Emphasizes Track Record of Innovation Powering Growth, Stockholder Value Creation Under Joe Kiani’s Leadership

Illuminates Risk Quentin Koffey Poses to Masimo’s Culture of Innovation

Strongly Encourages Stockholders to Protect Their Investment by Voting FOR H Michael Cohen and Julie Shimer, Ph.D., on the WHITE Proxy Card

Visit KeepMasimoStrong.com for More Information

The Board of Directors of Masimo Corporation (“Masimo” or the “Company”) (Nasdaq: MASI) today issued a letter to stockholders in connection with the Company’s Annual Meeting of Stockholders to be held on June 26, 2023. The letter outlines the importance of Masimo’s mission-driven innovation to its financial success and how Politan Capital Management (“Politan”) nominee Quentin Koffey’s ill-informed plans to meddle in Masimo’s R&D strategy endanger the Company’s future.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230613488874/en/

(Graphic: Business Wire)

Electing Quentin Koffey to the Board would threaten Masimo’s mission, guiding principles, strategy and leadership and jeopardize the potential of your investment in Masimo. The Board encourages stockholders to vote FOR Masimo’s highly qualified director nominees, H Michael Cohen and Julie Shimer, Ph.D.

Find more information on why your vote is so important to the future of Masimo at www.KeepMasimoStrong.com. The full text of the Board’s letter to our stockholders can be found here:

Dear Fellow Masimo Shareholders:

Over nearly 30 years, Masimo has built an unparalleled reputation for constant innovation in service of our shared mission of improving lives. Masimo’s founder, chairman and chief executive officer Joe Kiani has been and remains at the center of this – constantly collaborating with Masimo’s R&D leadership and customers and being named as an inventor on approximately 25 percent of Masimo’s patent filings. The culture of mission-driven innovation that Mr. Kiani and Masimo have fostered is fundamental to our relationships with our customers and employees, has driven strong returns for Masimo shareholders and powers our strategy.

Politan’s nominee Quentin Koffey has claimed he will “fix” innovation at Masimo but has provided no concrete plan. If Mr. Koffey is elected to the Board, his efforts to “fix” Masimo are far more likely to harm the Company. Putting aside the baseless premise that Masimo has an innovation problem, Mr. Koffey has no hands-on experience in the medical technology industry and prior to Masimo had never even invested in the industry, much less directly overseen capital allocation and R&D. In fact, he has never sat on a Board or run any business other than his own two-year-old hedge fund, which has just three employees including Mr. Koffey and his cofounder. His hubris is no different than that of his more prominent peer Bill Ackman, who despite his lack of direct retail experience promised investors he would fix J.C. Penney and instead ran it into the ground. But unlike J.C. Penney at the time, Masimo is a fast-growing, highly valued market leader in a complex, innovation-driven industry.

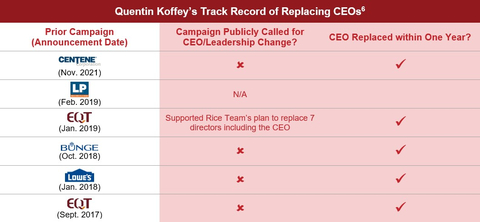

Mr. Koffey continues to disingenuously claim this contest is not about control or ousting Mr. Kiani. In Politan’s letter to shareholders filed today, he asked you to believe that he is “committed to working constructively and collegially with Mr. Kiani.” The facts on this matter are indisputable: In all but one of Mr. Koffey’s past campaigns, the CEO has been replaced within one year of the campaign.1 Moreover, while Politan now baselessly argues that only “two directors…can generate discussion and analysis,” the reality is that Politan refused our previous offer to work together to appoint two mutually agreeable independent directors, insisting that Mr. Koffey be appointed to the Board. As we have said from the beginning, Politan’s agenda isn’t about what’s best for Masimo’s shareholders – it’s about Quentin Koffey’s personal self-interest.

Mr. Koffey’s experiences, philosophy, actions and agenda are fundamentally incompatible with Masimo’s guiding principles and culture of innovation. Innovation happens in the hospital, in the lab and at the workbench – not in a spreadsheet. Paired with his history of replacing CEOs and win-at-any-cost tactics, Mr. Koffey’s ill-informed plans to meddle in Masimo’s R&D strategy threaten to irrevocably damage the Company’s value-creating culture and endanger its future.

There is no need to take this risk. Masimo’s Board has consistently acted on shareholder input and has even committed to appoint Michelle Brennan, an experienced and independent candidate nominated by Politan, to the Board.2 Under this Board and prior Boards, Masimo has created an irreplaceable engine for innovation, delivered above-market and above-target results, and charted a focused strategy to drive sustainable revenue and earnings growth. A vote FOR Masimo’s director nominees H Michael Cohen and Julie Shimer, Ph.D., on the WHITE proxy card is a vote to keep Masimo innovating and growing.

MISSION-DRIVEN INNOVATION IS FUNDAMENTAL TO MASIMO’S SUCCESS

Going back to its founding, Masimo’s success is testament to the power of mission-driven innovation over short-sighted financial analysis. Hired by a medical technology company to help design a cheaper pulse oximeter to meet market demand, Mr. Kiani instead discovered a massive opportunity to improve the clinical performance of the device. The company declined to pursue it, and Mr. Kiani obtained a release allowing him to start Masimo and build the clinically superior pulse oximeter he envisioned.

Innovation later enabled Masimo to break the stranglehold of hospital group purchasing organizations (GPOs) by highlighting financial practices that prioritized GPOs’ revenues over patient safety and shut out innovative new products. SET® pulse oximetry’s clear clinical advantages – reliably helping clinicians to save lives and babies’ eyesight when other pulse oximeters could not – broke open the market to Masimo and paved the way for steady growth.

Again and again, Masimo’s financial success has come from pursuing innovation in service of our mission to save and improve lives. For example, our rainbow® technology, which has been shown to help clinicians reduce mortality by 30 percent post-surgery with SpHb and PVi, has become our second-largest business line.

We were also able to respond quickly to the urgent calls we received from our hospital customers looking for ways to monitor Covid patients remotely and accelerate the growth of our telemonitoring business because of the lifesaving work we were already doing to monitor patients taking opioids at home.

This track record of mission-driven innovation has attracted employees committed to Masimo’s mission and guiding principles, including a core team of like-minded, passionate engineers. The talent pool of engineers with expertise in signal processing and medical technology is limited, and the team Masimo and Mr. Kiani have built over more than 30 years would be exceedingly difficult, if not impossible, to replicate.

Likewise, Masimo’s unparalleled reputation with customers and clinicians is the hard-earned product of decades of successfully working alongside our customers to innovate solutions to their problems. Turning our backs on our customers in the name of maximizing short-term ROIC would have devastating repercussions for our reputation and our ability to continue to grow and create long-term value for our shareholders.

MISSION-DRIVEN INNOVATION HAS DELIVERED STRONG RESULTS FOR SHAREHOLDERS

Since Masimo went public in 2007, its mission-driven innovation has consistently delivered for shareholders. Masimo’s stock has returned 1,012 percent from its IPO to May 1, 2023, the day before Politan announced its nominations, and 852 percent and 105 percent in the ten and five years prior to that date.

From 2017 to 2022, Masimo’s innovation strategy drove revenue growth that significantly exceeded the 8-10 percent target established at our 2017 Investor Day, including above-target and above-market growth in each of the major product categories:

- Total revenue grew at a 13 percent compound annual growth rate (CAGR) vs. the 8-10 percent target;

- SET® revenue grew at a 10 percent CAGR vs. the 6-8 percent target;

- rainbow® revenue grew at a 17 percent CAGR vs. the 10 percent target; and

- Hospital Automation and Other Advanced Parameters revenue grew at a 26 percent CAGR vs. the 20 percent target.

Notably, since sales of SET® began, Masimo has sustained growth rates more than double the pulse oximetry market growth rate in large part due to the other innovative technologies that leverage our healthcare infrastructure and give hospitals more reasons to standardize on Masimo’s platform. Expanding our total addressable market (TAM) in healthcare has provided us even more opportunities to showcase the value of our entire portfolio and to continue to gain market share in pulse oximetry.

As a result, Masimo’s proven ability to innovate into adjacent markets and drive total portfolio growth has supported its premium valuation vs. medical technology companies operating in core markets growing at rates similar to the overall pulse oximetry market. Masimo traded at a 38 percent premium to these peers as of May 1, 2023.3

At the same time, Masimo’s focused and disciplined capital allocation has ensured that the rapid pace of innovation has delivered consistently strong returns on invested capital. While Politan has attempted to highlight what it claims is Masimo’s “concerning pace of new product launches” since 2017, the reality is Masimo’s R&D expenditures are in line with the broader medical technology industry4 and lower than most high-growth medtech peers.5 Despite that, Masimo’s ROIC has exceeded the industry and high-growth peers across the entire decade prior to the Sound United acquisition, thanks to the productivity of Masimo’s engineers and our disciplined capital allocation. ROIC only dipped in 2022 because it includes acquisition related costs and non-cash amortization and does not yet reflect the considerable benefits from the deal and the strategy it enables.

OUR CURRENT STRATEGY IS BUILT ON FOCUSED, MISSION-DRIVEN INNOVATION

Our strategic extension into consumer health is motivated by the recognition of the value Masimo’s mission-driven innovation and expertise in non-invasive monitoring can bring to patients, consumers and hospitals in markets that are becoming more connected to professional healthcare.

Just as each of our major healthcare product categories has built on and reinforced the success of our SET® platform, the Sound United acquisition and subsequent creation of Masimo Consumer leverage our core competencies in signal processing technology and Sound United’s existing consumer infrastructure to expand our TAM and strengthen our entire healthcare franchise.

Our first new products in telemonitoring and consumer health exemplify this approach, featuring innovations that advance our mission, address critical needs and tie back to our healthcare business.

- The Masimo W1™ advanced health tracking watch puts medical-grade monitoring in a consumer-friendly form factor to enable patients to be continuously monitored at home. As a centerpiece for fast-growing “hospital-at-home” programs, the W1™ has the potential to drive health system consideration of Masimo’s full suite of monitoring, automation, and telehealth solutions.

- The Masimo Stork™ baby monitor brings the same clinically proven Masimo SET® technology used to monitor newborns in the hospital to parents who want to monitor their babies at home. With connectivity to Masimo SafetyNet™, Stork™ will in time offer another entry point to the Masimo telemonitoring and telehealth ecosystem.

We have executed Masimo’s mission-driven expansion into consumer health while continuing to adhere to our disciplined approach to capital allocation. The Board’s rigorous evaluation of the acquisition and the consumer health strategy included ensuring that the deal met Masimo’s established return requirements and establishing accountability for ongoing performance. The purchase price for Sound United was reasonable and accretive, and we are confident that ROIC will return to pre-2022 levels over our long-range plan. We have prioritized the creation of a successful and replicable consumer health product launch process built on Sound United’s existing sales, marketing and distribution capabilities and limited incremental spending on consumer product launches to one percent of revenue.

Our strategy creates value for patients, clinicians, hospitals and shareholders by bringing Masimo’s differentiated and clinically superior technologies, proven track record of innovation and customer-driven approach to product development to new markets, while also enhancing the Company’s ability to serve patients and hospitals regardless of care setting. With the Board and management’s track record of strong execution, Masimo is well-positioned to drive sustainable revenue and earnings growth for many years to come.

MR. KOFFEY THREATENS TO DESTROY MASIMO’S SUCCESSFUL BUSINESS MODEL

By contrast, Mr. Koffey has put Masimo’s mission-driven innovation squarely in his crosshairs. Between his intention to meddle in Masimo’s R&D, his track record of replacing CEOs, and his attacks on and ongoing litigation against Mr. Kiani, we firmly believe that electing Mr. Koffey to the Board opens the door to the rapid destruction of the culture that has led to Masimo’s success.

To shareholders who ask, “What’s the harm?”— this is it. At every turn, Mr. Koffey has failed to demonstrate that he has anything to offer Masimo shareholders but substantial risk. He has no relevant experience – like Mr. Ackman at J.C. Penney, he is out of his depth in the industry. Strategically, he has proposed nothing more than elementary financial engineering, cutting investments in growth to juice ROIC and earnings and garner a quick pop in stock price at long-term investors’ expense. And he has wildly and irresponsibly distorted the facts about Masimo’s performance, strategy and oversight to advance his self-serving agenda. Masimo’s long-term shareholders are not confused by his false portrayal of Masimo’s historical performance.

Right up to the Annual Meeting, Mr. Koffey will claim to be constructive and promise to work collaboratively with Mr. Kiani, notwithstanding his attacks on Mr. Kiani to date. He doesn’t dare suggest that he wants to replace Mr. Kiani because he knows shareholders don’t want to take that risk. But this is exactly what has occurred with all but one of his prior campaigns – avoid direct criticism of the CEOs, then have them replaced.

Electing Quentin Koffey to the Board threatens Masimo’s mission, principles, strategy and leadership and jeopardizes the potential of your investment in Masimo. Please do not vote using any blue proxy card you may receive from Politan. Any vote on the blue proxy card will revoke your prior vote on a WHITE proxy card, and only your latest-dated proxy counts.

YOUR VOTE ON THE WHITE PROXY CARD IS CRITICAL

Your vote for our nominees helps ensure that Masimo continues innovating to improve lives and create shareholder value.

We urge you to use the enclosed WHITE proxy card to vote today “FOR” all Masimo’s director nominees: Julie Shimer, Ph.D., and H Michael Cohen.

Masimo’s Board has been unified and unwavering in its commitment to act in the best interests of all shareholders. We look forward to continuing our fruitful engagement with you as we work to drive value for all shareholders by delivering on Masimo’s mission.

Thank you for your continued support,

Masimo Board of Directors

| ____________________ | ||

1 |

Includes past campaigns publicly associated with Quentin Koffey at Politan, D.E. Shaw and Senator Investment Group and excludes Masimo and hostile bid campaigns; CEO replacement includes cases where a CEO departure was announced within 1 year of the public campaign announcement. |

|

2 |

Masimo’s commitment is contingent upon the election of Masimo’s director nominees and stockholder approval of the proposal to expand the Board of Directors to seven directors at the 2023 Annual Meeting. |

|

3 |

Reflects premium of Masimo AV / NTM EBITDA on May 1, 2023, to average AV / NTM EBITDA of select medical technology peers that operate in core markets growing at rates similar to the overall pulse oximetry market (Integra LifeSciences, Hologic, Teleflex, ICU Medical, Enovis, Cooper, STERIS, LivaNova and DentsplySirona). |

|

4 |

As represented by the Dow Jones U.S. Select Medical Device Index. |

|

5 |

The High-Growth MedTech Peer Index includes Align, DexCom, Edwards, Insulet, Intuitive and ResMed. |

|

6 |

Includes past campaigns publicly associated with Quentin Koffey at Politan, D.E. Shaw and Senator Investment Group and excludes Masimo and hostile bid campaigns; CEO replacement includes cases where a CEO departure was announced within 1 year of the public campaign announcement. |

|

About Masimo

Masimo (Nasdaq: MASI) is a global technology company that develops and produces a wide array of industry-leading monitoring technologies, including innovative measurements, sensors, patient monitors, and automation and connectivity solutions. In addition, Masimo Consumer Audio is home to eight legendary audio brands, including Bowers & Wilkins®, Denon®, Marantz®, and Polk Audio®. Our mission is to improve life, improve patient outcomes and reduce the cost of care. Masimo SET® Measure-through Motion and Low Perfusion™ pulse oximetry, introduced in 1995, has been shown in over 100 independent and objective studies to outperform other pulse oximetry technologies. Masimo SET® has also been shown to help clinicians reduce severe retinopathy of prematurity in neonates, improve CCHD screening in newborns, and, when used for continuous monitoring with Masimo Patient SafetyNet™ in post-surgical wards, reduce rapid response team activations, ICU transfers, and costs. Masimo SET® is estimated to be used on more than 200 million patients in leading hospitals and other healthcare settings around the world, and is the primary pulse oximetry at 9 of the top 10 hospitals as ranked in the 2022-23 U.S. News and World Report Best Hospitals Honor Roll. In 2005, Masimo introduced rainbow® Pulse CO-Oximetry technology, allowing noninvasive and continuous monitoring of blood constituents that previously could only be measured invasively, including total hemoglobin (SpHb®), oxygen content (SpOC™), carboxyhemoglobin (SpCO®), methemoglobin (SpMet®), Pleth Variability Index (PVi®), RPVi™ (rainbow® PVi), and Oxygen Reserve Index (ORi™). In 2013, Masimo introduced the Root® Patient Monitoring and Connectivity Platform, built from the ground up to be as flexible and expandable as possible to facilitate the addition of other Masimo and third-party monitoring technologies; key Masimo additions include Next Generation SedLine® Brain Function Monitoring, O3® Regional Oximetry, and ISA™ Capnography with NomoLine® sampling lines. Masimo’s family of continuous and spot-check monitoring Pulse CO-Oximeters® includes devices designed for use in a variety of clinical and non-clinical scenarios, including tetherless, wearable technology, such as Radius-7®, Radius PPG® and Radius VSM™, portable devices like Rad-67®, fingertip pulse oximeters like MightySat® Rx, and devices available for use both in the hospital and at home, such as Rad-97®. Masimo hospital and home automation and connectivity solutions are centered around the Masimo Hospital Automation™ platform, and include Iris® Gateway, iSirona™, Patient SafetyNet, Replica®, Halo ION®, UniView®, UniView :60™, and Masimo SafetyNet®. Its growing portfolio of health and wellness solutions includes Radius T® and Masimo W1™ watch. Additional information about Masimo and its products may be found at www.masimo.com. Published clinical studies on Masimo products can be found at www.masimo.com/evidence/featured-studies/feature/.

ORi and RPVi have not received FDA 510(k) clearance and are not available for sale in the United States. The use of the trademark Patient SafetyNet is under license from University HealthSystem Consortium.

Forward-Looking Statements

All statements other than statements of historical facts included in this press release that address activities, events or developments that we expect, believe or anticipate will or may occur in the future are forward-looking statements including, in particular, certain statements regarding Masimo’s innovation strategy and business model, as well as statements regarding Politan and its founder and nominee, Quentin Koffey, including risks associated therewith. These forward-looking statements are based on management’s current expectations and beliefs and are subject to uncertainties and factors, all of which are difficult to predict and many of which are beyond our control and could cause actual results to differ materially and adversely from those described in the forward-looking statements. These risks include those set forth in this press release and certain other factors discussed in the “Risk Factors” section of our most recent periodic reports filed with the Securities and Exchange Commission (“SEC”), including our most recent Form 10-K and Form 10-Q, all of which you may obtain for free on the SEC’s website at www.sec.gov. Although we believe that the expectations reflected in our forward-looking statements are reasonable, we do not know whether our expectations will prove correct. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof, even if subsequently made available by us on our website or otherwise. We do not undertake any obligation to update, amend or clarify these forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Additional Information Regarding The Annual Meeting of Stockholders Currently Expected to Be Held on June 26, 2023 and Where to Find It

Masimo has filed a definitive proxy statement containing a form of WHITE proxy card with the SEC in connection with its solicitation of proxies for its 2023 Annual Meeting of Stockholders. MASIMO’S SHAREHOLDERS ARE STRONGLY ENCOURAGED TO READ THE DEFINITIVE PROXY STATEMENT (AND ANY AMENDMENTS AND SUPPLEMENTS THERETO) AND ACCOMPANYING WHITE PROXY CARD AS THEY WILL CONTAIN OR CONTAIN IMPORTANT INFORMATION. Stockholders may obtain the proxy statement, any amendments or supplements to the proxy statement and other documents as and when filed by Masimo with the SEC without charge from the SEC’s website at www.sec.gov.

Certain Information Regarding Participants

Masimo, its directors and certain of its executive officers may be deemed to be participants in connection with the solicitation of proxies from Masimo’s stockholders in connection with the matters to be considered at the 2023 Annual Meeting of Stockholders. Information regarding the ownership of Masimo’s directors and executive officers in Masimo common shares is included in Masimo’s definitive proxy statement, which can be found through the SEC’s website at www.sec.gov. To the extent holdings of Masimo’s securities by directors or executive officers have changed since the amounts set forth in the definitive proxy statement, such changes have been or will be reflected on SEC filings filed by the applicable individuals on Forms 3, 4 and 5, which can be found through the SEC’s website at www.sec.gov. These documents can be obtained free of charge from the sources indicated above.

Masimo, SET, Signal Extraction Technology, Improving Patient Outcome and Reducing Cost of Care... by Taking Noninvasive Monitoring to New Sites and Applications, rainbow, SpHb, SpOC, SpCO, SpMet, PVI and ORI are trademarks or registered trademarks of Masimo Corporation.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230613488874/en/

Contacts

Investor Contact: Eli Kammerman

(949) 297-7077

ekammerman@masimo.com

Media Contact: Evan Lamb

(949) 396-3376

elamb@masimo.com