Select Highlights include -

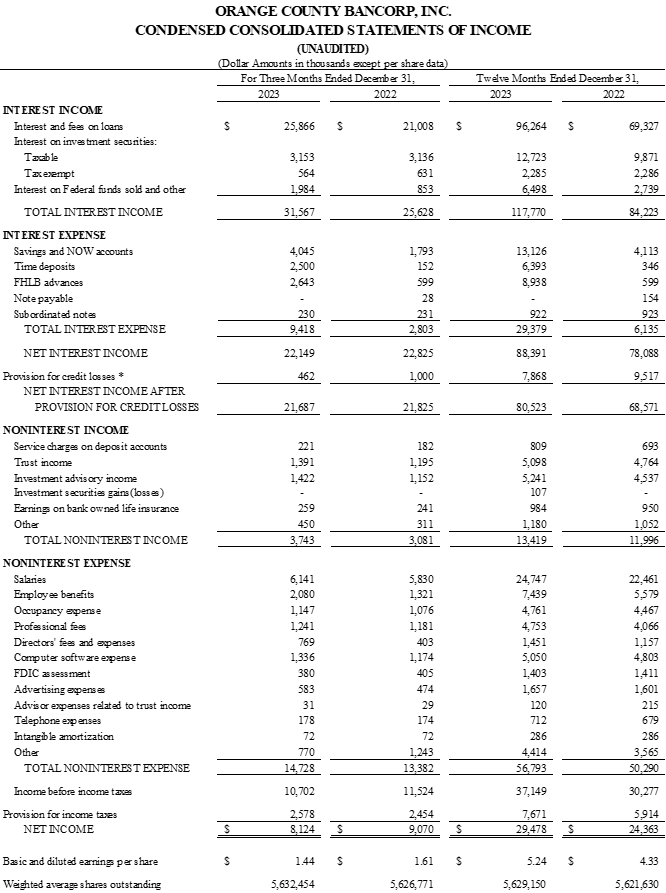

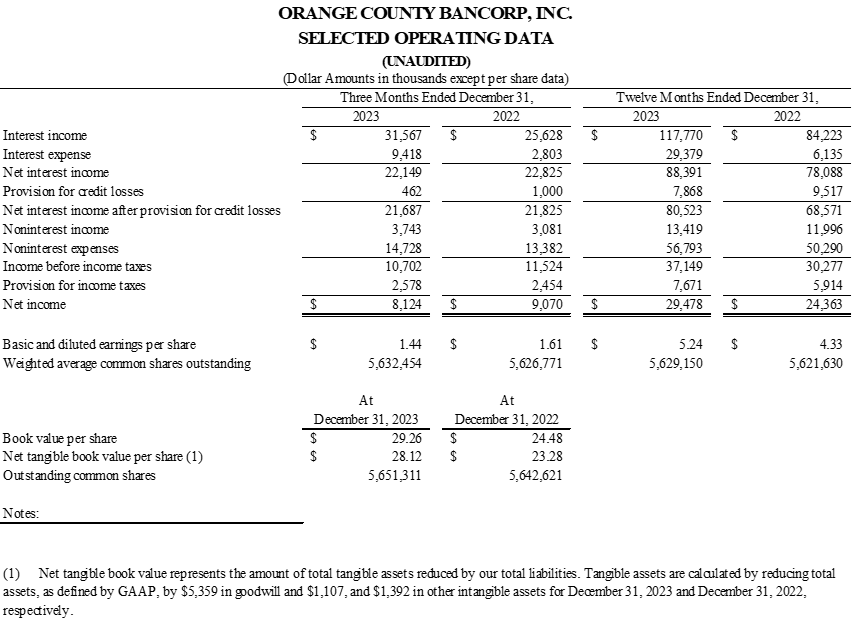

- Net Income of $29.5 million for the year ended December 31, 2023 represents an increase of $5.1 million, or 21.0%, as compared to $24.4 million for the year ended December 31, 2022

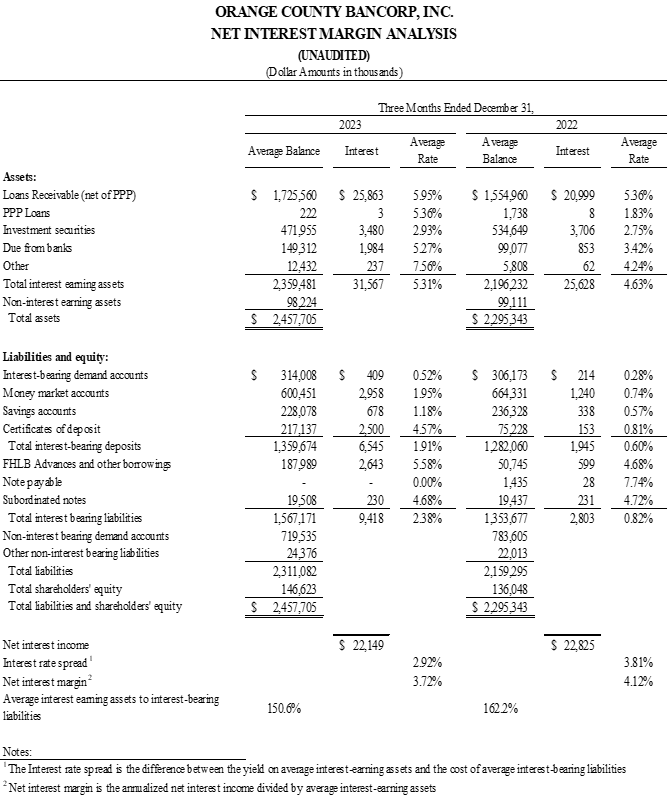

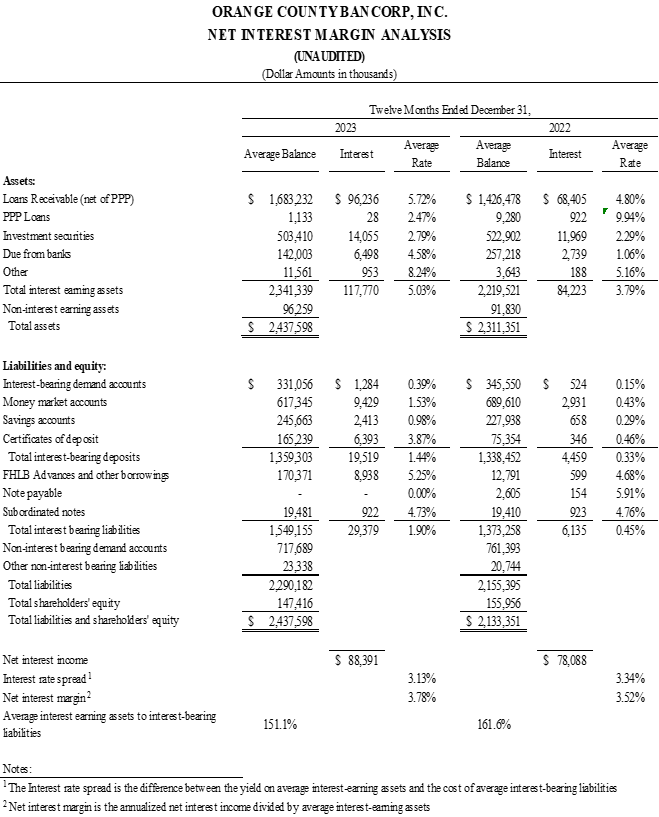

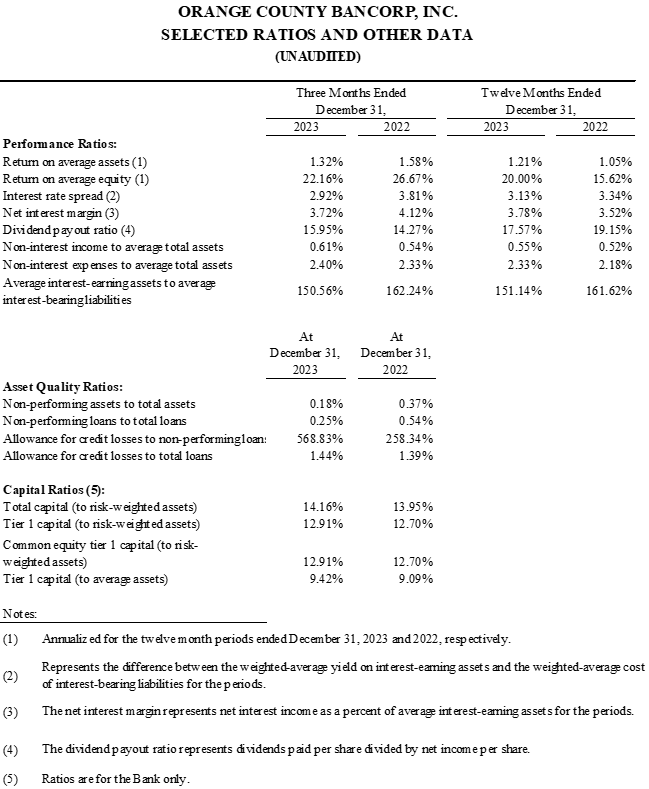

- Net interest margin of 3.78% for the year ended December 31, 2023 represents an increase of 26 basis points, or 7.4%, versus the year ended December 31, 2022

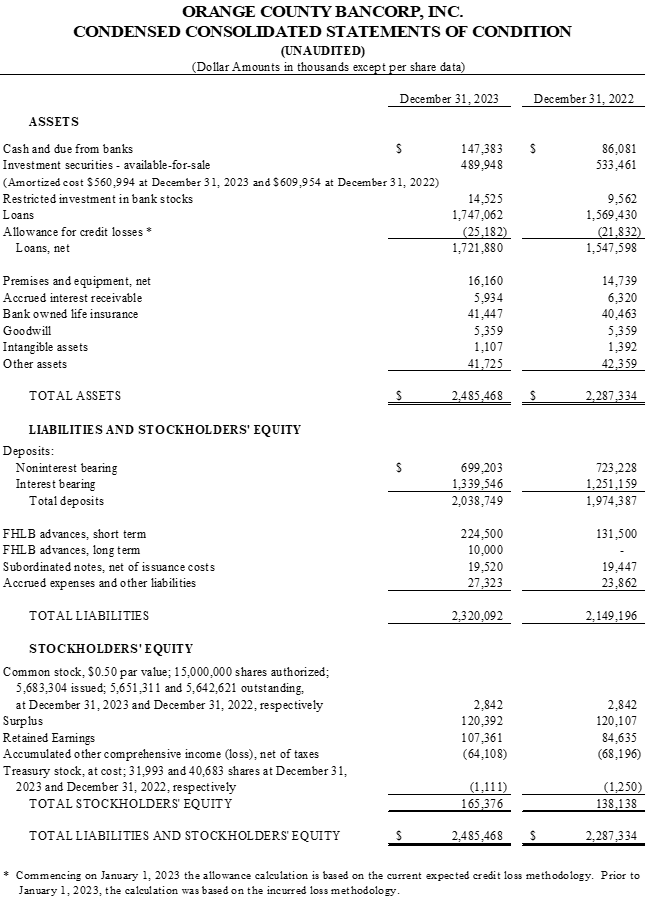

- Total Assets grew $198.1 million, or 8.7%, to $2.5 billion at December 31, 2023 as compared to the prior year end

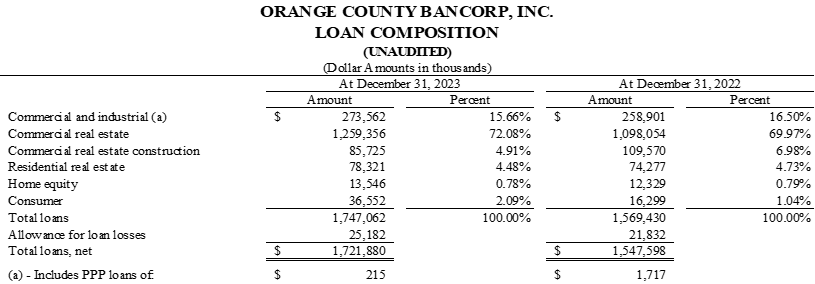

- Total Loans grew $177.6 million, or 11.3%, reaching $1.8 billion at December 31, 2023 versus prior year end

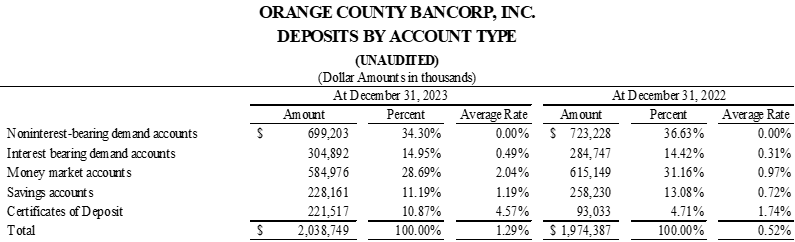

- Total Deposits rose $64.4 million, or 3.3%, reaching $2.0 billion at December 31, 2023 as compared to prior year end

- Book value per share increased $4.78, or 19.5%, reaching $29.26 at December 31, 2023 as compared to $24.48 at December 31, 2022

- Trust and investment advisory income rose $1.0 million, or 11.2%, to $10.3 million, for the year ended December 31, 2023 from $9.3 million for the year ended December 31, 2022.

MIDDLETOWN, NY / ACCESSWIRE / January 31, 2024 / Orange County Bancorp, Inc. (the "Company" - Nasdaq:OBT), parent company of Orange Bank & Trust Co. (the "Bank") and Hudson Valley Investment Advisors, Inc. ("HVIA"), today announced net income of $29.5 million, or $5.24 per basic and diluted share, for the year ended December 31, 2023 as compared to $24.4 million for the year ended December 31, 2022. This represents an increase of 21.0%, or $5.1 million. The increase in full year earnings was the result of continued strong growth in net interest income, including interest income associated with loans and cash balances, as well as a reduction in expense related to provision for credit losses. For the quarter ended December 31, 2023, the Company earned $8.1 million, or $1.44 per basic and diluted share, as compared to $9.1 million, or $1.61 per basic and diluted share, for the quarter ended December 31, 2022. This decrease was primarily due to increased interest expense associated with the rising rate environment during 2023.

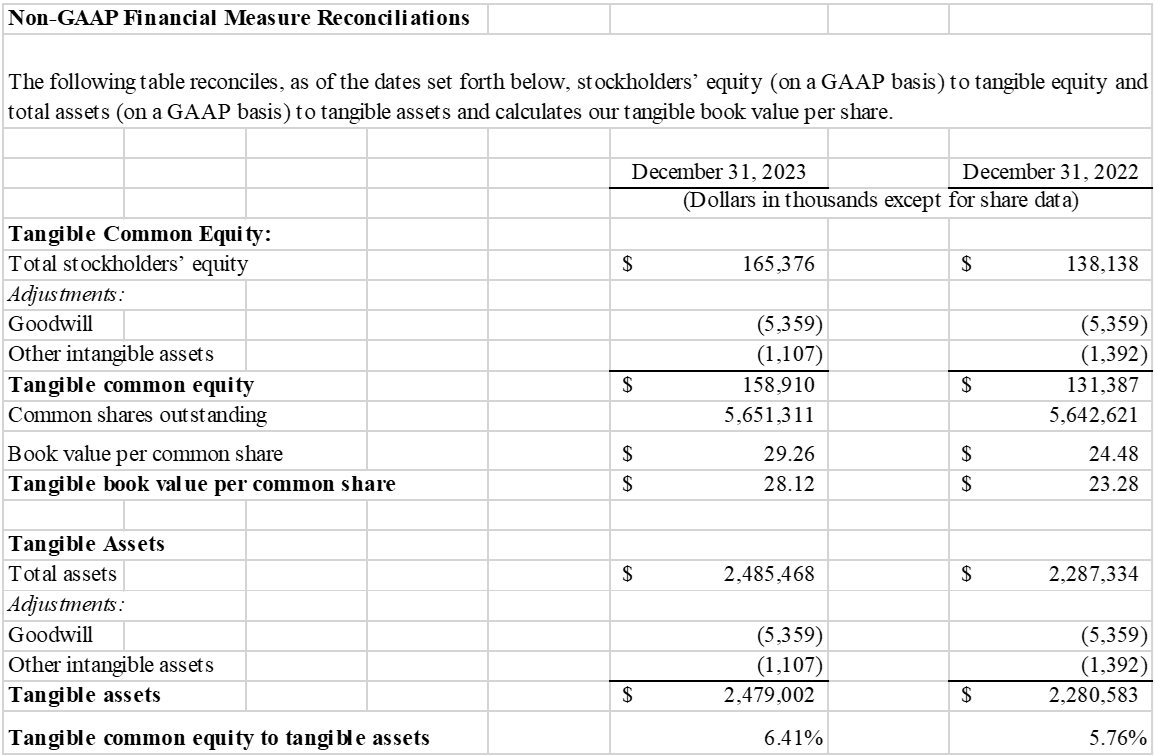

Book value per share rose $4.78, or 19.5%, from $24.48 at December 31, 2022 to $29.26 at December 31, 2023. Tangible book value per share also increased $4.84, or 20.8%, from $23.28 at December 31, 2022 to $28.12 at December 31, 2023 (see "Non-GAAP Financial Measure Reconciliation" below for additional detail). These increases were due primarily to earnings growth during the year coupled with a decrease in unrealized losses in the investment portfolio attributed to interest rate changes in the fourth quarter 2023.

"I am very pleased and excited to report record full year earnings for 2023," said Orange Bank President and CEO Michael Gilfeather. "It was an extremely challenging year for the banking sector, with the Federal Reserve's inflation fighting efforts resulting in four interest rate increases through July, before turning less hawkish. Though economic activity in our operating markets remained strong throughout the year, loan demand was gradually tempered by the rising costs of lending. Throughout the year, we remained laser-focused on our low-cost deposit base, which is closely linked to our cash management services. This attention to account relationships has been a key driver of our business success and market leading net interest margin.

Our management team's ability to execute on our "trusted advisor" strategy in response to these complex market dynamics laid the foundation for our success in 2023. The combination of experience and execution resulted in record earnings for the year, with net income up $5.1 million, or 21.0%, to $29.5 million primarily due to strong net interest margin and effectively managed growth of loans and deposits.

For the year, total loans grew $177.6 million, or 11.3%, to $1.8 billion at December 31, 2023. Though marginally slower than in prior periods, we intentionally managed loan growth lower in response to elevated market uncertainty. As a result, the average yield on our loan portfolio for full year 2023 rose 92 basis points, or 19.2%, to 5.72% versus 4.80% for the year ended December 31, 2022. As competitors backed away from loan origination, we still seized the opportunity to initiate and further build relationships with some of the region's most established businesses, strengthening our foundation for long-term, high-quality growth. And with economic activity across our operating regions continuing to remain strong, we are optimistic additional opportunities will continue to present themselves.

On the funding side, total deposits rose $64.4 million, or 3.3%, to $2.0 billion at December 31, 2023 in comparison to year end 2022, despite the challenging rate environment. As a business-focused bank, we have managed liquidity needs and funding costs through FHLB borrowing and brokered deposits. This affords us the ability to better manage long-term funding costs and, in conjunction with our significant non-interest-bearing deposit base, is reflected in our consistently low cost of deposits. Average cost of deposits for the year ended December 31, 2023, stood at 94 basis points, up 73 basis points over 2022. Despite the challenges higher interest rates present in gathering new deposits, we believe our client-centric, business banking model enables us to lessen the impact of higher rates, grow core deposits, and reduce borrowing costs as markets and opportunities allow.

The combination of conservative, high-quality growth in our loan portfolio and higher, but managed deposit costs resulted in net interest margin increasing 26 basis points, or 7.4%, to 3.78% for the full year ended December 31, 2023. Though pleased with these results, we know our ability to increase net interest margin in the face of continued relative high interest rates will remain challenging. We believe, however, our consistently demonstrated ability to manage net interest margin pressure in 2023 reflects the quality and durable nature of our business model.

Our Wealth Management division also showed strong results for the quarter and year, providing the Bank with an additional stream of income ancillary to our core lending business. While outside the traditional bank model, wealth management has become an essential part of our service offering, providing businesses and high net worth individuals expertise that strengthens their relationship with the Bank. For the quarter and full year ended December 31, 2023, trust and investment advisory income rose $466 thousand, or 19.9%, to $2.8 million and $1.0 million, or 11.2%, to $10.3 million, respectively, versus the same quarter and full year ended December 31, 2022.

As previously mentioned, this past year has been one of the most challenging for the banking industry in recent history. This makes our strong quarterly and record full year results all the more impressive. It is the result of unwavering commitment to our clients, knowledge of the markets we serve, and diligent management focus on execution. These allowed us to respond to changing market dynamics, maintain margins and credit quality, and increase profitability. The true test of any business model isn't just how well it performs in good times, but how well it performs when challenged. I am pleased to report ours performed admirably and again thank our employees for their outstanding efforts, our shareholders for their ongoing support, and our clients for their unwavering trust. Without all three, 2023 would have yielded lesser results."

Fourth Quarter and Full Year 2023 Financial Review

Net Income

Net income for the fourth quarter of 2023 was $8.1 million, a decrease of $948 thousand, or 10.5%, from net income of $9.1 million for the fourth quarter of 2022. This decrease represents a combination of lower net interest income and increased noninterest expenses versus the same quarter last year. Net income for the twelve months ended December 31, 2023 was $29.5 million as compared to $24.4 million for 2022.

Net Interest Income

For the three months ended December 31, 2023, net interest income fell $676 thousand, or 3.0%, to $22.2 million, versus $22.8 million during the same period last year. Although total interest income rose, the decrease was driven primarily by a $6.6 million increase in interest expense related to deposit and borrowing costs in the current period. For the year ended December 31, 2023, net interest income increased $10.3 million, or 13.2%, over the year ended December 31, 2022.

Total interest income rose $5.9 million, or 23.2%, to $31.6 million for the three months ended December 31, 2023, compared to $25.6 million for the three months ended December 31, 2022. The increase reflected 23.1% growth in interest and fees associated with loans, a 0.5% increase in income from taxable investment securities, and a 132.6% increase in income related to fed funds interest and balances held at correspondent banks. For the year ended December 31, 2023, total interest income rose $33.6 million, or 39.8%, to $117.8 million as compared to $84.2 million for the year ended December 31, 2022.

Total interest expense increased $6.6 million during the fourth quarter of 2023, to $9.4 million, as compared to $2.8 million in the fourth quarter of 2022. The increase represented the continued impact of rising interest rates and higher cost FHLB borrowings and brokered deposits as alternate sources of funding. Interest expense from FHLB advances during the current quarter totaled $2.6 million as compared to $599 thousand during the fourth quarter of 2022. Interest expense related to brokered deposits totaled $2.4 million during the fourth quarter of 2023 as compared to $108 thousand during the fourth quarter of 2022. Interest expense associated with savings and NOW accounts totaled $4.1 million during the fourth quarter of 2023 as compared to $1.8 million during the fourth quarter of 2022. During the year ended December 31, 2023, total interest expense rose $23.2 million, to $29.4 million, as compared to $6.1 million for last year.

Provision for Credit Losses

As of January 1, 2023, the Company adopted the current expected credit losses methodology ("CECL") accounting standard, which includes loans individually evaluated, as well as loans evaluated on a pooled basis to assess the adequacy of the allowance for credit losses. The Bank seeks to estimate lifetime losses in its loan and investment portfolio by using expected discounted cash flows and supplemental qualitative considerations, including relevant economic considerations, portfolio concentrations, and other external factors, as well as evaluating investment securities held by the Bank.

The Company recognized a provision for credit losses of $462 thousand for the three months ended December 31, 2023, as compared to $1.0 million for the three months ended December 31, 2022. This decrease reflects the impact of the methodology associated with estimated lifetime losses and types of loans closed during the quarter. The allowance for credit losses to total loans was 1.44% as of December 31, 2023 versus 1.39% as of December 31, 2022. For the year ended December 31, 2023, the provision for credit losses totaled $7.9 million, as compared to $9.5 million for the year ended December 31, 2022. The 2023 provision includes the effect of a $5 million reserve associated with the write-off of an investment in Signature Bank subordinated debt. No additional reserves for investment securities were recorded during 2023.

Non-Interest Income

Non-interest income rose $662 thousand, or 21.5%, to $3.7 million for the three months ended December 31, 2023 as compared to $3.1 million for the three months ended December 31, 2022. This growth was related to increased fee income within each of the Company's fee income categories, including investment advisory, trust, and service charges on deposit accounts. For the year ended December 31, 2023, non-interest income increased approximately $1.4 million, to $13.4 million, as compared to $12.0 million for the year ended December 31, 2022.

Non-Interest Expense

Non-interest expense was $14.7 million for the fourth quarter of 2023, reflecting an increase of $1.4 million, or 10.1%, as compared to $13.4 million for the same period in 2022. The increase in non-interest expense for the current three-month period was the result of continued investment in Company growth. This investment consists primarily of increases in compensation, occupancy, information technology, and deposit insurance costs. Our efficiency ratio increased to 56.9% for the three months ended December 31, 2023, from 51.7% for the same period in 2022. For the year ended December 31, 2023, our efficiency ratio remained level at 55.8% as compared to year end 2022. Non-interest expense for the year ended December 31, 2023 reached $56.8 million, reflecting a $6.5 million increase over non-interest expense of $50.3 million for the year ended December 31, 2022.

Income Tax Expense

Provision for income taxes for the three months ended December 31, 2023 was $2.6 million, compared to $2.5 million for the same period in 2022. The increase was directly related to required provisions associated with the company's earnings for the quarter. For the year ended December 31, 2023, the provision for income taxes was $7.7 million, as compared to $5.9 million for the year ended December 31, 2022. Our effective tax rate for the three-month period ended December 31, 2023 was 24.1%, as compared to 21.3% for the same period in 2022. Our effective tax rate for the year ended December 31, 2023 was 20.7%, as compared to 19.5% for 2022.

Financial Condition

Total consolidated assets increased $198.1 million, or 8.7%, from $2.3 billion at December 31, 2022 to $2.5 billion at December 31, 2023. The increase reflected continued growth in loans, deposits, and cash during the year.

Total cash and due from banks increased from $86.1 million at December 31, 2022, to $147.4 million at December 31, 2023, an increase of approximately $61.3 million, or 71.2%. This increase resulted primarily from increases in deposit balances and borrowings. The increase in borrowings reflected a strategic decision to bolster and maintain higher cash levels during 2023.

Total investment securities fell $38.6 million, or 7.1%, from $543.0 million at December 31, 2022 to $504.5 million at December 31, 2023. The decrease represented a combination of investment maturities and sales, changes in fair value, and a write-off associated with Signature Bank subordinated debt resulting from that bank's failure during the first three months of 2023.

Total loans increased $177.6 million, or 11.3%, from $1.6 billion at December 31, 2022 to $1.8 billion at December 31, 2023. The increase was due primarily to $161.3 million of commercial real estate loan growth and $14.7 million of commercial and industrial loan growth. PPP loans decreased to $215 thousand at December 31, 2023 from $1.7 million at December 31, 2022.

Total deposits increased $64.4 million, to $2.0 billion at December 31, 2023 from approximately $2.0 billion at December 31, 2022. This increase was due primarily to $140.1 million of growth in time deposits associated with brokered deposits which the Bank utilized to increase cash balances and support loan growth during the year. Deposit composition at December 31, 2023 included 49.3% in demand deposit accounts (including NOW accounts). Uninsured deposits, net of fully collateralized municipal relationships, remain stable and represent approximately 37% of total deposits at December 31, 2023, as compared to 43% of total deposits at December 31, 2022.

Stockholders' equity increased $27.2 million, or 19.7%, to $165.4 million at December 31, 2023 from $138.1 million at December 31, 2022. The increase was due primarily to $29.5 million of net income during 2023 and an approximately $4.1 million decrease in unrealized losses on the market value of investment securities within the Company's equity as accumulated other comprehensive income (loss) ("AOCI"), net of taxes.

At December 31, 2023, the Bank maintained capital ratios in excess of regulatory standards for well capitalized institutions. The Bank's Tier 1 capital-to-average-assets ratio was 9.42%, both common equity and Tier 1 capital-to-risk-weighted-assets were 12.91%, and total-capital-to-risk-weighted-assets was 14.16%.

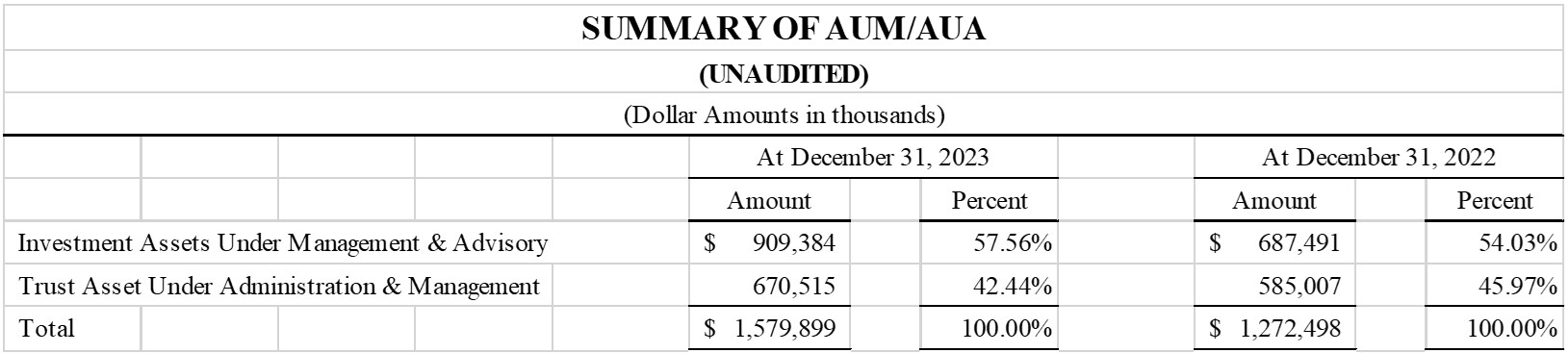

Wealth Management

At December 31, 2023, our Wealth Management Division, which includes trust and investment advisory, totaled approximately $1.6 billion in assets under management or advisory as compared to approximately $1.3 billion at December 31, 2022, reflecting an increase of approximately 24.2%. Trust and investment advisory income for the year ended December 31, 2023 totaled $10.3 million and represented an increase of approximately 11.2%, or $1.0 million, as compared to $9.3 million for year ended December 31, 2022.

The breakdown of trust and investment advisory assets as of December 31, 2023 and December 31, 2022, respectively, is as follows:

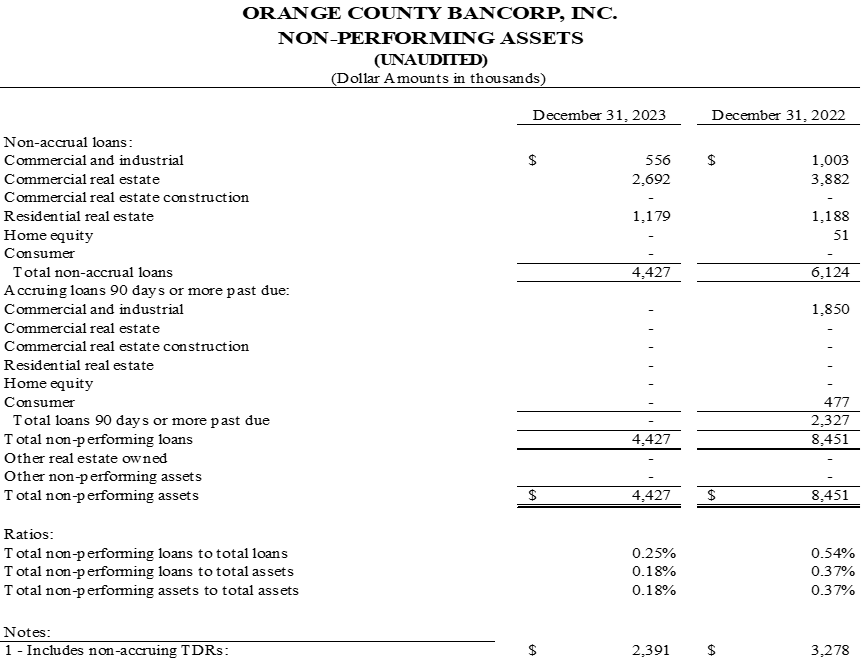

Loan Quality

At December 31, 2023, the Bank had total non-performing loans of $4.4 million, or 0.25% of total loans. Total non-accrual loans represented approximately $4.4 million of loans at December 31, 2023, compared to $6.1 million at December 31, 2022.

Liquidity

Management believes the Bank has the necessary liquidity to meet normal business needs. The Bank uses a variety of resources to manage its liquidity position. These include short term investments, cash from lending and investing activities, core-deposit growth, and non-core funding sources, such as time deposits exceeding $100,000, brokered deposits, FHLBNY advances, and other borrowings. As of December 31, 2023, the Bank's cash and due from banks totaled $147.4 million. The Bank maintains an investment portfolio of securities available for sale, comprised mainly of US Government agency and treasury securities, Small Business Administration loan pools, mortgage-backed securities, and municipal bonds. Although the portfolio generates interest income for the Bank, it also serves as an available source of liquidity and funding. As of December 31, 2023, the Bank's investment in securities available for sale was $490.0 million, of which $135.7 million was not pledged as collateral. Additionally as of December 31, 2023, the Bank's overnight advance line capacity at the Federal Home Loan Bank of New York was $613.6 million, of which $108.0 million was used to collateralize municipal deposits and $234.5 million was utilized for overnight and long term FHLBNY advances. As of December 31, 2023, the Bank's unused borrowing capacity at the FHLBNY was $271.1 million. The Bank also maintains additional borrowing capacity of $25 million with other correspondent banks. Additional funding is available to the Bank through the Bank Term Funding Program ("BTFP") and discount window lending by the Federal Reserve. The Bank maintains approximately $102.2 million of collateral under the BTFP but did not utilize this funding source during 2023. The BTFP will expire in March 2024 and no longer be an additional source of funding.

The Bank also considers brokered deposits an element of its deposit strategy. As of December 31, 2023, the Bank had brokered deposit arrangements with various terms totaling $172.4 million.

About Orange County Bancorp, Inc.

Orange County Bancorp, Inc. is the parent company of Orange Bank & Trust Company and Hudson Valley Investment Advisors, Inc. Orange Bank & Trust Company is an independent bank that began with the vision of 14 founders over 125 years ago. It has grown through innovation and an unwavering commitment to its community and business clientele to approximately $2.5 billion in total assets. Hudson Valley Investment Advisors, Inc. is a Registered Investment Advisor in Goshen, NY. It was founded in 1996 and acquired by the Company in 2012.

Forward Looking Statements

Certain statements contained herein are "forward looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward looking statements may be identified by reference to a future period or periods, or by the use of forward looking terminology, such as "may," "will," "believe," "expect," "estimate," "anticipate," "continue," or similar terms or variations on those terms, or the negative of those terms. Forward looking statements are subject to numerous risks and uncertainties, including, but not limited to, those related to the real estate and economic environment, particularly in the market areas in which the Company operates, competitive products and pricing, fiscal and monetary policies of the U.S. Government, inflation, changes in government regulations affecting financial institutions, including regulatory fees and capital requirements, changes in prevailing interest rates, increased levels of loan delinquencies, problem assets and foreclosures, credit risk management, asset-liability management, cybersecurity risks, the continuing effects of the COVID-19 pandemic, the financial and securities markets and the availability of and costs associated with sources of liquidity.

The Company wishes to caution readers not to place undue reliance on any such forward looking statements, which speak only as of the date made. The Company wishes to advise readers that the factors listed above could affect the Company's financial performance and could cause the Company's actual results for future periods to differ materially from any opinions or statements expressed with respect to future periods in any current statements. The Company does not undertake and specifically declines any obligation to publicly release the results of any revisions that may be made to any forward looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

For further information:

Michael Lesler

EVP & Chief Financial Officer

mlesler@orangebanktrust.com

Phone: (845) 341-5111

SOURCE: Orange County Bancorp, Inc.

View the original press release on accesswire.com