This press release contains forward-looking information that is based upon assumptions and is subject to risks and uncertainties as indicated in the cautionary note contained within this press release.

Dream Unlimited Corp. (TSX: DRM) (“Dream”, “the Company” or “we”) today announced its financial results for the three and twelve months ended December 31, 2021 (“fourth quarter”).

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220222006088/en/

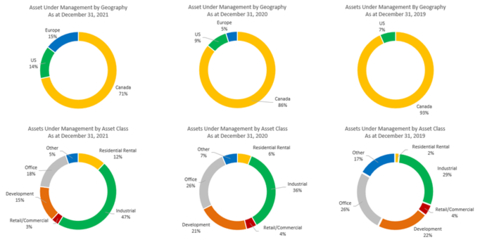

Breakdown of Assets Under Management by Asset Class and Geography (Graphic: Business Wire)

“2021 has been an exceptional year for Dream across all lines of business,” said Michael Cooper, Chief Responsible Officer. “Our western Canada land and housing business had a very profitable year and 2022 has significant pre-sales leading to the expectation of another good year, our development team is making great progress on our developments and anticipated profits are as planned, and with our innovative impact focus, we are accessing more opportunities and working closely with the government on some of their highest priorities. Our asset management business also had an outstanding year with the introduction of our private asset management business, which now manages about $1.4 billion of equity from institutions and high net worth individuals. We have also seen significant growth across our public vehicles, with Dream Industrial REIT’s robust acquisition and development pipelines and Dream Impact Trust’s acquisitions of impact investments. With various developments nearing completion over the next two years, including portions of our impact investments at Zibi and the West Don Lands, we enter 2022 well-positioned to continue developing and acquiring best in class assets in great markets.”

As of December 31, 2021, assets under management(1) were $15 billion, up $5 billion since 2020, with fee earning assets under management(1) of $9 billion as of year end, up from $5 billion at the end of 2020. We have significantly expanded our assets under management in the past two years, increasing our geographic diversification outside of Canada from 7% in 2019 to 29% in 2021 while expanding our investments in the industrial and residential rental asset classes from 31% to 59% over the same period. A breakdown of assets under management by asset class and geography as of December 31, 2021, 2020 and 2019 is included above.

As at December 31, 2021 our debt to total assets ratio(1) was 37% and we ended the year with $275.6 million in available liquidity(2).

A summary of our consolidated results for the three and twelve months ended December 31, 2021 is included in the table below.

|

|

For the three months ended December 31, |

For the twelve months ended December 31, |

||||||

(in thousands of Canadian dollars, except per share amounts) |

2021 |

|

2020 |

|

2021 |

|

2020 |

||

Revenue |

|

$ |

150,122 |

$ |

48,639 |

$ |

325,922 |

$ |

347,623 |

Net margin |

|

$ |

34,685 |

$ |

5,245 |

$ |

60,566 |

$ |

72,320 |

Net margin (%)(1) |

|

|

23.1% |

$ |

10.8% |

|

18.6% |

|

20.8% |

Earnings (loss) before income taxes |

|

$ |

95,349 |

$ |

(31,181) |

$ |

125,875 |

$ |

197,620 |

Earnings (loss) for the period(3) |

|

$ |

80,317 |

$ |

(32,315) |

$ |

110,661 |

$ |

159,638 |

|

|

|

|

|

|

|

|

|

|

Basic earnings (loss) per share(3) |

|

$ |

1.87 |

$ |

(0.70) |

$ |

2.52 |

$ |

3.37 |

Diluted earnings (loss) per share |

|

$ |

1.81 |

$ |

(0.70) |

$ |

2.46 |

$ |

3.31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2021 |

December 31, 2020 |

|

Total assets |

|

|

|

|

|

$ |

3,488,674 |

$ |

2,844,373 |

Total liabilities |

|

|

|

|

|

$ |

2,066,461 |

$ |

1,437,761 |

Shareholders’ equity (excluding non-controlling interest)(4) |

$ |

1,422,213 |

$ |

1,391,646 |

|||||

Total issued and outstanding shares |

|

|

|

|

|

|

42,836,031 |

|

45,011,928 |

Earnings before income taxes after adjusting for fair value adjustments taken on Dream Impact Trust units held by other unitholders(1) for the three months ended December 31, 2021 was $99.1 million, an increase of $70.2 million relative to the prior year. The change is primarily due to higher lot sales in Western Canada, fair value gains on the Company’s investment properties portfolio and increased fees earned from our growing asset management platform. Higher earnings were also driven by the growth of our GTA multi-family rental portfolio, with 1,140 units (at 100%) acquired in the second half of 2021.

Earnings before income taxes after adjusting for fair value adjustments taken on Dream Impact Trust units held by other unitholders(1) for the twelve months ended December 31, 2021 was $150.9 million, up from $119.9 million in the prior year. Current year pre-tax earnings were primarily driven by the gains across our multi-family rental portfolio, higher earnings from the Company’s equity accounted investments, including Dream Office REIT, increased earnings from our asset management platform and improved results from Arapahoe Basin. The comparative year results include the gain on sale of our renewable power portfolio, the sale of 480 acres at Glacier Ridge and occupancies at our Canary Block, Riverside Square, BT Towns and Zibi developments, with limited comparable activity in 2021.

Earnings before income taxes for the three and twelve months ended December 31, 2021 was $95.3 million and $125.9 million, respectively due to the aforementioned operational results in addition to the fair value changes in Dream Impact Trust units held by other unitholders.

Highlights: Recurring Income

- In the fourth quarter, revenue and net operating income(1) derived from recurring income sources increased to $35.9 million and $10.0 million, respectively, due to higher earnings from our asset management platform, Toronto investment properties and our recreational properties portfolio. Included in results for the quarter is $2.4 million in net operating income(1) from seven multi-family rental properties in the GTA acquired in 2021.

- In the year ended December 31, 2021, our recurring income segment generated revenue and net operating income(1) of $116.8 million and $40.4 million, respectively, up by $24.5 million and $13.2 million over the prior year, primarily due to increased earnings from our asset management platform and Toronto investment properties, in addition to increased visitors and a full year of operations at Arapahoe Basin.

- Included in revenue for the year ended December 31, 2021 was $22.7 million in fees earned from Dream Industrial REIT, up from $11.3 million in the prior year, largely driven by $2.4 billion in acquisitions in 2021, which generated acquisition fees and higher base fees for the Company. Dream Industrial REIT has an additional $400 million in acquisitions closed, under contract or in exclusive negotiations in 2022. In 2021, Dream Industrial REIT raised over $2.2 billion in capital through equity issues and unsecured debentures. We have also raised nearly $1.4 billion in capital to date for our private asset management business, inclusive of Dream Impact Fund, a U.S. apartment portfolio with a buy/fix/sell strategy, and our U.S. industrial fund. Our asset management team remains focused on sourcing, managing and growing both our public and private platform through 2022 and our target is to raise an additional $1 billion in private equity this year.

- In the year ended December 31, 2021, Arapahoe Basin generated Adjusted EBITDA(1) of $10.7 million, up from $2.3 million in the prior year, largely due to reduced social distancing measures and our investment in summer activities including the Aerial Adventure Park, the Via Ferrata climbing course, various hiking and biking trails, disc golf, events and specialty dining. Similarly, in the year ended December 31, 2021, Arapahoe Basin generated net earnings of $6.5 million, an increase of $8.3 million over 2020.

- Results for 2021 include $62.1 million in equity earnings on our 33% interest in Dream Office REIT, up from $36.2 million over the comparative period. Improved results were driven by fair value gains at Dream Office REIT and through the REIT’s 10.5% interest in Dream Industrial REIT, in addition to increased operating income at Dream Industrial REIT from recent acquisitions. As at February 18, 2022, the Company had a 29% interest in Dream Impact Trust and a 35% interest in Dream Office REIT, inclusive of interests held by Dream’s Chief Responsible Officer.

- Across the Dream group platform, which includes assets held through the Company, Dream Impact Trust, Dream Impact Fund and Dream Office REIT, we have nearly 5,300 units and 11.5 million sf of gross leasable area (“GLA”) in stabilized rental, retail and commercial properties, in addition to our recreational properties. Over the next four years, we expect to add an additional 2,500 units and 2.4 million sf of rental, retail and commercial GLA to our recurring income portfolio, including West Don Lands Blocks 8 and 3/4/7, Canary Block 10, and several buildings at Zibi.

Highlights: Development

- In the three months ended December 31, 2021, we generated revenue and net margin of $114.2 million and $26.7 million, respectively, compared to revenue of $28.9 million and net margin of $0.6 million in the comparative period. The improved results were driven by higher lot sales in Western Canada, including our first sales at Alpine Park in Calgary, our most valuable land holding in Western Canada.

- Year-to-date, revenue and net margin for the development segment was $209.2 million and $27.1 million, respectively, down by $46.2 million and $24.6 million from 2020, which included the sale of 480 acres at Glacier Ridge and condominium occupancies at Riverside Square, BT Towns and Kanaal at Zibi.

- We achieved 959 lot sales and 119 housing occupancies in 2021, up from 335 lot sales and 107 housing occupancies in 2020. As of February 18, 2022, we have secured commitments for 794 lots, 19 acres and 69 houses across our communities in Saskatchewan and Alberta that we expect to contribute to earnings in 2022.

- Across the Dream group platform, we have approximately 4.0 million sf of GLA in retail or commercial properties and over 20,000 condominium or purpose-built rental units (at the project level) in our development pipeline. For further details on our development pipeline, refer to the “Summary of Dream’s Assets & Holdings” section of our MD&A.

Highlights: Impact Investing

- Dream has developed a well-defined impact strategy that can be applied not only to Dream Impact Trust and Dream Impact Fund, but across our various business lines and our REITs. Dream released its inaugural impact report and disclosure statement as a signatory to the Operating Principles for Impact Management in May 2021. On December 1, 2021, we have made a public commitment to achieving net zero greenhouse gas emissions by 2035, 15 years in advance of the Paris Agreement, with Arapahoe Basin targeting net zero by 2025. Both Dream Impact Trust and Dream Office REIT received five-star GRESB ratings this year, and 87% of Dream Office REIT’s portfolio is WELL Health-Safety certified. We also announced our Social Procurement Program on November 8, 2021, with quantifiable supply chain targets to be met by 2025.

- To support our net zero targets, Dream has pursued creative financing arrangements across our platform, including a $136.6 million commitment from the Canada Infrastructure Bank to retrofit 19 buildings in Ontario and Saskatchewan, two green bond closings by Dream Industrial REIT raising $650 million to finance eligible green projects, $189 million in green loans relating to Canary Block 10 (Dream’s interest in the Indigenous Hub in Toronto), a $30 million convertible debenture offering by Dream Impact Trust used to finance impact investments, and a $23 million in financing for Zibi Community Utility secured through the Federation of Canadian Municipalities Green Municipal Fund.

- On December 1, 2021, Canada Housing Mortgage Corporation (“CMHC”) announced the MLI Select program, which is designed to preserve and create affordable, climate-compatible multi-unit residential housing. Through collaborative engagement, Dream supported CMHC as they designed this innovative insured financing product.

- On January 22, 2022, the National Capital Commissions (“NCC”) announced in partnership with CMHC that Dream was selected to develop the first phase of the Building LeBreton project in Ottawa, Ontario. Dream LeBreton will be Canada’s largest residential zero-carbon project with 601 residential rental units, 40% of which will be affordable and 31% will be accessible. The site is adjacent to a light-rail station, various pedestrian pathways and our 34-acre Zibi development.

- On February 15, 2022, Waterfront Toronto announced that Dream and Great Gulf Group were selected to develop the Quayside site in downtown Toronto. Quayside is a 3.4 million sf all-electric, zero carbon community which will include over 800 affordable housing units, a two acre forested green space, and a significant urban farm atop one of Canada’s largest residential mass timber buildings.

- To further our commitment to impact in our communities, we recently announced the Dream Community Foundation that will offer and support the creation of affordable housing and invest in programs and services aimed at supporting our most vulnerable residents. The foundation will initially be funded by the Cooper family, through a pledge of $25 million over 5 years, with third party donations and/or government subsidies to be assessed in the future. The foundation aims to provide programming and donations to build community amongst tenants and local neighbourhoods while allowing our public vehicles to earn market returns on their impact investments.

Share Capital & Return to Shareholders

- In the year ended December 31, 2021, 2.4 million Subordinate Voting Shares were purchased for cancellation by the Company at an average price of $25.29 under a normal course issuer bid ("NCIB") for total proceeds of $61.4 million (year ended December 31, 2020 - 7.7 million Subordinate Voting Shares at an average price of $22.07, inclusive of 5.0 million Subordinate Voting Shares purchased for cancellation under a substantial issuer bid). Subsequent to year end, 0.3 million Subordinate Voting Shares were purchased for cancellation by the Company under the NCIB at an average price of $39.31.

-

Dividends of $4.3 million and $13.5 million were declared and paid on its Subordinate Voting Shares and Class B Shares in the three and twelve months ended December 31, 2021, respectively (three and twelve months ended December 31, 2020 - $2.7 million and $11.2 million, respectively).

Select financial operating metrics for Dream’s segments for the three and twelve months ended December 31, 2021 are summarized in the table below.

|

|

|

|

Three months ended December 31, 2021 |

||||

(in thousands of dollars except

|

Recurring income |

Development |

Corporate and other |

Total |

||||

Revenue |

$ |

35,883 |

$ |

114,239 |

$ |

— |

$ |

150,122 |

% of total revenue |

|

23.9% |

|

76.1% |

|

—% |

|

100.0% |

Net margin |

$ |

7,996 |

$ |

26,689 |

$ |

— |

$ |

34,685 |

Net margin (%)(1) |

|

22.3% |

|

23.4% |

|

n/a |

|

23.1% |

|

|

|

|

Twelve months ended December 31, 2021 |

||||

(in thousands of dollars except

|

Recurring income |

Development |

Corporate and other |

Total |

||||

Revenue |

$ |

116,766 |

$ |

209,156 |

$ |

— |

$ |

325,922 |

% of total revenue |

|

35.8% |

|

64.2% |

|

—% |

|

100.0% |

Net margin |

$ |

33,502 |

$ |

27,064 |

$ |

— |

$ |

60,566 |

Net margin (%)(1) |

|

28.7% |

|

12.9% |

|

n/a |

|

18.6% |

|

|

|

As at December 31, 2021 |

|||||

Segment assets |

$ |

1,885,019 |

$ |

1,575,453 |

$ |

28,202 |

$ |

3,488,674 |

Segment liabilities |

$ |

739,363 |

$ |

558,870 |

$ |

768,228 |

$ |

2,066,461 |

Segment shareholders’ equity |

$ |

1,145,656 |

$ |

1,016,583 |

$ |

(740,026) |

$ |

1,422,213 |

Shareholders’ equity per share(5) |

$ |

26.75 |

$ |

23.73 |

$ |

(17.28) |

$ |

33.20 |

|

|

|

|

Three months ended December 31, 2020 |

||||

(in thousands of dollars except

|

Recurring income |

Development |

Corporate and other |

Total |

||||

Revenue |

$ |

19,758 |

$ |

28,881 |

$ |

— |

$ |

48,639 |

% of total revenue |

|

40.6% |

|

59.4% |

|

—% |

|

100.0% |

Net margin |

$ |

4,597 |

$ |

648 |

$ |

— |

$ |

5,245 |

Net margin (%)(1) |

|

23.3% |

|

2.2% |

|

n/a |

|

10.8% |

|

|

|

|

Twelve months ended December 31, 2020 |

||||

(in thousands of dollars except

|

Recurring income |

Development |

Corporate and other |

Total |

||||

Revenue |

$ |

92,229 |

$ |

255,394 |

$ |

— |

$ |

347,623 |

% of total revenue |

|

26.5% |

|

73.5% |

|

—% |

|

100.0% |

Net margin |

$ |

20,637 |

$ |

51,683 |

$ |

— |

$ |

72,320 |

Net margin (%)(1) |

|

22.4% |

|

20.2% |

|

n/a |

|

20.8% |

|

|

|

As at December 31, 2020 |

|||||

Segment assets |

$ |

1,118,871 |

$ |

1,560,924 |

$ |

164,578 |

$ |

2,844,373 |

Segment liabilities |

$ |

313,274 |

$ |

452,100 |

$ |

672,387 |

$ |

1,437,761 |

Segment shareholders’ equity |

$ |

805,597 |

$ |

1,093,858 |

$ |

(507,809) |

$ |

1,391,646 |

Shareholders’ equity per share(5) |

$ |

17.90 |

$ |

24.30 |

$ |

(11.28) |

$ |

30.92 |

Other Information

Information appearing in this press release is a select summary of results. The financial statements and MD&A for the Company are available at www.dream.ca and on www.sedar.com.

Conference Call

Senior management will host a conference call on February 23, 2022 at 8:00 am (ET). To access the call, please dial 1-888-465-5079 in Canada or 416- 216-4169 elsewhere and use passcode 9643 707#. To access the conference call via webcast, please go to Dream’s website at www.dream.ca and click on Calendar of Events in the News and Events section. A taped replay of the conference call and the webcast will be available for 90 days.

About Dream Unlimited Corp.

Dream is a leading developer of exceptional office and residential assets in Toronto, owns stabilized income generating assets in both Canada and the U.S., and has an established and successful asset management business, inclusive of $15 billion of assets under management across three Toronto Stock Exchange ("TSX") listed trusts, our private asset management business and numerous partnerships. We also develop land and residential assets in Western Canada. Dream expects to generate more recurring income in the future as its urban development properties are completed and held for the long term. Dream has a proven track record for being innovative and for our ability to source, structure and execute on compelling investment opportunities. A comprehensive overview of our holdings is included in the "Summary of Dream's Assets and Holdings" section of our MD&A.

Non-GAAP Measures and Other Disclosures

In addition to using financial measures determined in accordance with IFRS, we believe that important measures of operating performance include certain financial measures that are not defined under IFRS. Throughout this press release, there are references to certain non-GAAP financial measures and other specified financial measures, including those described below, which management believes are relevant in assessing the economics of the business of Dream. These performance and other measures are not standardized financial measures under IFRS, and may not be comparable to similar measures disclosed by other issuers. However, we believe that they are informative and provide further insight as supplementary measures of financial performance, financial position or cash flow, or our objectives and policies, as applicable.

Non-GAAP Financial Measures

“Adjusted EBITDA” represents net income for the period adjusted for interest expense on debt; amortization and depreciation; share of earnings from equity accounted investments; and net current and deferred income tax expense (recovery). This non-IFRS measure is an important measure used by the Company in evaluating the performance of divisions within our recurring income segment.

Year ended December 31, 2021 |

|||||||||||||||

|

Asset management |

Stabilized properties |

Arapahoe Basin |

Dream Impact Trust &

|

Total recurring income |

||||||||||

Net earnings |

$ |

92,946 |

$ |

17,054 |

$ |

6,452 |

$ |

20,671 |

$ |

137,123 |

|||||

Less: Interest expense |

|

(135) |

|

(8,345) |

|

(120) |

|

(3,514) |

|

(12,114) |

|||||

Less: Taxes |

|

- |

|

- |

|

- |

|

- |

|

- |

|||||

Less: Depreciation and amortization |

|

- |

|

(1,068) |

|

(4,111) |

|

- |

|

(5,179) |

|||||

Less: Share of earnings from equity accounted investments |

|

75,791 |

|

5,994 |

|

(46) |

|

1,173 |

|

82,912 |

|||||

Adjusted EBITDA |

$ |

17,290 |

$ |

20,473 |

$ |

10,729 |

$ |

23,012 |

$ |

71,504 |

|||||

Year ended December 31, 2020 |

|||||||||||||||

|

Asset management |

Stabilized properties

|

Arapahoe Basin |

Dream Impact Trust &

|

Total recurring income |

||||||||||

Net earnings |

$ |

40,529 |

$ |

25,235 |

$ |

(1,853) |

$ |

10,281 |

$ |

74,282 |

|||||

Less: Interest expense |

|

(126) |

|

(6,294) |

|

(191) |

|

(3,095) |

|

(9,706) |

|||||

Less: Taxes |

|

- |

|

- |

|

- |

|

- |

|

- |

|||||

Less: Depreciation and amortization |

|

- |

|

(1,134) |

|

(3,916) |

|

- |

|

(5,050) |

|||||

Less: Share of earnings from equity accounted investments |

|

31,944 |

|

34,048 |

|

(48) |

|

(143) |

|

65,801 |

|||||

Adjusted EBITDA |

$ |

8,711 |

$ |

(1,295) |

$ |

2,302 |

$ |

13,519 |

$ |

23,237 |

|||||

"Consolidation and fair value adjustments" represents certain IFRS adjustments required to reconcile Dream standalone and Dream Impact Trust results to the consolidated results as at and for the years ended December 31, 2021 and 2020. Consolidation and fair value adjustments relate to business combination adjustments on acquisition of Dream Impact Trust on January 1, 2018 and related amortization, elimination of intercompany balances including the investment in Dream Impact Trust units, adjustments for co-owned projects, fair value adjustments to the Dream Impact Trust units held by other unitholders, and deferred income taxes.

"Earnings before income taxes after adjusting for fair value on Dream Impact Trust units held by other unitholders" represents the Company's pre-tax earnings excluding the impact from the volatility of Dream Impact Trust's share price.

|

For the three months ended December 31, |

For the year ended December 31, |

||||||||||

|

|

2021 |

|

2020 |

|

2021 |

|

2020 |

||||

Earnings before income taxes |

$ |

95,349 |

$ |

(31,181) |

$ |

125,875 |

$ |

197,620 |

||||

Less: Adjustments related to Dream Impact Trust units |

|

(3,782) |

|

(60,130) |

|

(25,019) |

|

77,764 |

||||

Earnings before income taxes after adjusting for fair value on Dream Impact Trust units held by other unitholders |

$ |

99,131 |

$ |

28,949 |

$ |

150,894 |

$ |

119,856 |

||||

“Net operating income" represents revenue less direct operating costs and is equal to gross margin as per Note 36 of the consolidated financial statements. Net operating income excludes general, administrative and overhead expenses, and amortization, which are included in net margin per Note 36 of the consolidated financial statements. This non-GAAP measure is an important measure used to assess the profitability of the Company’s recurring income segment. Net operating income for the recurring income segment for the year ended December 31, 2021 and 2020 is calculated as follows:

|

For the three months ended December 31, |

For the year ended December 31, |

||||||||||

|

|

2021 |

|

2020 |

|

2021 |

|

2020 |

||||

Revenue |

$ |

35,883 |

$ |

19,758 |

$ |

116,766 |

$ |

92,229 |

||||

Less: Direct operating costs |

|

(25,921) |

|

(13,491) |

|

(76,351) |

|

(65,007) |

||||

Less: Selling, marketing, depreciation and other indirect costs |

|

(1,966) |

|

(1,670) |

|

(6,913) |

|

(6,585) |

||||

Net margin |

$ |

7,996 |

$ |

4,597 |

$ |

33,502 |

$ |

20,637 |

||||

Add: Depreciation |

|

1,380 |

|

1,159 |

|

4,907 |

|

3,544 |

||||

Add: General and administrative expenses |

|

586 |

|

511 |

|

2,006 |

|

3,041 |

||||

Net operating income |

$ |

9,962 |

$ |

6,267 |

$ |

40,415 |

$ |

27,222 |

||||

Supplementary and Other Financial Measures

"Assets under management (“AUM”)" is the respective carrying value of gross assets managed by the Company on behalf of its clients, investors or partners under asset management agreements, development management agreements and/or management services agreements at 100% of the client's total assets. All other investments are reflected at the Company's proportionate share of the investment's total assets without duplication. Assets under management is a measure of success against the competition and consists of growth or decline due to asset appreciation, changes in fair market value, acquisitions and dispositions, operations gains and losses, and inflows and outflows of capital.

"Available liquidity" represents Dream's standalone corporate cash and debt facilities to cover the Company’s capital requirements including acquisitions. This financial measure is used by the Company to forecast and plan to hold adequate amounts of available liquidity allow for the Company to settle obligations as they come due.

|

|

December 31, 2021 |

|

December 31, 2020 |

||

Dream standalone corporate level cash |

$ |

2,135 |

$ |

42,010 |

||

Operating line availability |

|

163,498 |

|

252,830 |

||

Margin loan availability |

|

110,000 |

|

110,000 |

||

Housing facilities availability |

|

- |

|

21,296 |

||

Available liquidity |

$ |

275,633 |

$ |

426,136 |

"Debt to total assets ratio" represents the Company's financial leverage and is calculated as debt as a percentage of total assets per the consolidated financial statements.

“Fee earning assets under management” represents assets under management that are managed under contractual arrangements that entitle the Company to earn asset management revenue calculated as the total of: (i) 100% of the purchase price of client properties, assets and/or indirect investments subject to asset management agreements; (ii) 100% of the carrying value of gross assets of the underlying development project subject to development management agreements; and (iii) 100% of the carrying value of specific Dream Office REIT redevelopment properties subject to a development management addendum under the shared services agreement with Dream Office REIT, without duplication.

“Net margin %” is an important measure of operating earnings in each business segment of Dream and represents net margin as a percentage of revenue.

Forward-Looking Information

This press release may contain forward-looking information within the meaning of applicable securities legislation, including, but not limited to, statements regarding our objectives and strategies to achieve those objectives; our beliefs, plans, estimates, projections and intentions, and similar statements concerning anticipated future events, future growth, expected net proceeds from sales or transactions, results of operations, performance, business prospects and opportunities, acquisitions or divestitures, tenant base, future maintenance and development plans and costs, capital investments, financing, the availability of financing sources, income taxes, vacancy and leasing assumptions, litigation and the real estate industry in general; as well as specific statements in respect of our development plans and proposals for current and future projects, including projected sizes, density, timelines, uses and tenants; anticipated current and future unit sales and occupancies and resulting revenue; our acquisition and development pipeline; the expansion and growth of our asset management business and private asset management division; expectations regarding raising private equity funds in 2022; our achievement of supply chain targets by 2025 in line with our social procurement program; expectations regarding the sale of assets; the expectation that our income generating assets will grow over time; expectations regarding our sustainability targets, including in respect of Dream LeBreton becoming Canada’s largest residential zero-carbon project; expectations regarding our reduction of greenhouse gas emissions, including in respect of our commitment to achieve net zero greenhouse gas emissions by 2035; expectations regarding the Dream Community Foundation’s activities and funding; and our overall financial performance, profitability and liquidity for future periods and years. Forward-looking information is based on a number of assumptions and is subject to a number of risks and uncertainties, many of which are beyond Dream’s control, which could cause actual results to differ materially from those that are disclosed in or implied by such forward-looking information. These assumptions include, but are not limited to: the nature of development lands held and the development potential of such lands, our ability to bring new developments to market, anticipated positive general economic and business conditions, including low unemployment and interest rates, positive net migration, oil and gas commodity prices, our business strategy, including geographic focus, anticipated sales volumes, performance of our underlying business segments and conditions in the Western Canada land and housing markets. Risks and uncertainties include, but are not limited to, general and local economic and business conditions, the impact of the COVID-19 pandemic on the Company and uncertainties surrounding the COVID-19 pandemic, including government measures to contain the COVID-19 pandemic employment levels, regulatory risks, mortgage rates and regulations, environmental risks, consumer confidence, seasonality, adverse weather conditions, reliance on key clients and personnel and competition. All forward-looking information in this press release speaks as of February 22, 2022. Dream does not undertake to update any such forward-looking information whether as a result of new information, future events or otherwise, except as required by law. Additional information about these assumptions and risks and uncertainties is disclosed in filings with securities regulators filed on SEDAR (www.sedar.com).

Endnotes:

(1) |

For the definition of the following specified financial measures: assets under management, fee earning assets under management, net margin (%), net operating income, debt to total assets ratio, earnings before income taxes after adjusting for fair value losses taken on Dream Impact Trust units held by other unitholders, adjusted EBITDA, consolidation and fair value adjustments, refer to the “Non-GAAP Measures and Other Disclosures” section of this press release. | |

(2) |

For the definition of the following capital management measure: available liquidity, refer to the “Non-GAAP Measures and Other Disclosures” section of this press release. | |

(3) |

Earnings (loss) for the three and twelve months ended December 31, 2021 includes a loss of $3.8 million and a loss of $25.0 million, respectively, on Dream Impact Trust units held by other unitholders (three and twelve months ended December 31, 2020 – loss of $60.1 million and a gain of $77.8 million, respectively). Refer to the “Additional Information – Consolidated Dream” section of our MD&A for results on a Dream standalone basis. | |

(4) |

Shareholders’ equity (excluding non-controlling interest) excludes $15.0 million of non-controlling interest as at December 31, 2020. | |

(5) |

Shareholders’ equity per share represents shareholders’ equity divided by total number of shares outstanding at period end. |

View source version on businesswire.com: https://www.businesswire.com/news/home/20220222006088/en/

Contacts

Dream Unlimited Corp.

Deb Starkman

Chief Financial Officer

(416) 365-4124

dstarkman@dream.ca

Kim Lefever

Director, Investor Relations

(416) 365-6339

klefever@dream.ca