American Campus Communities, Inc. (NYSE: ACC) (“ACC” or the “Company”) today issued an open letter to shareholders highlighting the Company’s successful portfolio management, track record of value creation, market outperformance and continuous Board refreshment, including:

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211216005343/en/

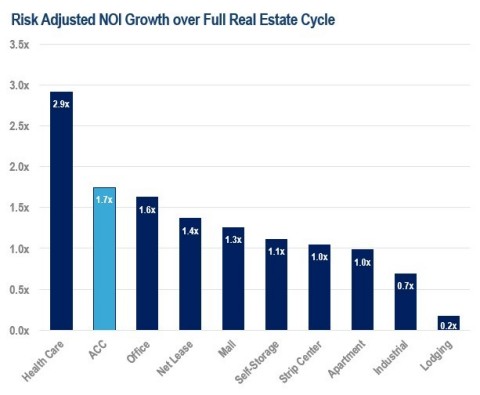

Risk Adjusted NOI Growth over Full Real Estate Cycle (Graphic: Business Wire)

- ACC’s shares are trading near all-time highs, reflecting its consistent operating performance that has resulted in one of the highest risk-adjusted net operating income (NOI) growth profiles over the full real estate cycle, as compared to other publicly traded REIT sectors1;

- Since the start of the pandemic, ACC has achieved a total shareholder return (TSR) of 57%, exceeding the 45% TSR generated by the RMS REIT total return index2; and

- For the third quarter of 2021, total property NOI returned to pre-pandemic levels a full year earlier than anticipated, with 95.8% opening fall occupancy and 3.8% average rental rate growth over the prior year for the 2022 same store portfolio, above the high end of the Company’s prior guidance. Recent operating performance clearly demonstrates ACC’s resiliency following the pandemic.

Against the backdrop of ACC’s positive momentum and exceptional performance, together with the Company’s continued engagement with Land & Buildings Investment Management (“Land & Buildings”), ACC is disappointed by Land & Buildings’ recent actions. Land & Buildings’ Founder and CIO, Jonathan Litt, privately requested Board representation for himself in November 2021. In the midst of continued discussions with our Board, Land & Buildings has chosen to launch a distracting and self-serving public campaign, rather than pursue a path of constructive engagement. In its letter to shareholders, the Company notes:

- Over the past 14 months, ACC has made every attempt to maintain an ongoing and constructive dialogue with Land & Buildings, as the Company does with all of its shareholders, including entering into a settlement agreement in January 2021.

-

With the support of Land & Buildings, earlier this year the Company appointed three new independent directors, elected a new Board Chair and formed a Capital Allocation Committee.

- Ongoing refreshment has resulted in a 40% diverse Board with an average independent director tenure of only 6.6 years.

- The Board’s Capital Allocation Committee consists of four independent directors, two of whom were appointed to the Board pursuant to the January 2021 agreement with Land & Buildings, including the Chair, Craig Leupold.

- Since the January 2021 settlement agreement, ACC’s refreshed Board has overseen strong TSR of 39%3.

- Land & Buildings has been misleading regarding its ongoing effort to secure a seat on the ACC Board for Mr. Litt4.

The full text of the Company’s letter follows:

Dear American Campus Communities shareholders,

Our Board of Directors and management team are committed to creating value for you, our shareholders.

ACC has been a pioneer in the student housing industry since its founding in 1993. We are now the largest developer, owner and manager of high-quality student housing communities in the United States. With an enterprise value of approximately $10.6 billion5, the Company’s 166 owned properties are in 71 markets. With our shares trading near all-time highs, our performance and shareholder value creation have been exceptional:

- Since our IPO in 2004, ACC has produced a total return of 565% compared to the RMS REIT total return of 379%6.

- Since completing our strategic portfolio refinement in 2018, ACC has outperformed the RMS REIT total return index by approximately 880 basis points7.

- Since COVID-19 was declared a global pandemic, ACC has outperformed the RMS REIT total return index by approximately 1,130 basis points8.

ACC’s refreshed Board and management team have engaged extensively with our investors and taken meaningful actions to deliver significant earnings per share growth and shareholder value creation. We made strategic decisions leading up to the pandemic that began to produce results as demonstrated by our FFOM per share growth in 2019. While the progress was temporarily disrupted by the pandemic, ACC has emerged as a stronger company and our efforts are yielding tangible results. We are excited about the Company’s runway for strong earnings and net asset value growth, which we expect will further drive substantial shareholder returns.

Achieving Strong Financial Results and Building for Long-Term Success

ACC has successfully enhanced its portfolio and diversified its sources of capital to drive significant earnings growth and shareholder value creation, including by:

- Strategically refining the assets in our portfolio with a focus on owning properties within walking distance to major Power 5 conference and Carnegie R1 universities that we believe are best positioned to deliver resilient performance over the long-term;

- Pursuing accretive investment opportunities in high-yielding developments;

- Funding any near-term capital needs through strategic capital recycling while maintaining consistent earnings growth for shareholders; and

- Minimizing the effect of the pandemic on our shareholders and generating a runway for strong future growth. As a result, ACC’s earnings trajectory is among the highest of all sectors in the real estate industry according to current analyst estimates.

Our results throughout 2021 and momentum leading into 2022 demonstrate that our best-in-class property operations team is capitalizing on historic industry tailwinds:

- Returned total property net operating income (NOI) to pre-pandemic levels a full year earlier than anticipated, demonstrating ACC’s resiliency following the COVID-19 pandemic;

- Achieved 95.8% opening fall occupancy and 3.8% average rental rate growth over the prior year for the 2022 same store portfolio, above the high end of our prior guidance;

- Delivered phase 5 of the Flamingo Crossings Village project on time and on budget, despite the national labor shortage and supply chain constraints, and welcomed over 4,500 residents within the first five months since the Disney College Program recommenced; and

- Awarded two new third-party development projects and commenced a third at Princeton University.

ACC’s consistent operating performance results in one of the highest risk-adjusted NOI growth profiles over the full real estate cycle, as measured starting from The Great Recession in 2008 and ending in 2019 before the impacts of the COVID-19 global pandemic9.

ACC is poised to benefit from its prior long-term strategic portfolio refinement, investments in our next-gen operating platform and the positive fundamentals of the student housing industry. ACC’s university markets are now experiencing record setting enrollment levels, including first year student enrollment growth at the highest levels in over 30 years, combined with new supply at the lowest levels in over a decade and significant activity in our on-campus public-private partnership business.

Recent Interactions with Land & Buildings

The Board and management team of ACC have sought to maintain a constructive dialogue with Land & Buildings since it contacted the company and became a shareholder last year. Land & Buildings first approached ACC in October of 2020 when the Company was battling the negative effects of the pandemic on higher education, the student housing industry and the Company’s business.

With Land & Buildings’ support in January 2021, we continued to refresh our Board and enhance our governance by identifying and appointing three new independent members, appointing a new Board Chair – Cydney Donnell, former Principal and Managing Director of European Investors/EII Realty Securities – and forming a Capital Allocation Committee. The Board’s new Capital Allocation Committee consists of four independent directors, two of whom were appointed to the Board pursuant to the January 2021 agreement with Land & Buildings, including Craig Leupold, former CEO of Green Street Advisors – a leading independent research and advisory firm for the real estate industry known for its analysis regarding corporate governance and capital allocation – who serves as Committee Chair. Notably, both Ms. Donnell and Mr. Leupold bring to the ACC Board significant investment experience and shareholder perspectives from their prior roles, contrary to Land & Buildings’ assertion that investor representation is needed.

In connection with our ongoing dialogue and correspondence, on November 1, 2021, ACC received a letter from Founder and Chief Investment Officer Jonathan Litt noting his intent to nominate himself to the ACC Board and work with us privately and constructively. Our Board’s Nominating and Corporate Governance Committee subsequently interviewed Mr. Litt as part of its regular process to evaluate candidates. Following the interview on November 18, Mr. Litt indicated he would provide the Committee follow-up information regarding topics he discussed, but to date, has yet to do so.

It is disappointing that Land & Buildings chose to publicly disclose its intent to nominate a candidate while still in its process with the Board. It is also unfortunate that Land & Buildings decided against continuing to work constructively with ACC as it had previously.

Well Positioned to Deliver Enhanced Value into the Future

Our Board and management have built a best-in-class, sector-leading operating platform that has delivered one of the most resilient NOI growth profiles amongst all REITs since the Company’s IPO over 17 years ago. ACC has successfully navigated through the catastrophic event of the COVID-19 global pandemic while both trying to mitigate the impact to shareholder value and being sensitive to the needs of residents, employees and university partners. We are highly optimistic that the fundamentals of the student housing operating environment provide investors with a unique opportunity for recession-resilient, robust organic growth, meaningful earnings growth, and substantial net asset value creation in the years ahead.

We look forward to our continuing dialogue with ACC shareholders and will keep you apprised of our progress.

Sincerely,

Cydney C. Donnell

Chair of the Board

The ACC Board intends to review any validly submitted proposed director nominees in accordance with the Company’s articles, by-laws and corporate governance guidelines. The Board intends to present its recommendation regarding any director nominees in ACC’s definitive proxy statement and other materials, to be filed with the U.S. Securities and Exchange Commission and mailed in due course. The 2022 Annual Meeting has not yet been scheduled and no shareholder action is required at this time.

BofA Securities is serving as financial advisor and Dentons US LLP is serving as legal counsel to the Company.

About American Campus Communities

American Campus Communities, Inc. is the largest owner, manager and developer of high-quality student housing communities in the United States. The company is a fully integrated, self-managed and self-administered equity real estate investment trust (REIT) with expertise in the design, finance, development, construction management and operational management of student housing properties. As of September 30, 2021, American Campus Communities owned 166 student housing properties containing approximately 111,900 beds. Including its owned and third-party managed properties, ACC's total managed portfolio consisted of 202 properties with approximately 140,700 beds. Visit www.americancampus.com.

Forward-Looking Statements

In addition to historical information, this press release contains forward-looking statements under the applicable federal securities law. These statements are based on management’s current expectations and assumptions regarding markets in which American Campus Communities, Inc. (the "Company") operates, operational strategies, anticipated events and trends, the economy, and other future conditions. Forward-looking statements are not guarantees of future performance and involve certain risks and uncertainties, which are difficult to predict. These risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the forward looking-statements include those related to the COVID-19 pandemic, about which there are still many unknowns, including the duration of the pandemic and the extent of its impact, and those discussed in our filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2020 under the heading "Risk Factors" and under the heading "Business - Forward-looking Statements" and subsequent quarterly reports on Form 10-Q. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events, or otherwise. The information contained on our website is not a part of this release.

Important Additional Information and Where to Find It

In the event that Lands & Buildings files a consent solicitation statement or a proxy statement with the SEC in connection with a solicitation to, among other things, possibly nominate any person for election to the board of directors of the Company (the “Solicitation”), the Company plans to file a proxy statement or a consent revocation statement, as applicable (each, a “Solicitation Statement”), with the SEC, together with a WHITE proxy card or consent revocation card, as applicable. SHAREHOLDERS ARE URGED TO READ THE APPLICABLE SOLICITATION STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT THE COMPANY WILL FILE WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Shareholders will be able to obtain, free of charge, copies of the Solicitation Statement, any amendments or supplements thereto and any other documents (including the WHITE proxy card or consent revocation card, as applicable) when filed by the Company with the SEC in connection with the Solicitation at the SEC’s website (http://www.sec.gov) or at the Company’s website at www.americancampus.com within the investor relations section.

Certain Information and Where to Find It

The Company, its directors and certain of its executive officers and other employees may be deemed to be participants in the solicitation of proxies from shareholders in connection with the Solicitation. Additional information regarding the identity of these potential participants, none of whom owns in excess of one percent (1%) of the Company’s shares, and their direct or indirect interests, by security holdings or otherwise, will be set forth in the applicable Solicitation Statement and other materials to be filed with the SEC in connection with the Solicitation. Information relating to the foregoing can also be found in the Company’s definitive proxy statement for its 2021 annual meeting of shareholders (the “2021 Proxy Statement”), filed with the SEC on March 17, 2021. To the extent holdings of the Company’s securities by such potential participants (or the identity of such participants) have changed since the information printed in the 2021 Proxy Statement, such information has been or will be reflected on Statements of Change in Ownership on Forms 3 and 4 filed with the SEC. You may obtain free copies of these documents using the sources indicated above.

1 Green Street Advisors Same-Store NOI Growth by Sector 2008-2019. Risk Adjusted NOI Growth & Average Annual NOI growth divided by the Standard Deviation of Annual NOI Growth |

2 Total return from March 11, 2020, when the WHO declared COVID-19 a pandemic to December 14, 2021 |

3 Total return from January 27, 2021, to December 14, 2021 |

4 Full text of Land & Buildings letters to ACC dated November 1, 2021 and November 9, 2021, and ACC response letter dated November 5, 2021, can be found in the Company’s 8-K filing with the SEC |

5 Based on share price as of September 30, 2021 |

6 Total return from August 11, 2004, to December 14, 2021 |

7 Total return from December 31, 2017, to December 14, 2021 |

8 Total return from March 11, 2020, when the WHO declared COVID-19 a pandemic to December 14, 2021 |

9 Green Street Advisors Same-Store NOI Growth by Sector 2008-2019. Risk Adjusted NOI Growth & Average Annual NOI growth divided by the Standard Deviation of Annual NOI Growth |

View source version on businesswire.com: https://www.businesswire.com/news/home/20211216005343/en/

Contacts

American Campus Communities, Inc., Austin

Ryan Dennison, 512-732-1000

Or

Andrew Siegel / Amy Feng / Greg Klassen

Joele Frank, Wilkinson Brimmer Katcher

(212) 355-4449