Primerica’s Household Budget Index sees slight decline

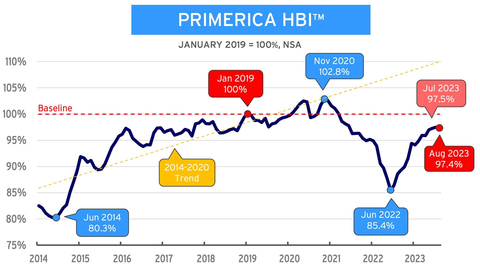

Primerica, Inc. (NYSE: PRI), a leading provider of financial services in the United States and Canada, announced today the release of the Primerica Household Budget Index™ (HBI™), a monthly index illustrating the purchasing power of U.S. middle-income households with incomes between $30,000 and $130,000. In August 2023, the average purchasing power for U.S. middle-income households was 97.4%, down from 97.5% in July 2023. A year ago, in August 2022, the index stood at 88.6%. The slight decrease this month shows that middle-income budgets are still stressed and saving for the future, while eliminating debt remains a challenge.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230928660855/en/

Primerica Household Budget Index™ - In August 2023, the average purchasing power for U.S. middle-income households was 97.4%, down from 97.5% in July 2023. A year ago, in August 2022, the index stood at 88.6%. The slight decrease this month shows that middle-income budgets are still stressed and saving for the future, while eliminating debt remains a challenge. (Graphic: Business Wire)

“The fragile financial condition of middle-income families experienced continued stress in August,” said Glenn J. Williams, CEO of Primerica. “Both gas and food costs rose, impacting the increase in purchasing power occurring since last June. Even small changes in the costs of necessity items can put families in the position of having to take on more debt or not being able to save as much for the future.”

“The cumulative impacts of inflation have been severe for middle-income households and go a long way to explaining why consumer sentiment is so low and credit card debt so high,” said Amy Crews Cutts, Ph.D., CBE®, economic consultant to Primerica. “Although worker compensation has been rising, it has not risen as fast as inflation in the cost of everyday necessity items for which middle-income households have little room in their budgets to accommodate.”

HBI HISTORICAL BACKGROUND

The index baseline is set at January 2019 and can be thought of as when middle-income households set a budget based on their earned income at that time. Between 2014 and 2020, the HBI™ results recorded steady gains in purchasing power for middle-income families, with a peak of 102.8% in November 2020. This means that relative to January 2019, households were in a stronger financial position to pay their monthly bills because wage growth outpaced the cost of everyday goods. Increasing inflation then caused the index to plummet. In June 2022, it reached a post-pandemic low of 85.4%.

Since the baseline of January 2019, the average middle-income household has cumulatively spent around $2,677 more than budget on basic necessities. In line with this, if the pandemic and ensuing inflation would not have been a factor, the HBI™ today would be closer to 110%.

For more information on the Primerica Household Budget Index, visit www.householdbudgetindex.com.

About the Primerica Household Budget Index™ (HBI™)

The Primerica Household Budget Index™ (HBI™) is constructed monthly on behalf of Primerica by its chief economic consultant Amy Crews Cutts, PhD, CBE®. The index measures the purchasing power of middle-income families with household incomes from $30,000 to $130,000 and is developed using data from the U.S. Bureau of Labor and the Federal Reserve. The index looks at the cost of necessities including food, gas, utilities and health care and earned income to track differences in inflation and wage growth.

The HBI™ is presented as a percentage. If the index is above 100%, the purchasing power of middle-income families is stronger than in the baseline period and they may have extra money left over at the end of the month that can be applied to things like entertainment, extra savings, or debt reduction. If it is under 100%, households may have to reduce overall spending to levels below budget, reduce their savings or increase debt to cover expenses. The HBI™ uses January 2019 as its baseline. This point in time reflects a recent “normal” economic time prior to the COVID-19 pandemic.

Periodically, prior HBI™ values may be revised due to revisions in the CPI series and Consumer Expenditure Survey releases by the U.S. Bureau of Labor Statistics.

About Primerica, Inc.

Primerica, Inc., is a leading provider of financial services to middle-income households in North America. Independent licensed representatives educate Primerica clients about how to better prepare for a more secure financial future by assessing their needs and providing appropriate solutions through term life insurance, which we underwrite, and mutual funds, annuities and other financial products, which we distribute primarily on behalf of third parties. We insured over 5.7 million lives and had over 2.8 million client investment accounts on December 31, 2022. Primerica, through its insurance company subsidiaries, was the #3 issuer of Term Life insurance coverage in the United States and Canada in 2022. Primerica stock is included in the S&P MidCap 400 and the Russell 1000 stock indices and is traded on The New York Stock Exchange under the symbol “PRI.”

View source version on businesswire.com: https://www.businesswire.com/news/home/20230928660855/en/

Contacts

Public Relations

Gana Ahn, 678-431-9266

gana.ahn@primerica.com

Investor Relations

Nicole Russell, 470-564-6663

nicole.russell@primerica.com