Cooking at home overwhelmingly preferred (80%) to eating out

Primerica, Inc. (NYSE: PRI), a leading provider of financial services and products in the United States and Canada, released its Financial Security Monitor™ (FSM™) survey for the second quarter of 2024. This national survey sheds light on the sentiments of consumers regarding their economic stability during this quarter finding that even amid reports of an improving economy they are not feeling the effects in their pocketbooks. Two-thirds of middle-income families reported they are falling behind the cost of living.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240626551113/en/

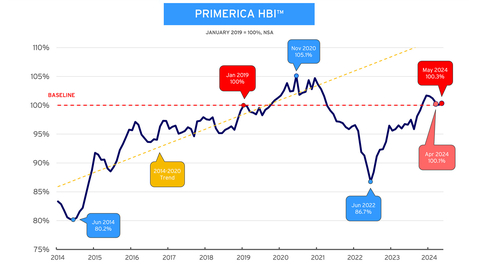

Primerica Household Budget Index™ (HBI™) - Middle-income households experienced a slight increase in purchasing power as the HBI™ rose for the first time in 5 months — 100.3% in May, up from 100.1% in April 2024. While a positive indicator as inflation slows down, middle-income households are still struggling to make up financial ground, with purchasing power running only slightly higher than the index baseline of January 2019. (Graphic: Business Wire)

This perception may be influencing individual financial habits with 80% of households reportedly cooking more meals at home instead of dining out or ordering takeout over the past year. The top two reasons for this shift in behavior were budget concerns, with 72% of respondents acknowledging this as a primary factor, followed by unreasonably high restaurant prices, which was a key factor for 62% of respondents.

“Middle-income families are continuing to make adjustments in their budgets in an attempt to manage the ongoing high cost of living,” said Glenn Williams, CEO of Primerica. “Unfortunately, their difficult decisions include the increasing use of credit cards and scaling back saving for the future, which both could negatively impact their long-term financial condition.”

This latest FSM™ survey coincides with the release of Primerica’s Household Budget Index™ (HBI™), which indicates middle-income households experienced a slight increase in purchasing power as the HBI™ rose for the first time in 5 months — 100.3% in May, up from 100.1% in April 2024. While a positive indicator as inflation slows down, middle-income households are still struggling to make up financial ground, with purchasing power running only slightly higher than the index baseline of January 2019.

“It’s mildly encouraging that, after taking overall inflation into account, middle-income households saw an average real income gain of 1.3% over the past 12 months,” said Amy Crews Cutts, Ph.D., CBE®, economic consultant to Primerica. “Yet as gasoline prices fell, the costs of other necessity goods rose more quickly, and it will take time for people to feel that both the broader economic and their own financial standing are on the rise.”

Key Findings from Primerica’s U.S. Middle-Income Financial Security Monitor

- Reports of cutting costs or pausing savings altogether by middle-income families remained steady. During the first quarter, 46% of families reported they were scaling back with 48% reporting the same during the second quarter.

- The percentage of people cooking at home has increased. There is a major shift in spending and saving habits among middle-income families, including a staggering 4:1 ratio of families who report cooking meals at home compared to eating at restaurants or ordering takeout.

- Majority grasp financial basics but not complexities. Overall, two-thirds (65%) of households feel confident in making sound financial decisions without outside help, particularly when it comes to financial fundamentals like building good credit (87% confident), paying down credit card debt (83%) and creating and following a financial budget (74%). However, households continue to express less confidence when it comes to more complex financial matters, including setting up a retirement account such as a 401(k) or Individual Retirement Account (IRA) (66% confident), buying life insurance (63%), and investing in stocks (50%).

- Anxiety and limited time are the main drivers in lack of financial planning. More than a quarter (31%) say they don’t contribute to a savings account, follow a budget, contribute to an investment account or set a financial budget each month. Anxiety (29%) and not having time (19%) continue to be cited as the biggest challenges people have tracking their financial information.

Primerica Financial Security Monitor™ (FSM™) Topline Trends Data

|

Jun 2024 |

Mar 2024 |

Dec 2023 |

Sept 2023 |

Jun 2023 |

Mar 2023 |

Dec 2022 |

Sep 2022 |

Jun 2022 |

How would you rate the condition of your personal finances? Share reporting “Excellent” or “good.” |

49% |

50% |

50% |

49% |

50% |

52% |

53% |

53% |

54% |

Analysis: Respondents remain split on their assessment of their personal finances. |

|||||||||

Overall, would you say your income is…? Share reporting “Falling behind the cost of living” |

66% |

67% |

68% |

72% |

71% |

72% |

72% |

75% |

75% |

Share reporting “Stayed about even with the cost of living” |

26% |

25% |

24% |

20% |

22% |

21% |

20% |

19% |

20% |

Analysis: Concern about meeting the increased cost of living remained steady with two-thirds reporting they are falling behind the cost of living. |

|||||||||

And in the next year, do you think the American economy will be…? Share reporting “Worse off than it is now” |

40% |

46% |

53% |

56% |

57% |

53% |

56% |

51% |

61% |

Share reporting “Uncertain” |

19% |

18% |

9% |

9% |

9% |

7% |

8% |

8% |

8% |

Analysis: Fewer respondents think the economy will get worse over the next year, while more are uncertain about the direction of the economy. |

|||||||||

Do you have an emergency fund that would cover an expense of $1,000 or more (for example, if your car broke down or you had a large medical bill)? (Reporting “Yes” responses.) |

63% |

62% |

60% |

62% |

61% |

58% |

59% |

60% |

61% |

Analysis: The percentage of Americans who have an emergency fund that would cover an expense of $1,000 or more has slightly improved over the past year. |

|||||||||

How would you rate the economic health of your community? (Reporting “Not so good” and “Poor” responses.) |

58% |

60% |

57% |

55% |

54% |

59% |

53% |

55% |

58% |

Analysis: Respondents’ rating of the economic health of their communities has gotten slightly worse over the past year. |

|||||||||

How would you rate your ability to save for the future? (Reporting “Not so good” and “Poor” responses.) |

68% |

67% |

73% |

71% |

71% |

73% |

74% |

73% |

72% |

Analysis: Though slightly improving, a significant majority continue to feel it is difficult to save for the future. |

|||||||||

In the past three months, has your credit card debt…? (Reporting “Increased” responses.) |

30% |

34% |

35% |

34% |

33% |

33% |

39% |

37% |

29% |

Analysis: Credit card debt has fallen slightly over the past year. |

|||||||||

About Primerica’s Middle-Income Financial Security Monitor™ (FSM™)

Since September 2020, the Primerica Financial Security Monitor™ has surveyed middle-income households quarterly to gain a clear picture of their financial situation, and it coincides with the release of the monthly HBI™ four times annually. Polling was conducted online from June 8-11, 2024. Using Dynamic Online Sampling, Change Research polled 1,017 adults nationwide with incomes between $30,000 and $130,000. Post-stratification weights were made on gender, age, race, education and Census region to reflect the population of these adults based on the five-year averages in the 2021 American Community Survey, published by the U.S. Census. The margin of error is 3.0%. For more information visit Primerica.com/public/financial-security-monitor.html.

About the Primerica Household Budget Index™ (HBI™)

The Primerica Household Budget Index™ (HBI™) is constructed monthly on behalf of Primerica by its chief economic consultant Amy Crews Cutts, PhD, CBE®. The index measures the purchasing power of middle-income families with household incomes from $30,000 to $130,000 and is developed using data from the U.S. Bureau of Labor Statistics, the US Bureau of the Census, and the Federal Reserve Bank of Kansas City. The index looks at the cost of necessities including food, gas, utilities, and health care and earned income to track differences in inflation and wage growth.

The HBI™ is presented as a percentage. If the index is above 100%, the purchasing power of middle-income families is stronger than in the baseline period and they may have extra money left over at the end of the month that can be applied to things like entertainment, extra savings, or debt reduction. If it is under 100%, households may have to reduce overall spending to levels below budget, reduce their savings or increase debt to cover expenses. The HBI™ uses January 2019 as its baseline. This point in time reflects a recent “normal” economic time prior to the COVID-19 pandemic.

Periodically, prior HBI™ values may be revised due to revisions in the CPI series and Consumer Expenditure Survey releases by the U.S. Bureau of Labor Statistics (BLS). Beginning with the October 2023 release of the HBI™ data, health insurance costs will no longer be included in the calculation of the HBI™ data as part of the healthcare component because of some newly acknowledged methodology that has been used by the BLS to calculate the health insurance CPI. The health insurance CPI, as calculated by BLS, does not measure consumer costs of health insurance such as the cost of premiums paid or a combination of premiums and deductibles, but rather premium values retained by health insurers we do not believe it accurately reflects consumer experiences. The healthcare component will continue to include medical services, prescription drugs and equipment. Prior published values have been adjusted to reflect this change. For more information visit householdbudgetindex.com.

About Primerica, Inc.

Primerica, Inc., headquartered in Duluth, GA, is a leading provider of financial products and services to middle-income households in North America. Independent licensed representatives educate Primerica clients about how to better prepare for a more secure financial future by assessing their needs and providing appropriate solutions through term life insurance, which we underwrite, and mutual funds, annuities and other financial products, which we distribute primarily on behalf of third parties. We insured approximately 5.7 million lives and had approximately 2.9 million client investment accounts on December 31, 2023. Primerica, through its insurance company subsidiaries, was the #2 issuer of Term Life insurance coverage in the United States and Canada in 2023. Primerica stock is included in the S&P MidCap 400 and the Russell 1000 stock indices and is traded on The New York Stock Exchange under the symbol “PRI”.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240626551113/en/

Contacts

Public Relations

Gana Ahn, 678-431-9266

gana.ahn@primerica.com

Investor Relations

Nicole Russell, 470-564-6663

nicole.russell@primerica.com