experiences. T-Mobile aims to ultimately enable 100% of upgrades and the majority of customer activations to be done digitally. The company is also joining forces with global technology leader OpenAI to custom-build IntentCX, a predictive AI platform that will revolutionize customer engagement, better anticipating and proactively solving customer issues, offering self-service options and taking actions on customers’ behalf. These efforts should reduce inbound customer contacts to Care by 75%, while increasing satisfaction and significantly lower operating costs.

- Profitable Share Taking – T-Mobile plans to consistently and profitably grow its core wireless business with continued share taking across underpenetrated markets and deeper customer relationships through its portfolio of products and services. The company has even more room to run in Smaller Markets and Rural Areas (SMRA), where its “win share” is now #1, and significantly above the company’s market share, on the strength of its extensive value and 5G network leadership. In addition, Top 100 Markets continue to be a significant growth driver, as the company remains underpenetrated among those shopping primarily on network, or “network seekers”, the company is posting consistent growth, building its overall market lead, while network reputation rapidly improves, demonstrating significant room to run. T-Mobile also remains underpenetrated in 30% of Top 100 Markets, where its market share is in third place, representing a growth opportunity that is more like SMRA. T-Mobile for Business (TFB) has transformed from a provider of basic cell phone service to a strategic solutions organization and continues to be a growth engine with significant momentum. Its next phase of growth will come from deploying enhanced digital tools, extending its leadership across small to mid-market companies, and continuing to deliver advanced solutions to Enterprise and Government customers. With this strategy, the company expects TFB will deliver double-digit service revenue compound annual growth rate from 2023 to 2027.

- Leading Broadband Growth – T-Mobile will continue its industry leading Broadband growth by scaling its national, yet hyper-local go-to-market playbook to serve more customers and create revenue opportunities. The company aims to reach 12 million 5G broadband customers by 2028 using excess capacity, a more than 50% increase from its previous target of 7 to 8 million customers by 2025. Fiber to the home will augment the company’s 5G broadband success, providing an accretive and complementary opportunity to deliver connectivity to even more Americans. With a 5G broadband waitlist of more than 1 million potential customers, combined with its brand, distribution, and existing customer base, T-Mobile can achieve lower cost to acquire new customers, lower cost to serve, and faster and deeper penetration curves enabling greater returns. The company expects to reach 12 to 15 million or more households passed by the end of 2030 with its fiber partnerships and expects to realize an all-in internal rate of return of around 20%, and potentially higher, from its fiber joint ventures.

- Growing New Businesses – Using its unique assets and by leveraging its embedded customer relationships, broad distribution, strong brand affinity, and the most advanced 5G network, T-Mobile will unlock opportunities that meet clear customer needs in new areas. One example is in the advertising space, where T-Mobile grew an opportunity to market solutions that it built to improve advertising in its own business to other advertisers into an over $1 billion in annual revenue business. Another example is T-Priority, which gives first responder agencies of all sizes priority on the T-Mobile network to help ensure best-in-class connectivity during times of congestion, especially massive emergencies, and offers support for a wide range of data-intensive applications.

- Outsized Financial Growth – T-Mobile has delivered industry leading growth across customers, service revenues, and profitability, translating those wins into what matters the most: the industry’s best Adjusted Free Cash Flow margin. Combining the key differentiators will result in continued industry leading growth in profitability and Adjusted Free Cash Flow conversion, and a best-in-class balance sheet, while enabling smart investments and driving outsized stockholder returns. T-Mobile’s 2027 guidance excludes pending acquisitions of UScellular, Metronet, and Lumos:

- Service revenue growth is anticipated to accelerate at a compound annual growth rate of approximately 5% at the midpoint from 2023 to 2027, as the company expects to deliver $75 to $76 billion in 2027. This is driven by continued wireless and broadband customer growth, continued growth in average revenue per account from deepening customer relationships and growth in new businesses.

- Core Adjusted EBITDA growth is anticipated to be industry leading as the company expects to deliver $38 to $39 billion in 2027, a compound annual growth rate of approximately 7% at the midpoint from 2023 to 2027, and an increase of approximately $10 billion compared to 2023 at the high-end of guidance. This is expected to be driven by the operating leverage from its profitable growth model and enhanced with further significant operating efficiencies through technology innovation, AI, and digital leadership.

- Adjusted Free Cash Flow is expected to be $18 to $19 billion in 2027, a compound annual growth rate of 8% at the midpoint from 2023 to 2027. T-Mobile expects to ramp to be a full cash taxpayer by 2027.

- Commitment to Balanced Capital Allocation – T-Mobile’s capital allocation philosophy remains unchanged. The company expects to maintain a prudent 2.5 times leverage target, with flexibility to de-lever slightly. In addition to $9 to $10 billion in annual capital expenditures to fund continued network leadership, the company expects ongoing investment in core business growth and evolution, and anticipates funding announced acquisitions and spectrum transactions, with flexibility to strategically add on accretive, value-generating investments on an opportunistic basis. The company will continue to apply a balanced and disciplined approach to stockholder returns with attractive dividends and potential for significant ongoing repurchases.

- T-Mobile’s transformative and profitable growth plan supports approximately $80 billion in capacity through 2027 for investments and stockholder returns based on the strong Adjusted Free Cash Flow generation and consistent leverage on robust growth in Core Adjusted EBITDA. This includes approximately $10 billion to fund announced acquisitions and up to $50 billion in stockholder returns through dividends and share repurchases – on top of the $25 billion we’ve already delivered to stockholders to date. About $20 billion will be retained as flexibility for accretive organic or inorganic growth investments, de-levering, or potentially additional stockholder returns.

- The company also announced today that the Company’s Board of Directors has declared a cash dividend of $0.88 per share on its issued and outstanding shares of common stock, an increase of $0.23 per share or 35% from the previous quarter. The dividend is payable on December 12, 2024 to stockholders of record as of the close of business on November 27, 2024.

1 We are not able to forecast Net income on a forward-looking basis without unreasonable efforts due to the high variability and difficulty in predicting certain items that affect Net income, including, but not limited to, Income tax expense and Interest expense. Core Adjusted EBITDA should not be used to predict Net income as the difference between this measure and Net income is variable.

2 Adjusted Free Cash Flow for 2020 is combined and adjusted due to the timing of the closing of the Sprint merger and excludes gross payments for the settlement of interest rate swaps. See “Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures”

Access via Webcast

The capital markets day event will be broadcast live and can be replayed via the Investor Relations website at https://investor.t-mobile.com.

T-Mobile Social Media

Investors and others should note that we announce material financial and operational information to our investors using our investor relations website (https://investor.t-mobile.com), newsroom website (https://t-mobile.com/news), press releases, SEC filings and public conference calls and webcasts. We also intend to use certain social media accounts as a means of disclosing information about us and our services and for complying with our disclosure obligations under Regulation FD (the @TMobileIR X account (https://x.com/TMobileIR), the @MikeSievert X account (https://x.com/MikeSievert), which Mr. Sievert also uses as a means for personal communications and observations, and the @TMobileCFO X account (https://x.com/tmobilecfo), and our CFO’s LinkedIn account (https://www.linkedin.com/in/peter-osvaldik-3887394), both of which Mr. Osvaldik also uses as a means for personal communication and observations). The information we post through these social media channels may be deemed material. Accordingly, investors should monitor these social media channels in addition to following our press releases, SEC filings and public conference calls and webcasts. The social media channels that we intend to use as a means of disclosing the information described above may be updated from time to time as listed on our investor relations website.

About T-Mobile US, Inc.

T-Mobile US, Inc. (NASDAQ: TMUS) is America’s supercharged Un-carrier, delivering an advanced 4G LTE and transformative nationwide 5G network that will offer reliable connectivity for all. T-Mobile’s customers benefit from its unmatched combination of value and quality, unwavering obsession with offering them the best possible service experience and undisputable drive for disruption that creates competition and innovation in wireless and beyond. Based in Bellevue, Wash., T-Mobile provides services through its subsidiaries and operates its flagship brands, T-Mobile, Metro by T-Mobile and Mint Mobile. For more information please visit: https://www.t-mobile.com.

Forward-Looking Statements

This communication includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact, including information concerning T-Mobile US, Inc.’s future results of operations, are forward-looking statements. These forward-looking statements are generally identified by the words “will,” “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “could” or similar expressions, or include numbers for future periods.

Forward-looking statements are based on current expectations and assumptions, which are subject to risks and uncertainties and may cause actual results to differ materially from the forward-looking statements. Important factors that could affect future results and cause those results to differ materially from those expressed in the forward-looking statements include, among others, the following: competition, industry consolidation and changes in the market for wireless communications services and other forms of connectivity; criminal cyberattacks, disruption, data loss or other security breaches; our inability to take advantage of technological developments on a timely basis; our inability to retain or motivate key personnel, hire qualified personnel or maintain our corporate culture; system failures and business disruptions, allowing for unauthorized use of or interference with our network and other systems; the scarcity and cost of additional wireless spectrum, and regulations relating to spectrum use; the impacts of the actions we have taken and conditions we have agreed to in connection with the regulatory proceedings and approvals of our merger with Sprint Corporation (“Sprint”) pursuant to a Business Combination Agreement with Sprint and the other parties named therein (as amended, the “Business Combination Agreement”) and the other transactions contemplated by the Business Combination Agreement, including the acquisition by DISH Network Corporation (“DISH”) of the prepaid wireless business operated under the Boost Mobile and Sprint prepaid brands (excluding the Assurance brand Lifeline customers and the prepaid wireless customers of Shenandoah Personal Communications Company LLC and Swiftel Communications, Inc.), including customer accounts, inventory, contracts, intellectual property and certain other specified assets, and the assumption of certain related liabilities (collectively, the “Prepaid Transaction”), the complaint and proposed final judgment agreed to by us, Deutsche Telekom AG (“DT”), Sprint Corporation, now known as Sprint LLC (“Sprint”), SoftBank Group Corp. (“SoftBank”) and DISH with the U.S. District Court for the District of Columbia, which was approved by the Court on April 1, 2020, the proposed commitments filed with the Secretary of the Federal Communications Commission (“FCC”), which we announced on May 20, 2019, certain national security commitments and undertakings, and any other commitments or undertakings entered into, including, but not limited to, those we have made to certain states and nongovernmental organizations (collectively, the “Government Commitments”), and the challenges in satisfying the Government Commitments in the required time frames and the significant cumulative costs incurred in tracking and monitoring compliance over multiple years; adverse economic, political or market conditions in the U.S. and international markets, including changes resulting from increases in inflation or interest rates, supply chain disruptions, and impacts of geopolitical instability, such as the Ukraine-Russia war and Israel-Hamas war; sociopolitical volatility and polarization; our inability to manage the ongoing commercial services arrangements entered into in connection with the Prepaid Transaction, and known or unknown liabilities arising in connection therewith; the timing and effects of any future acquisition, divestiture, investment, or merger involving us, including our inability to obtain any required regulatory approval necessary to consummate any such transactions; any disruption or failure of our third parties (including key suppliers) to provide products or services for the operation of our business; our substantial level of indebtedness and our inability to service our debt obligations in accordance with their terms; changes in the credit market conditions, credit rating downgrades or an inability to access debt markets; the risk of future material weaknesses we may identify, or any other failure by us to maintain effective internal controls, and the resulting significant costs and reputational damage; any changes in regulations or in the regulatory framework under which we operate; laws and regulations relating to the handling of privacy and data protection; unfavorable outcomes of and increased costs from existing or future regulatory or legal proceedings; difficulties in protecting our intellectual property rights or if we infringe on the intellectual property rights of others; our offering of regulated financial services products and exposure to a wide variety of state and federal regulations; new or amended tax laws or regulations or administrative interpretations and judicial decisions affecting the scope or application of tax laws or regulations; our wireless licenses, including those controlled through leasing agreements, are subject to renewal and may be revoked; our exclusive forum provision as provided in our Certificate of Incorporation; interests of DT, our controlling stockholder, which may differ from the interests of other stockholders; the dollar amount authorized for our 2023-2024 Stockholder Return Program may not be fully utilized, and our share repurchases and dividend payments pursuant thereto may fail to have the desired impact on stockholder value; future sales of our common stock by DT and SoftBank and our inability to attract additional equity financing outside the United States due to foreign ownership limitations by the FCC; and other risks as disclosed in our most recent annual report on Form 10-K, 10-Q and other filings with the Securities and Exchange Commission. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law.

T-Mobile US, Inc.

Reconciliation of Non-GAAP Financial Measures to GAAP Financial Measures

(Unaudited)

This release includes non-GAAP financial measures. The non-GAAP financial measures should be considered in addition to, but not as a substitute for, the information provided in accordance with GAAP. Reconciliations for the non-GAAP financial measures to the most directly comparable GAAP financial measures are provided below. T-Mobile is not able to forecast Net income on a forward-looking basis without unreasonable efforts due to the high variability and difficulty in predicting certain items that affect GAAP net income, including, but not limited to, Income tax expense and Interest expense. Adjusted EBITDA and Core Adjusted EBITDA should not be used to predict Net income, as the difference between either of these measures and Net income is variable.

Adjusted EBITDA and Core Adjusted EBITDA are reconciled to Net income as follows:

(in millions, except percentages) |

Year Ended

|

||

Net income |

$ |

8,317 |

|

Adjustments: |

|

||

Interest expense, net |

|

3,335 |

|

Other income, net |

|

(68 |

) |

Income tax expense |

|

2,682 |

|

Operating income |

|

14,266 |

|

Depreciation and amortization |

|

12,818 |

|

Stock-based compensation (1) |

|

644 |

|

Merger-related costs |

|

1,034 |

|

Legal-related recoveries, net (2) |

|

(42 |

) |

Gain on disposal group held for sale |

|

(25 |

) |

Other, net (3) |

|

733 |

|

Adjusted EBITDA |

|

29,428 |

|

Lease revenues |

|

(312 |

) |

Core Adjusted EBITDA |

$ |

29,116 |

|

|

|||

Adjusted Free Cash Flow and Adjusted Free Cash Flow, excluding gross payments for the settlement of interest rate swaps, are calculated as follows:

|

Year Ended December 31, |

||||||||||||||

(in millions, except percentages) |

2020

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2023 |

|

||

Net cash provided by operating activities |

$ |

9,751 |

|

|

$ |

13,917 |

|

|

$ |

16,781 |

|

|

$ |

18,559 |

|

Cash purchases of property and equipment, including capitalized interest |

|

(11,956 |

) |

|

|

(12,326 |

) |

|

|

(13,970 |

) |

|

|

(9,801 |

) |

Proceeds from sales of tower sites |

|

— |

|

|

|

40 |

|

|

|

9 |

|

|

|

12 |

|

Proceeds related to beneficial interests in securitization transactions |

|

3,134 |

|

|

|

4,131 |

|

|

|

4,836 |

|

|

|

4,816 |

|

Cash payments for debt prepayment or debt extinguishment costs |

|

(82 |

) |

|

|

(116 |

) |

|

|

— |

|

|

|

— |

|

Adjusted Free Cash Flow |

$ |

847 |

|

|

$ |

5,646 |

|

|

$ |

7,656 |

|

|

$ |

13,586 |

|

Gross cash paid for the settlement of interest rate swaps |

|

2,343 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Adjusted Free Cash Flow, excluding gross payments for the settlement of interest rate swaps |

$ |

3,190 |

|

|

$ |

5,646 |

|

|

$ |

7,656 |

|

|

$ |

13,586 |

|

|

|||||||||||||||

The guidance range for Adjusted Free Cash Flow and Adjusted Free Cash Flow CAGR from 2023-2027 are calculated as follows:

|

FY 2027 |

||||||

(in millions) |

Guidance Range |

||||||

Net cash provided by operating activities |

$ |

24,000 |

|

|

$ |

25,000 |

|

Cash purchases of property and equipment, including capitalized interest |

|

(9,000 |

) |

|

|

(10,000 |

) |

Proceeds related to beneficial interests in securitization transactions (1) |

|

3,000 |

|

|

|

4,000 |

|

Adjusted Free Cash Flow |

$ |

18,000 |

|

|

$ |

19,000 |

|

|

|

|

|

||||

Net cash provided by operating activities CAGR from 2023-2027 (2) |

|

|

|

7.2 |

% |

||

Adjusted Free Cash Flow CAGR from 2023-2027 (2) |

|

|

|

8.0 |

% |

||

|

|||||||

T-Mobile US, Inc.

Combined Cash Flow Metrics

(Unaudited)

The following tables present certain cash flow metrics on a combined basis as though the Merger had been completed on January 1, 2019. Adjustments have been made to the historical results of Sprint for policy and definition alignment. Cash flows associated with the Sprint wireless prepaid and Boost brands before they were divested on July 1, 2020, are included. The unaudited combined cash flow metrics are provided for illustrative purposes only and do not purport to represent what the actual consolidated cash flows would have been had the Merger actually occurred on the date indicated, nor do they purport to project the future consolidated cash flows for any future period or as of any future date. For the purposes of this section, “Combined” means the summation of historically reported standalone GAAP amounts of T-Mobile and Sprint. “As adjusted” metrics are those that have been adjusted from their historical standalone presentation to align to the accounting policies and definitions of T-Mobile. See footnotes for details of significant adjustments.

(in millions) |

Three Months Ended March 31, 2020 |

||

Net cash provided by operating activities |

|

||

Combined net cash provided by operating activities |

$ |

4,144 |

|

Capital expenditures - leased devices (1) |

|

(1,416 |

) |

Combined net cash provided by operating activities, as adjusted |

$ |

2,728 |

|

Cash purchases of property & equipment |

|

||

Combined cash purchases of property and equipment |

$ |

4,091 |

|

Capital expenditures - leased devices (1) |

|

(1,416 |

) |

Combined cash purchases of property and equipment, as adjusted |

$ |

2,675 |

|

Net cash used in investing activities |

|

||

Combined net cash used in investing activities |

$ |

(3,796 |

) |

Capital expenditures - leased devices (1) |

|

1,416 |

|

Combined net cash used in investing activities, as adjusted |

$ |

(2,380 |

) |

Net cash used in financing activities |

|

||

Combined net cash used in financing activities (2) |

$ |

(1,737 |

) |

|

|||

Combined Net cash provided by operating activities is reconciled to Combined Free Cash Flow, as adjusted as follows:

(in millions) |

Three Months Ended March 31, 2020 |

||

Combined net cash provided by operating activities |

$ |

4,144 |

|

Capital expenditures - leased devices (1) |

|

(1,416 |

) |

Combined net cash provided by operating activities, as adjusted (1) |

|

2,728 |

|

Combined cash purchases of property and equipment, as adjusted (1) |

|

(2,675 |

) |

Proceeds related to beneficial interests in securitization transactions |

|

868 |

|

Combined Free Cash Flow, as adjusted |

$ |

921 |

|

|

|||

Definition of Terms

- Adjusted EBITDA and Core Adjusted EBITDA - Adjusted EBITDA represents earnings before Interest expense, net of Interest income, Income tax expense, Depreciation and amortization, stock-based compensation and certain expenses, gains and losses which are not reflective of our ongoing operating performance (“Special Items”). Special Items include Merger-related costs, including network decommissioning costs, incremental costs directly attributable to COVID-19, impairment expense, loss (gain) on disposal groups held for sale, certain legal-related recoveries and expenses, restructuring costs not directly attributable to the Merger (including severance) and other non-core gains and losses. Core Adjusted EBITDA represents Adjusted EBITDA less device lease revenues. Adjusted EBITDA and Core Adjusted EBITDA are non-GAAP financial measures utilized by our management to monitor the financial performance of our operations. We historically used Adjusted EBITDA and we currently use Core Adjusted EBITDA internally as a measure to evaluate and compensate our personnel and management for their performance. We use Adjusted EBITDA and Core Adjusted EBITDA as benchmarks to evaluate our operating performance in comparison to our competitors. Management believes analysts and investors use Adjusted EBITDA and Core Adjusted EBITDA as supplemental measures to evaluate overall operating performance and to facilitate comparisons with other wireless communications services companies because they are indicative of our ongoing operating performance and trends by excluding the impact of interest expense from financing, non-cash depreciation and amortization from capital investments, non-cash stock-based compensation, and Special Items. Management believes analysts and investors use Core Adjusted EBITDA because it normalizes for the transition in the Company’s device financing strategy, by excluding the impact of device lease revenues from Adjusted EBITDA, to align with the exclusion of the related depreciation expense on leased devices from Adjusted EBITDA. Adjusted EBITDA and Core Adjusted EBITDA have limitations as analytical tools and should not be considered in isolation or as substitutes for income from operations, net income or any other measure of financial performance reported in accordance with GAAP.

- Adjusted Free Cash Flow - Net cash provided by operating activities less cash payments for purchases of property and equipment, plus proceeds from sales of tower sites and proceeds related to beneficial interests in securitization transactions and less Cash payments for debt prepayment or debt extinguishment costs. Adjusted Free Cash Flow is utilized by T-Mobile’s management, investors, and analysts of our financial information to evaluate cash available to pay debt, repurchase shares, pay dividends and provide further investment in the business. Starting in Q1 2023, we renamed Free Cash Flow to Adjusted Free Cash Flow. This change in name did not result in any change to the definition or calculation of this non-GAAP financial measure.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240917928175/en/

Contacts

- Media Relations: mediarelations@t-mobile.com

- Investor Relations: investor.relations@t-mobile.com