2024 Kerrigan OEM Survey finds OEMs expect sales to increase and earnings to normalize at higher levels over the next 12 months, despite high interest rates and affordability challenges; majority of OEMs developing ICE production contingency plans as electric vehicle (“EV”) demand softens and EV sales expectations wane

Automotive OEMs are generally optimistic about the health of the automotive industry over the next 12 months, with the vast majority expecting new vehicle sales to increase or remain the same versus 2023, according to the just-released 2024 Kerrigan OEM Survey.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240729703758/en/

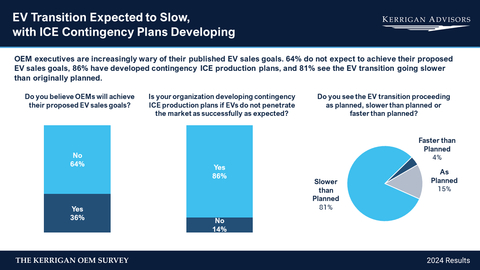

EV Transition Expected to Slow, with ICE Contingency Plans Developing (Graphic: Business Wire)

The survey, gathered from Kerrigan Advisors’ annual survey of automotive OEM executives in conjunction with the issuance of The Blue Sky Report®, is designed to gauge OEM executives’ perspectives on the franchise system, dealer profitability and electric vehicle sales. The 2024 results indicate that despite high interest rates and consumer affordability challenges, the industry is amid a normalization period, in which dealership sales, profits and inventories are moderating, likely at more attractive levels than the pre-pandemic period. Strikingly, the survey reveals significant challenges with the industry’s transition to EVs, with 81% of OEMs expecting the transition to be slower than originally forecast.

“Our second annual survey of OEM executives provides a critical window into their unique perspectives of the automotive industry. The survey offers a candid, on-the-ground view of auto retail’s opportunities and challenges in the near and medium term,” said Erin Kerrigan, Founder and Managing Director of Kerrigan Advisors. “The results underscore the continuing evolution of the auto retail marketplace, particularly regarding the demand challenges associated with EVs. It is interesting to see that most OEMs are making contingency plans for increased ICE production and admitting their EV sales projections will not be met. Even with the EV miscalculations, we are pleased to see that executives have a largely positive outlook on the auto retail industry, expecting rebounding new vehicle sales and gross margins to remain above pre-pandemic levels for the foreseeable future.”

Dealership Profits, Sales, Margins and Inventories Reflect Improving Outlook

Only 54% of OEM executives surveyed expect dealership profitability to decline in the next 12 months, compared with 69% in 2023. Consistent with this improved outlook, 41% of OEMs expect profits to remain the same over the next 12 months, versus just 24% who had that expectation last year. As with 2023, a slim minority project dealership earnings to increase in the near-term. These results are an indication that auto retail profits are beginning to normalize for many franchises.

Despite high interest rates and consumer affordability challenges, 44% of OEMs expect new vehicle sales to increase over the next 12 months, while 48% project sales will remain at 2023 levels, only 8% expect a decline. This sales optimism is likely a byproduct of rising new vehicle inventory expectations, with 70% projecting days’ supply to normalize between 60 and 90 days, up from 38% in 2023.

“We are in the midst of auto retail’s great normalization. After years of historically high dealership profits, new vehicle inventories are rebounding and gross profit margins are on the decline,” continued Erin Kerrigan. “That said, we are pleased to see the majority of OEM executives do not expect a return to pre-pandemic gross profit margins. In fact, an increasing number of executives predict dealership earnings will flatten in 2024 - an indication OEMs do not intend to return to a period of overproduction and excess inventories.”

EV Transition Remains Slow, Impacting OEM Decisions

In addition to the vast majority who anticipate a slower transition to EVs, over two-thirds of OEMs surveyed project that they will not meet their proposed EV sales goals, with 86% reporting they are developing contingency ICE production plans if EVs do not penetrate the market as successfully as expected. These results are consistent with the declining sales growth in EVs – through June 2024, EV sales growth is down 84% compared to 2023.

The failure of OEMs to meet their projected EV sales is also driving substantial modifications to their expected changes to the auto retail model: over half of OEM respondents do not expect the agency model to be introduced in the US in the next five years, a dramatic shift from the only 24% who were skeptical in 2023. The survey also reveals a major change related to anticipated increases in facility requirements, with 60% expecting no increase in requirements over the next five years, and only 18% projecting an increase, compared to 32% in 2023. Additionally, while OEMs are more supportive of the dealership legacy sales model, a rising number expect to take a leading role in the customer relationship and data ownership. The majority (67%) expect the customer relationship and data will be shared by OEMs and dealers in the future, though 19% (a 16% increase from 2023) believe the OEM will exclusively own the customer relationship and data. Just 14% of respondents project the legacy model, in which the dealer is the primary owner of the customer relationship, will remain. These results demonstrate the OEMs’ continued desire to have more direct management of the customer relationship.

“As our survey makes clear, the industry’s transition to EVs will be much slower than originally projected and OEMs are preparing necessary contingency plans for increased ICE and hybrid production to meet consumer demand,” said Ryan Kerrigan, Managing Director of Kerrigan Advisors. “This has also led to a pullback in OEMs’ changes to the retail sales model and facility requirements, with some, such as Ford, abandoning their plans to take a more active role in retailing and recognizing the dealer network is the most economic and efficient sales model. That being said, as our survey indicates, executives still believe the customer relationship and data is squarely in their future domain. The 2024 Kerrigan OEM Survey cements the industry’s expectation that change is the only constant.”

Key OEM Survey Data

- 46% project profits will stay the same or increase in the next 12 months, while 54% expect a decline in the next 12 months an improvement from 69% in 2023.

- 62% expect new car margins to normalize above 2019 levels, while only 38% believe they will return to 2019 levels.

- 44% say new vehicle sales will increase over the next 12 months, 48% project sales will remain at 2023’s levels and 8% expect a decline.

- Days’ supply of new vehicles is expected to normalize at 60-90 days in the next 12 months say 70% of respondents, up from 38% in 2023. 22% project days’ supply to remain within 30-60 days in the next 12 months, down from 59% in 2023.

- 81% of OEM executives believe the transition to EVs will be slower than originally planned.

- 64% do not expect to meet their EV sales goals, prompting 86% of respondents to reveal their organizations are developing contingency ICE production plans if EVs do not penetrate the market as expected.

- 67% expect customer relationship/data will be shared by OEMs and dealers in the future, although 19% (a 16% increase from 2023) believe OEMs will exclusively own the data. 14% of respondents say the dealer will be the primary owner.

- Only 18% of respondents projected an increase in facility requirements over the next 5 years, while 60% believe they will remain the same, and 22% anticipate a decline.

Methodology

The data for The Kerrigan OEM Survey was gathered from Kerrigan Advisors’ annual survey of automotive OEM executives in conjunction with the issuance of The Blue Sky Report®. The survey is based on over 110 responses from OEM executives in Kerrigan Advisors’ proprietary database. Responses were collected from December 2023 to June 2024.

- To download the full Kerrigan OEM Survey report, click here.

- To download a preview of The Blue Sky Report®, published by Kerrigan Advisors, click here.

- To access The Kerrigan Index™, click here.

- To access results from the latest Kerrigan Dealer Survey, click here.

About Kerrigan Advisors

Kerrigan Advisors is the leading sell-side advisor and thought partner to auto dealers nationwide. Since its founding in 2014, the firm has led the industry with the sale of over 275 dealerships representing more than $9 billion in client proceeds, including the third largest transaction in auto retail history – the sale of Jim Koons Automotive Companies to Asbury Automotive Group. The firm advises the industry’s leading dealership groups, enhancing value through the lifecycle of growing, operating and, when the time is right, selling their businesses. Led by a team of veteran industry experts with backgrounds in investment banking, private equity, accounting, finance and real estate, Kerrigan Advisors does not take listings, rather they develop a customized sales approach for each client to achieve their personal and financial goals. In addition to the firm’s sell-side advisory services, Kerrigan Advisors also provides a suite of consulting and investor services including growth strategy, market valuation assessments, capital allocation, transactional due diligence, open point proposals, operational improvement and real estate due diligence.

Kerrigan Advisors monitors conditions in the buy/sell market and publishes an in-depth analysis each quarter in The Blue Sky Report®, which includes Kerrigan Advisors’ signature blue sky charts, multiples, and analysis for each franchise in the luxury and non-luxury segments. To download a preview of the report, click here. The firm also releases monthly The Kerrigan Index™ composed of the seven publicly traded auto retail companies with operations focused on the US market. The Kerrigan Auto Retail Index is designed to track dealership valuation trends, while also providing key insights into factors influencing auto retail. To access The Kerrigan Index™, click here. To read the 2023 Kerrigan Dealer Survey, click here. Kerrigan Advisors also is the co-author of NADA’s Guide to Buying and Selling a Dealership.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240729703758/en/

Contacts

Kerrigan Advisors Media Contact:

Melanie Webber (melanie@mwebbcom.com), mWEBB Communications, 949-307-1723