VANCOUVER, BC / ACCESSWIRE / January 9, 2024 / BeMetals Corp. (TSXV:BMET)(OTCQB:BMTLF)(Frankfurt:1OI.F) (the "Company" or "BeMetals") is pleased to announce results of drill hole D22-C1 at the D-Prospect of the Pangeni Copper Project. The Company also reports completion of the 2023 phases of drilling at the Kato and Todoroki projects in Japan. In addition, BeMetals has closed a C$2 million convertible debenture private placement funding with strategic investor B2Gold Corp. (TSX: BTO, NYSE American: BTG, NSX: B2G) ("B2Gold"), as part of a funding package previously announced on August 1, 2023.

Highlights:

- Pangeni Copper Project: D-Prospect: Drill hole D22-C1 intersected 18.10 metres grading 0.70% Copper

- The copper intersection has a grade that exceeds the grades of certain operating, large-scale, copper mines in the Domes Region of the Zambian Copperbelt (1) (2) and has a width similar to mineralized units in these deposits (3)

- This copper intersection is open along strike to the southwest and west, and both up and down dip beneath the Kalahari sand cover

- Kazan Gold Project: The 2023 phase of drilling has been completed at the Kato Project and the Company also completed its two planned drill holes at the Todoroki Project

Note: Table 1 below provides details of this and other intersections in drill hole D22-C1. Notes (1) (2) (3) referenced and detailed in Pangeni Copper Project section below.

John Wilton, President and CEO of BeMetals, stated "We are very pleased and excited by the results from drill hole D22-C1 at the Pangeni Copper Project in Zambia. These new results, including 18.10 metres grading 0.70% copper confirm the pedigree of the geological setting, and highlight similarities to known mined deposits in the Domes Region of the Zambian Copperbelt. These factors illustrate the potential for the D-Prospect to deliver, with additional successful exploration drilling, a significant zone of copper mineralization. Importantly, this copper interval is open along strike to the southwest and west, and both up and down dip beneath the Kalahari sand cover.

This D22-C1 intersection reinforces the targeted tier one discovery potential of the Pangeni Copper Project. Further observation and interpretation to be completed in the coming months, along with pending drill hole results, will guide the design of follow-up exploration at the D-Prospect.

We are also pleased to announce the completion of the C$ 2 million convertible debenture with our strategic investor B2Gold, which will allow the Company to continue advancing our high quality portfolio of copper and gold exploration projects."

PANGENI COPPER PROJECT: D-PROSPECT

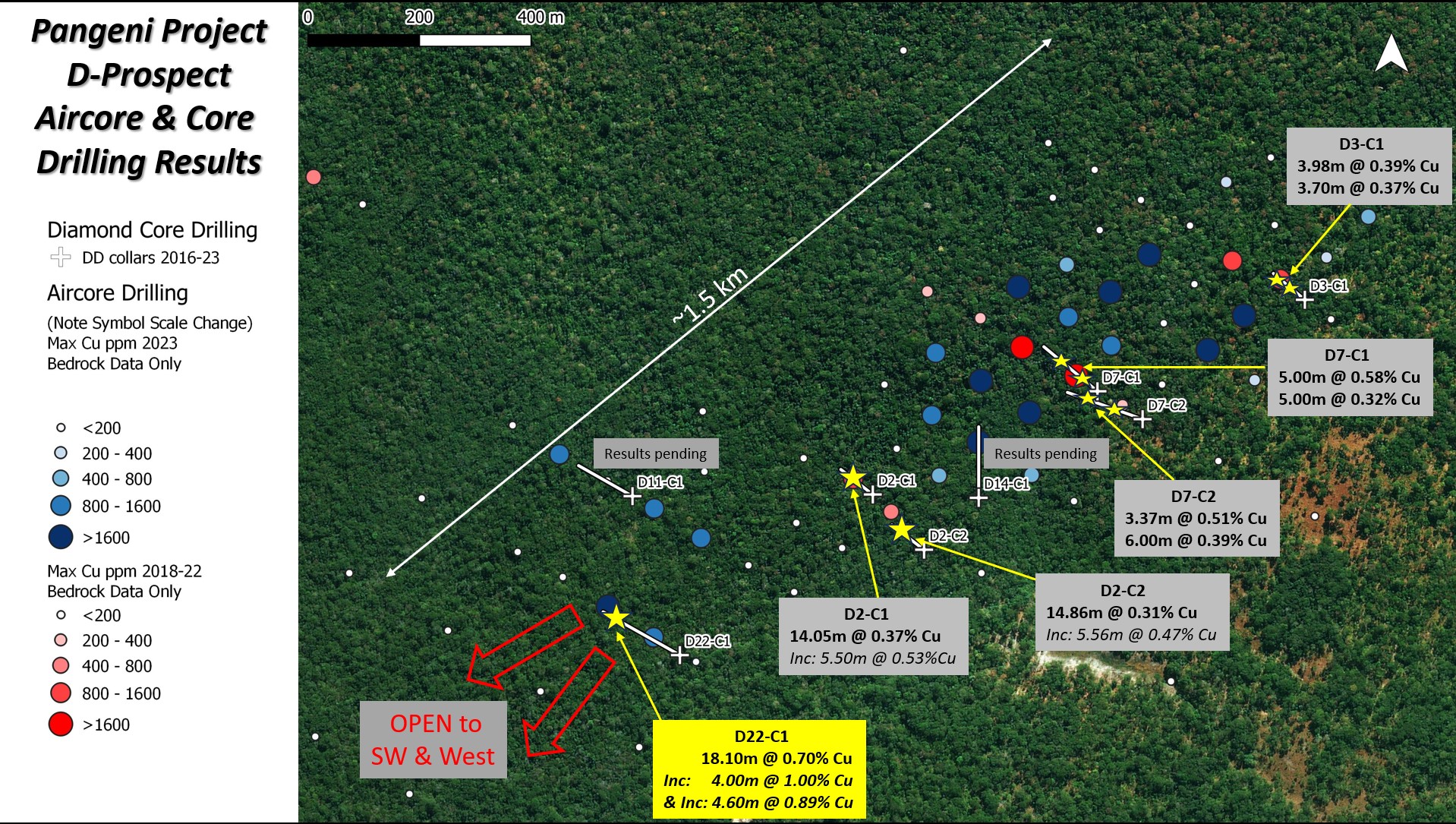

The 2023 drilling campaign at the D-Prospect comprised 2,032 metres of shallow air core drilling to test for bedrock copper anomalies below the Kalahari sand cover, and 787 metres of follow-up core drilling in three holes (D22-C1, D14-C1, D11-C1; see Figure 1). Results from D-14-C1 and D11-C1 are pending from the D-Prospect and will be announced when available.

The D22-C1 interval of 18.10 metres grading 0.70% copper delivers significant mineralization:

- The grade of 0.70% copper exceeds that of certain deposits in the Domes Region. (Examples: First Quantum Minerals' Sentinel Mine Reserves: 792.4 million tonnes grading 0.46% Cu (1) and Barrick Gold's Lumwana Mine Reserves: 538.8 million tonnes grading 0.56% Cu (2)).

- The width of 18.10 metres is comparable to the thicknesses of the mineralized units in several deposits with a similar interpreted style of copper mineralization in the Domes Region. At the Lumwana Mine, the average mineralized thickness of the ore schist unit at the Malundwe deposit is 15 metres (3), and the average thicknesses of the upper, central, and lower ore schist units at the Chimiwungo deposit are 10, 60 and 12 metres, respectively (3).

Notably, the D22-C1 drill intersection is open along the interpreted strike of the geological units to the southwest and west as well as both up and down dip beneath the Kalahari sand cover. Some 400 metres along strike to the northeast of the D22-C1 intersection, previously reported drill hole D2-C1 returned a zone of 14.05 metres at 0.37% copper. Further interpretation, and potential future drilling, will determine if these two intersections can be linked.

Importantly, drill core observation of the main D22-C1 intercept reveals an interpreted zonation of the copper sulphide minerals from a narrow but meaningful interval of high-tenor chalcocite through chalcopyrite plus bornite and chalcopyrite only to chalcopyrite plus pyrite. This mineral zonation can be taken as evidence for a robust mineralizing system and, in combination with existing and future drill intersections, could provide vectors towards feeders for the D-Prospect mineralization.

Table 1 provides details of all results from the D22-C1 drill hole and Table 2 information on the azimuth, dip, end of hole depth and collar coordinates. It should be noted that there are several additional zones of copper mineralization both above and below the main intercept.

1) First Quantum Minerals Ltd. website, Mineral Reserves - as at December 31, 2022, and reported based on a long-term $3.00/lb Cu price. The current depleted in-pit Mineral Reserve as at December 31, 2022 for Sentinel.

(2) Barrick Gold Corporation website, Mineral Reserves - December 31, 2013, Technical Report on the Lumwana Mine, North-Western Province, Republic of Zambia, Barrick Gold Corporation, Report for NI 43-101, March 27, 2014.

(3) Bernau, R., Roberts, S., Richards, M., Nisbet, B., Boyce, A., Nowecki, J. (2013) The geology and geochemistry of the Lumwana Cu (± Co ± U) deposits, NW Zambia. Mineralium Deposita, 48:137-153.

Figure 1: Pangeni Copper Project: D-Prospect: D22-C1 Results, Plan Map with Location of 2023 Program Drill Holes, Previous Core Drill Holes, and Combined Phases of Shallow Air Core Results

Note: D22-C1 results reported here (See Tables 1 & 2). Other drill hole results previously reported in BeMetals' news releases: BeMetals Reports Encouraging Core Drilling Results from Pangeni Copper Exploration Project in Zambia, dated October 16, 2019, BeMetals Returns Further Positive Drilling Results from Pangeni Copper Project, dated April 14, 2021, and BeMetals Intersects Further Encouraging Copper Results from Pangeni Exploration Project in Zambia, dated January 25, 2022.

Table 1: D22-C1 Drill Hole Intersection Results

Prospect, Borehole ID & Interval |

From |

To |

Core Interval (m) |

Cu % |

D-Prospect |

||||

D22-C1: Interval 1 |

105.81 |

109.16 |

3.35 |

0.44 |

D22-C1: Interval 2 |

237.95 |

242.00 |

4.05 |

0.40 |

D22-C1: Interval 3 |

260.00 |

278.10 |

18.10* |

0.70 |

including |

260.00 |

264.00 |

4.00 |

1.04 |

also Including |

272.00 |

276.60 |

4.60 |

0.89 |

D22-C1: Interval 4 |

284.50 |

288.34 |

3.84 |

0.48 |

Table 1 Notes: Intertek Genalysis completed the analytical work with the core samples processed at their preparation facility in Kitwe, Zambia. All analytical procedures were conducted in an Intertek Genalysis laboratory in Perth, Australia. Reported widths are drilled core lengths as true widths are unknown at this time. Based upon current data it is estimated true widths range between 85 and 90% of the drilled intersections. A nominal cut-off grade of 0.35% Cu has been used to determine the boundaries of these intersections with no more than 1.9 metres of internal dilution of the intercept. *A nominal cut-off grade of 0.55% Cu has been used to determine the boundaries of this intersections with no more than 5.0 metres of internal dilution of the intercept.

Table 2: Pangeni Project: D-Prospect: Drill Hole ID, Azimuth, Dip, End of Hole Depth and Collar Coordinates

Drill |

Azimuth degree | Dip Degree |

End of hole Depth (m) |

Easting (m) | Northing (m) |

Elevation (m) | Results Status |

D22-C1 |

300 |

-60 |

313.30 |

176,935 |

8,601,001 |

1326 |

Results Received |

D14-C1 |

000 |

-60 |

251.80 |

177,471 |

8,601,283 |

1321 |

Results Pending |

D11-C1 |

300 |

-60 |

222.00 |

176,850 |

8,601,286 |

1330 |

Results Pending |

QUALITY ASSURANCE AND QUALITY CONTROL

The results reported here for this core drilling program were analyzed by Intertek Genalysis, an independent and accredited laboratory. Samples were prepared at their facility in Kitwe, Zambia and analytical work conducted in Perth, Australia. The results were determined using multi-acid, near total digest, and analyzed by Inductively Coupled Plasma ("ICP") Optical (Atomic) Emission Spectrometry ("OES"). The core sampling was conducted with a robust sampling protocol that included the appropriate insertion of standard reference material, duplicates and blanks into the sample stream. Field operations and management have been provided by Remote Exploration Services ("RES") an independent geological consulting and contracting company. The core drilling was conducted by Blurock Mining (Drilling) Services of Kitwe, Zambia.

PANGENI COPPER PROJECT: 2023 EXPLORATION PROGRAM

The Pangeni Project copper mineralization, discovered by the Company, is a westerly extension of the Copperbelt concealed under relatively thin but extensive Kalahari sand cover. The open pit Sentinel Copper Mine, operated by First Quantum Minerals Ltd., is located approximately 130 kilometres northeast of the Pangeni Project and currently represents the westernmost copper mine of the Domes Region within the prolific Zambian Copperbelt.

During the recently completed 2023 exploration program, 5,004 metres of shallow air core and 1,887 metres of follow-up core drilling were completed at several prospects and targets in the Project area. This work was conducted by prudently deploying, based upon many years of operational exploration experience in Zambia, a US$2 million exploration budget, which is pro rata funded by BeMetals (72.2%) and the Japan Organization for Metals and Energy Security ("JOGMEC") (27.8%).

In addition to BeMetals and JOGMEC, the Pangeni exploration team also includes optionees Copper Cross Zambia Limited ("CCZ") providing effective daily technical management of the project, Pangeni Mineral Resources Limited ("PMRL") the licence holders and community relations managers, along with contractors Remote Exploration Services ("RES") and BluRock Mining (Drilling) Services of Kitwe, Zambia.

KAZAN GOLD PROJECT: OPERATIONAL UPDATE

During 2023, the Company completed a total of approximately 2,725 metres of drilling at the Kato Gold Project, and an initial 449 metres of scout drilling in two holes at the Todoroki gold/silver project. The results from the Todoroki drilling are expected during Q1, 2024. Overall, the Company made significant progress during the year with drilling phases at both the Kato and Todoroki projects, and the other projects in the Kazan portfolio are advancing towards drill target status.

At the Kato Project results have been received for drill holes KT23-21, KT23-22, and KT23-23. The results of these drill holes are shown in Table 3 and their location coordinates are in Table 4. Drill hole KT23-21 returned a breccia facies of the Seta Vein, where only low core recoveries were achieved, and an intersection of 4.10 metres grading 0.56 grams per tonne ("g/t") gold ("Au"). While hole KT23-22 did not reach the Seta Vein target zone, it did intersect several relatively narrow but shallow mineralized veins, supporting the Kato corridor exploration potential at the project. (see news release; BeMetals Drilling Results Define Target Zones within Seta Vein and Identify Corridor of Gold Mineralization at Kato Project in Japan, July 12, 2023). The full set of drilling results are currently being compiled and a geological model updated. It is thought this work will provide refined targets, based upon the improved geological understanding, both within the Kato corridor and new Kato district exploration targets for future drill testing.

Table 3: Kato Gold Project KT23-21, KT23-22 and KT23-23 Drill Hole Results

Drill hole and |

From |

To |

Core Interval (m) |

Au g/t |

Ag |

Comments |

KT23-21 |

313.20 |

317.30 |

4.10 |

0.56 |

4.37 |

Seta Vein, Breccia (Low core recoveries) |

KT23-22 |

31.96 |

34.20 |

2.24 |

1.10 |

25.43 |

|

69.90 |

70.50 |

0.60 |

1.07 |

11.40 |

||

74.40 |

75.00 |

0.60 |

1.43 |

14.50 |

||

77.16 |

80.35 |

3.19 |

0.87 |

10.41 |

||

146.09 |

148.4 |

2.31 |

1.41 |

34.71 |

||

199.68 |

206.35 |

6.67 |

0.76 |

3.84 |

Kamitake Vein (1) |

|

213.00 |

216.85 |

3.70 |

0.72 |

3.80 |

Kamitake Vein (1) |

|

KT23-22 Did not intersect Seta Vein (1) |

||||||

KT23-23 |

123.50 |

124.00 |

0.50 |

0.85 |

25.80 |

Drilled outside Kato corridor and did not intersect any significant mineralization |

Table 1 Notes: Intertek Testing Services completed the analytical work with the core samples processed at their accredited laboratory in Manila, Philippines (See details in QA/QA section below). Reported widths are drilled core lengths as true widths are unknown at this time. Based upon current data it is estimated true widths range between 55 to 65% of the drilled intersections. For the mineralized intervals a nominal cut-off grade of 0.5 g/t Au has been used to determine the boundaries of the intersections with no more than 1.20m internal dilution of the intercept. (1) Current interpretation.

Table 4: Kato Project: KT23-21 to KT23-23: Drill Hole ID, Azimuth, Dip, End of Hole Depth and Collar Coordinates

Drill Hole ID |

Azimuth Degree |

Dip Degree |

End of hole Depth (m) |

Easting |

Northing (m) | Elevation (m) |

KT23-21 |

57 |

-60 |

351.30 |

683535 |

4796626 |

469 |

KT23-22 |

58 |

-69 |

363.50 |

683620 |

4796401 |

453 |

KT23-23 |

24 |

-59 |

350.00 |

683726 |

4797093 |

557 |

QUALITY ASSURANCE AND QUALITY CONTROL

The new results reported here for this core drilling program were analyzed by Intertek Testing Services, an independent and accredited laboratory. Samples were prepared and analytical work conducted in Manila, Philippines. The results were obtained using the following analytical methods as appropriate to determine the gold grades; FA50N/AA of 50g fire assay, with Atomic Absorption Spectrometry ("AAS") finish and FA50GR/GR of 50g fire assay with Gravimetric finish for over limit samples exceeding 10 g/t Au. The core sampling was conducted with a robust sampling protocol that included the appropriate insertion of standard reference material, duplicates, and blanks into the sample stream. Field operations and management have been conducted by BeMetals' personnel. The core drilling was conducted by Energold Drilling.

C$ 2 MILLION CONVERTIBLE DEBENTURE PRIVATE PLACEMENT

On January 8, 2024 (the "Closing Date"), BeMetals closed an additional C$2 million of funding with strategic investor B2Gold Corp. ("B2Gold"), as previously disclosed on August 1, 2023. The funding was completed as a non-brokered private placement to B2Gold of an unsecured convertible debenture in the amount of C$2,000,000 (the "Offering"). The convertible debenture (the "Debenture") matures on January 8, 2029 and bears interest at the rate of 7% per annum calculated and compounded annually in arrears on each anniversary date. The principal amount of the Debenture is convertible into common shares of BeMetals at the option of the holder at any time on or before the maturity date at a price of $0.25 per share. Accrued interest on the Debenture is convertible into common shares at the option of the holder on the maturity date at a price per share that is the greater of $0.25 and market price at the time of conversion (subject to prior approval by the TSX Venture Exchange). The Debenture and any accrued interest thereon is repayable in part or in full at any time without penalty. The proceeds of the Offering will be used to advance the Company's portfolio of copper and gold projects, as well as for general working capital. The Debenture, and the common shares that can be acquired on conversion thereof, are subject to a hold period ending on May 9, 2024. The Company is not paying any bonuses, finder's fees, commissions, or transaction fees with regards to the Offering.

RELATED PARTY TRANSACTION DISCLOSURE

As B2Gold is an insider of the Company, the Offering constitutes a "related party transaction" within the meaning of Multilateral Instrument 61-101 - Protection of Minority Security holders in Special Transactions ("MI 61-101"). The Company previously disclosed the funding provided in the Offering in its news release disseminated on August 1, 2023 and its material change report filed on August 11, 2023 (referred to therein as the "Additional Funding"). The Company is relying on the exemption from the requirements to obtain a formal valuation for the Offering based on section 5.5(b) of MI 61-101. The Company obtained minority shareholder approval for the funding provided in the Offering at its shareholder meeting held on September 6, 2023.

EARLY WARNING DISCLOSURE

In connection with the Offering, on the Closing Date, B2Gold acquired the Debenture in the principal amount of C$2,000,000. Prior to completion of the Offering, B2Gold held 33,276,115 common shares of BeMetals, representing approximately 18.8% of the outstanding common shares of BeMetals as at the Closing Date. If converted in full on the Closing Date, B2Gold would acquire an additional 8,000,000 BeMetals common shares, representing approximately 4.5% of the issued and outstanding common shares of BeMetals as at the Closing Date.

Additionally, as announced in the Company's news release dated August 1, 2023, B2Gold holds other securities convertible into common shares of BeMetals in the form of another unsecured convertible debenture in the principal amount of C$3,300,000 (the "Initial Debenture" and together with the Debenture, the "Debentures"). Pursuant to the Initial Debenture, the principal amount is convertible into up to 13,200,000 common shares of BeMetals, representing approximately 7.4% of the issued and outstanding common shares of BeMetals as at the Closing Date.

B2Gold can also acquire additional common shares of BeMetals from the conversion of accrued interest on the Initial Debenture and Debenture, on the respective maturity dates, but such amounts are not known at this time as the conversions of accrued interest are subject to a minimum conversion price of market price as set by the policies of the TSX Venture Exchange.

Immediately following closing of the Offering, B2Gold owns 18.8% of the issued and outstanding common shares of the Company on an undiluted basis as at the Closing Date, and, assuming the conversion of the Debentures in full, approximately 27.4% of the issued and outstanding common shares of BeMetals on a partially diluted basis as at the Closing Date.

B2Gold acquired the Debenture for investment purposes pursuant to the terms of a debenture subscription agreement with BeMetals. B2Gold will evaluate its investment in BeMetals from time to time and may, based on such evaluation, market conditions and other circumstances, increase or decrease shareholdings as circumstances require through market transactions, private agreements or otherwise. The exemption relied on for the acquisition of the Debenture under the subscription agreement is Section 2.3 of National Instrument 45-106 - Prospectus Exemptions.

A copy of the Early Warning report filed by B2Gold in connection with the Offering will be available on BeMetals' SEDAR+ profile. B2Gold's head office is located at Suite 3400 - 666 Burrard Street, Vancouver, BC, V6C 2X8.

QUALIFIED PERSON STATEMENT

The technical information in this news release for BeMetals has been reviewed and approved by John Wilton, CGeol FGS, CEO and President of BeMetals, and a "Qualified Person" as defined under National Instrument 43-101.

ON BEHALF OF BEMETALS CORP.

"John Wilton"

John Wilton

President, CEO and Director

For further information about BeMetals please visit our website at bemetalscorp.com and sign-up to our email list to receive timely updates, or contact:

Derek Iwanaka

Vice President, Investor Relations & Corporate Development

Telephone: 604-928-2797

Email: diwanaka@bemetalscorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release

Cautionary Note Regarding Forward-Looking Statements

This news release contains "forward-looking statements" and "forward looking information" (as defined under applicable securities laws), based on management's best estimates, assumptions and current expectations. Such statements include but are not limited to, the use of proceeds of the Offering, statements with respect to future exploration, development and advancement of the Kazan Projects in Japan and the Pangeni Project in Zambia, and the acquisition of additional base and/or precious metal projects. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as "expects", "expected", "budgeted", "forecasts", "anticipates", "plans", "anticipates", "believes", "intends", "estimates", "projects", "aims", "potential", "goal", "objective", "prospective", and similar expressions, or that events or conditions "will", "would", "may", "can", "could" or "should" occur. These statements should not be read as guarantees of future performance or results. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from those expressed or implied by such statements, including but not limited to: the actual results of exploration activities, the availability of financing and/or cash flow to fund the current and future plans and expenditures, the ability of the Company to satisfy the conditions of the option agreement for the Pangeni Project, and changes in the world commodity markets or equity markets. Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. The forward-looking statements and forward looking information are made as of the date hereof and are qualified in their entirety by this cautionary statement. The Company disclaims any obligation to revise or update any such factors or to publicly announce the result of any revisions to any forward-looking statements or forward looking information contained herein to reflect future results, events or developments, except as require by law. Accordingly, readers should not place undue reliance on forward-looking statements and information. Please refer to the Company's most recent filings under its profile at www.sedar.com for further information respecting the risks affecting the Company and its business.

SOURCE: BeMetals Corp.

View the original press release on accesswire.com