New 1.1km Santa Helena exploration target identified extending towards Alamo

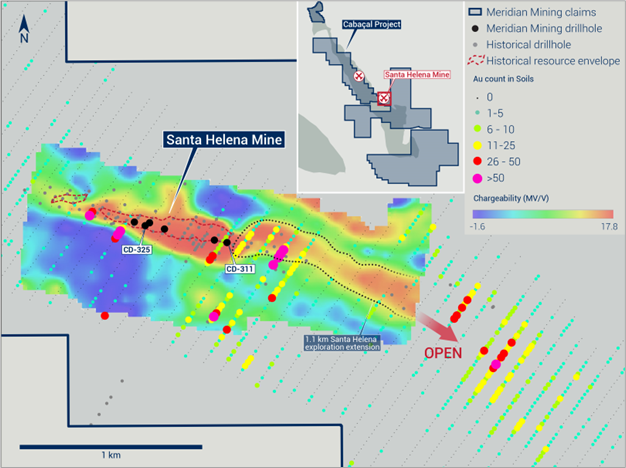

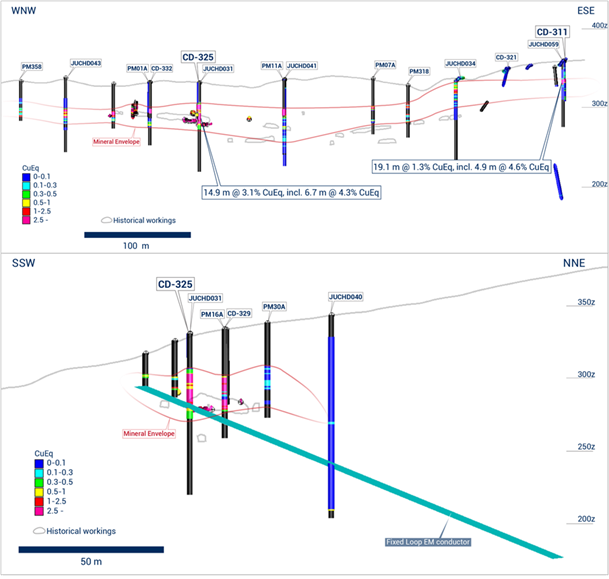

LONDON, UK / ACCESSWIRE / September 12, 2023 / Meridian Mining UK S (TSX:MNO)(OTCQX:MRRDF)(Frankfurt/Tradegate:2MM) ("Meridian" or the "Company") is pleased to report its first drill results in the Santa Helena copper, gold, silver and zinc mine, including 14.9m @ 3.1% CuEq from 26.3m. Santa Helena's near surface massive sulphides are hosted within a broader mineralized zone, representing the next potential open pit target within the Cabaçal Belt ("Figure 1 and 2"). The recent incorporation of Meridian's geophysics and mapping has identified an additional 1.1km near-mine exploration extension to Santa Helena, doubling the area of interest beyond the 1.0km strike of the historical resource area. This new target extends Santa Helena's prospectivity towards the ~4km Alamo target.

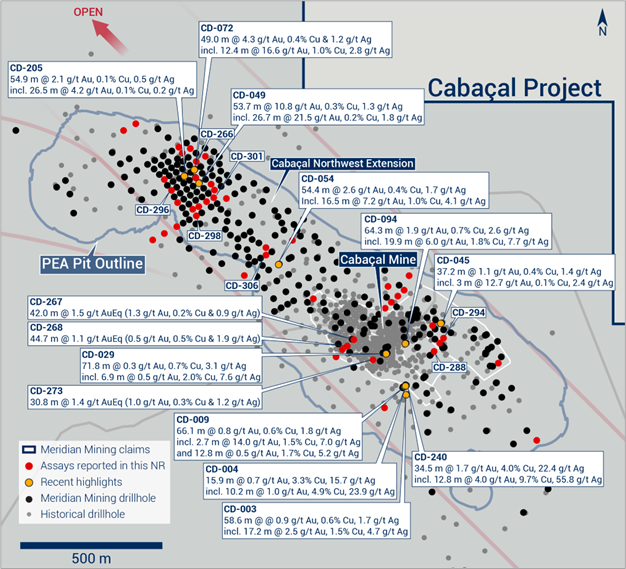

Meridian is also reporting further robust results from the ongoing resource definition program at Cabaçal ("Figure 3"). Broad zones of gold-copper mineralization continue to be intercepted and these values will be included in the Q4 resource and PEA update.

The results represent part of the Company's dual track strategy, of advancing the Cabaçal mine towards a production decision in 2024 while exploring the wider potential of the 50km Cabaçal VMS belt. Further Santa Helena and Cabaçal drill results are pending.

Highlights Reported Today

-

First results from Santa Helena return high-grade copper-gold-silver and zinc massive sulphides

- CD-325: 14.9m @ 3.1% CuEq (1.2% Cu, 1.6g/t Au, 37.4g/t Ag & 3.8% Zn) from 26.3m; Including

- 6.7m @ 4.3% CuEq (1.6% Cu, 2.6g/t Au, 56.9g/t Ag & 5.1% Zn) from 27.5m;

- CD-311: 19.1m @ 1.3% CuEq (0.5% Cu, 0.5g/t Au, 12.0g/t Ag & 2.0% Zn) from 8.0m; Including

- 4.9m @ 4.6% CuEq (1.7% Cu, 1.6g/t Au, 43.3g/t Ag & 7.6% Zn) from 22.2m; and

- New 1.1km open exploration target extending out from Santa Helena towards the Alamo target has been defined.

- CD-325: 14.9m @ 3.1% CuEq (1.2% Cu, 1.6g/t Au, 37.4g/t Ag & 3.8% Zn) from 26.3m; Including

-

Cabaçal program continues to deliver strong ongoing Cu-Au-Ag results

- CD-298: 30.0m @ 1.2g/t AuEq (0.3g/t Au, 0.6% Cu & 3.9g/t Ag) from 59.0m; Including

- 6.4m @ 3.9g/t AuEq (0.7g/t Au, 2.1% Cu & 16.4g/t Ag) from 78.7m;

- CD-273: 30.8m @ 1.4g/t AuEq (1.0g/t Au, 0.3% Cu & 1.2g/t Ag) from 54.6m; Including

- 6.1m @ 3.9g/t AuEq (4.0g/t Au & 1.1g/t Ag) from 54.9m;

- 8.9m @ 1.3g/t AuEq (0.3g/t Au, 0.7% Cu & 2.2g/t Ag) from 108.1m;

- CD-268: 44.7m @ 1.1g/t AuEq (0.5g/t Au, 0.5% Cu & 1.9g/t Ag) from 51.9m; Including

- 6.3m @ 3.5g/t AuEq (1.0g/t Au, 1.7% Cu, 8.4g/t Ag) from 86.0m;

- CD-267: 42.0m @ 1.5g/t AuEq (1.3g/t Au, 0.2% Cu & 0.9g/t Ag) from 29.5m; Including

- 1.8m @ 13.4g/t AuEq (13.5g/t Au & 0.6g/t Ag) from 40.6m; and

- 6.1m @ 4.0g/t AuEq (4.0g/t Au, 0.1% Cu & 0.7g/t Ag) from 56.7m.

- CD-298: 30.0m @ 1.2g/t AuEq (0.3g/t Au, 0.6% Cu & 3.9g/t Ag) from 59.0m; Including

Mr. Gilbert Clark, CEO, comments: "The Company is very pleased with these first shallow high-grade drill results from Santa Helena, carrying some very strong grades. In an excellent start to Santa Helena's exploration program, the prospectivity of its historical resource area has been doubled in strike length via an additional 1.1km geophysical extension and associated soil anomalies. The open nature of Santa Helena's prospectivity, extending towards the Alamo prospect, represents the largest copper-gold-silver and zinc exploration target in the belt. We believe strongly that Santa Helena's unmined shallow resource and immediate exploration upside potential will deliver further success."

"The Cabaçal deposit continues to deliver robust intersections of shallow gold-copper-silver mineralization that will be incorporated into the Q4 resource and PEA updates. Cabaçal's PEA[1] envisages a stand-alone open pit mine and mill, while neighbouring deposits like Santa Helena have the potential to benefit from this by being only a short trucking distance away. The Cabaçal belt's potential to grow towards being a mining district with multiple open pit projects has been enhanced with these results."

Santa Helena Drill Program

Santa Helena is a Cu-Au-Ag & Zn deposit located ~9km to the southeast of the Cabaçal Mine area. It has over 10,000m of historical drilling and is one of a series of exploration targets along the Mine Corridor. The Company commenced an initial drill program in August 2023 as part of a verification program, to validate the historical data in line with 43-101 requirements, and to initiate scout drilling for resource extensions defined by geophysics. The Company's compilation of historical drill data indicated that many historical holes were not completely sampled, that reconciliation of surveyed drilled positions and past mine workings suggested that the high-grade massive sulphide mineralization was only partially mined, and that extensions of near-surface mineralization to the east were also not integrated into the historical resource calculations[2]. The Company has concluded that this historical resource area is considered open.

The Company has completed 7 holes to date, with the first two reported, which have returned:

- CD-325: 14.9m @ 3.1% CuEq (1.2% Cu, 1.6g/t Au, 37.4g/t Ag & 3.8% Zn) from 26.3m;

Including the massive sulphides assaying:

- 6.7m @ 4.3% CuEq (1.6% Cu, 2.6g/t Au, 56.9g/t Ag & 5.1% Zn) from 27.5m; and

- CD-311: 19.1m @ 1.3% CuEq (0.5% Cu, 0.5g/t Au, 12.0 g/t Ag & 2.0% Zn) from 8.0m;

Including the massive sulphides assaying:

- 4.9m @ 4.6% CuEq (1.7% Cu, 1.6g/t Au, 43.3g/t Ag & 7.6% Zn) from 22.2m;

True width is considered to be 80 to 90% of intersection width.

CD-325 was drilled above the area of the historical mine workings ("Figure 3"), twinning JUCHD-031, which originally intersected 27.6m @ 1.6% Cu, 1.5g/t Au, 36.3g/t Ag & 4.4% Zn from 24.9m. The hole terminated in a mining void of 5.2m width from 41.2m. Further high-grade mineralization would be present in the footwall, although the hole could not advance below the void.

CD-311 was drilled 65m past the eastern limit of the mine workings, and on the maximum eastern limit of the historical resource envelope (Figure 3). The hole confirmed intact mineralization, consistent with a position in historical hole JUCHD-059, which returned 8.2m @ 1.8% Cu, 1.4g/t Au, 30.9g/t Ag & 4.7% Zn from 21.0m. The wider footprint of mineralization intersected in CD-311 reflected the selective nature of historical sampling practices which left halo mineralization around the massive sulphides unsampled.

_______________

[1] Meridian Mining News Release of March 6, 2023

[2] Meridian Mining News Release of March 29, 2022.

The twinning results compare favourably to the historical data, ("Figure 2") and importantly confirm that strong grades of base and precious metals are present at shallow depths, easily accessible to potential open pit extraction.

The Company is drilling a combination of vertical and angled holes to test the potential for mineralized structures in multiple orientations, and is sampling the holes in full, having established at Cabaçal that the gold overprint can generate detached gold-only layers past the limit of the VMS base metal envelop. Drilling is currently targeting the potential for shallow extensional mineralization outside of the historical resource envelope, where a recent Meridian soil infill program confirmed gold in soil grades of up to 0.95 g/t Au.

Santa Helena's 1.1km near-mine Exploration Corridor

The Company has completed an initial Gradient Array Induced Polarization survey ("IP survey") over the eastern extensions of Santa Helena, into the Alamo property. This has defined a 1.1km chargeability corridor, (see Figure 1) extending eastward from the limit of the Santa Helena resource. Indications of a small offset suggest that the projection from the Santa Helena position has not been effectively drilled. The western and southern flanks of this anomaly exhibit historical gold intersections in BP trenching and shallow drilling, and the chargeability anomaly trends towards an eastern gold in soil anomaly, commencing 1.3km east of the historical Santa Helena Resource. A second near-mine exploration target has emerged on the northern flank of the IP survey area where Santa Helena's VMS stratigraphy starts to project under sedimentary cover and will require further delineation.

The Company considers that the wide spaced historical scout drilling conducted to date along the corridor has not effectively tested the position in an environment where the VMS horizon is known to be folded and faulted, and subjected to a high-grade gold-overprint event. The Company will be resuming geophysical programs shortly to refine further drill targets along this prospective corridor.

Cabaçal Project Development and Resource Definition Program

Drilling continues at the Cabaçal deposit, where strong robust results continue to be delivered as the Company advances with its resource infill and extension drill programs.

Highlights from the Cabaçal Northwest Extension (CWNE) include:

- CD-266: 4.1m @ 2.3g/t AuEq (1.5g/t Au, 0.6% Cu & 2.4g/t Ag) from 49.2m, and

- 3.0m @ 3.9g/t AuEq (3.3g/t Au, 0.4% Cu & 0.9g/t Ag) from 63.4m;

- CD-296: 9.4m @ 1.0g/t AuEq (0.1g/t Au, 0.7% Cu & 0.5g/t Ag) from 13.8m; and

- 23.1m @ 0.5g/t AuEq (0.2g/t Au, 0.2% Cu & 1.2g/t Ag) from 42.0m

- CD-298: 30.0m @ 1.2g/t AuEq (0.3g/t Au, 0.6% Cu & 3.9g/t Ag) from 59.0m, Including:

- 6.4m @ 3.9g/t AuEq (0.7g/t Au, 2.1% Cu & 16.4g/t Ag) from 78.7m;

- CD-301: 30.0m @ 1.2g/t AuEq (0.3g/t Au, 0.6% Cu & 3.9g/t Ag) from 59.0m, Including:

- 6.4m @ 3.9g/t AuEq (0.7g/t Au, 2.1% Cu & 16.4g/t Ag) from 78.7m;

- CD-306: 49.8m @ 0.9g/t AuEq (0.3g/t Au, 0.5% Cu & 2.1g/t Ag) from 82.2m, Including:

- 7.9m @ 2.2g/t AuEq (0.7g/t Au, 1.1% Cu & 5.6g/t Ag) from 91.5m; and

- 5.4m @ 1.5g/t AuEq (0.4g/t Au, 0.8% Cu & 3.9g/t Ag) from 105.4m.

Highlights from the Cabaçal mine environment include:

- CD-267 (SCZ): 42.0m @ 1.5g/t AuEq (1.3g/t Au, 0.2% Cu & 0.9g/t Ag) from 29.5m, Including:

- 1.8m @ 13.4g/t AuEq (13.5g/t Au & 0.6g/t Ag) from 40.6m;

- 6.1m @ 4.0g/t AuEq (4.0g/t Au, 0.1% Cu & 0.7g/t Ag) from 56.7m;

- CD-268 (SCZ): 44.7m @ 1.1g/t AuEq (0.5g/t Au, 0.5% Cu & 1.9g/t Ag) from 51.9m, Including:

- 6.3m @ 3.5g/t AuEq (1.0g/t Au, 1.7% Cu & 8.4g/t Ag) from 86.0m;

- CD-273 (SCZ): 30.8m @ 1.4g/t AuEq (1.0g/t Au, 0.3% Cu & 1.2g/t Ag) from 54.6m, Including

- 6.1m @ 3.9g/t AuEq (4.0g/t Au & 1.1g/t Ag) from 54.9m, and

- 8.9m @ 1.3g/t AuEq (0.3g/t Au, 0.7% Cu & 2.2g/t Ag) from 108.1m;

- CD-288 (CCZ): 51.6m @ 0.8g/t AuEq (0.3g/t Au, 0.4% Cu & 1.6g/t Ag) from 26.0m, Including:

- 5.8m @ 1.6g/t AuEq (1.4g/t Au, 0.2% Cu & 1.1g/t Ag) from 55.3m;

- CD-294 (ECZ) 46m @ 0.7g/t AuEq (0.1g/t Au 0.4% Cu, & 2.0g/t Ag) from 15.0m, Including:

- 8.0m @ 1.4g/t AuEq (0.1g/t Au, 0.9% Cu & 5.9g/t Ag) from 45.0m;

-

24.7m @ 1.1g/t AuEq (0.5g/t Au, 0.5% Cu & 2.4g/t Ag) from 71.0m; Including

- 3.9m @ 2.7g/t AuEq (1.8g/t Au, 0.7% Cu & 3.3g/t Ag) from 72.5m.

Drilling continues to target infill of the CNWE & Cabaçal mine environment, and scout drilling continues on the resource peripheries. A fifth rig has been mobilized to drill a series of water monitoring bores as part of the environmental permitting process. Project development studies continue to advance in preparation for submission of the Environmental Impact Assessment (EIA-RIMA), positioning the project for the consideration of an expanded production scenario of up to 4.5Mtpa. Testwork on geotechnical samples remains in progress, to evaluate the potential to steepen pit wall angles beyond the PEA assumptions so to improve the mines ore to waste strip ratio.

About Meridian

Meridian Mining UK S is focused on:

- The development and exploration of the advanced stage Cabaçal VMS gold‐copper project;

- Regional scale exploration of the Cabaçal VMS belt;

- Exploration in the Jaurú & Araputanga Greenstone belts (the above all located in the State of Mato Grosso, Brazil); and

- Exploring the Espigão polymetallic project in the State of Rondônia, Brazil.

Cabaçal is a gold-copper-silver rich VMS deposit with the potential to be a standalone mine within the 50km VMS belt. Cabaçal's base and precious metal-rich mineralization is hosted by volcanogenic type, massive, semi-massive, stringer, and disseminated sulphides within deformed metavolcanic-sedimentary rocks. A later-stage gold overprint event has emplaced high-grade gold mineralization.

The Cabaçal Mineral Resource estimate consists of Indicated resources of 52.9 million tonnes at 0.6g/t gold, 0.3% copper and 1.4g/t silver and Inferred resources of 10.3 million tonnes at 0.7g/t gold, 0.2% copper & 1.1g/t silver (at a 0.3 g/t gold equivalent cut-off grade), including a higher-grade near-surface zone supporting a starter pit.

The Preliminary Economic Assessment technical report (the "PEA Technical Report") dated March 30, 2023, entitled: "Cabaçal Gold-Copper Project NI 43-101 Technical Report and Preliminary Economic Assessment, Mato Grosso, Brazil" outlines a base case after-tax NPV5 of USD 573 million and 58.4% IRR from a pre-production capital cost of USD 180 million, leading to capital repayment in 10.6 months (assuming metals price scenario of USD 1,650 per ounces of gold, USD 3.59 per pound of copper, and USD 21.35 per ounce of silver). Cabaçal has a low All-in-Sustaining-Cost of USD 671 per ounce gold equivalent for the first five years, driven by high metallurgical recovery, a low life-of-mine strip ratio of 2.1:1, and the low operating cost environment of Brazil (see press release dated March 6, 2023).

Readers are encouraged to read the PEA Technical Report in its entirety. The PEA Technical Report may be found on the Company's website at www.meridianminig.co and under the Company's profile on SEDAR at www.sedar.com.

The qualified persons for the PEA Technical Report are: Robert Raponi (P. Eng), Principal Metallurgist with Ausenco Engineering), Scott Elfen (P. E.), Global Lead Geotechnical and Civil Services with Ausenco Engineering), Simon Tear (PGeo, EurGeol), Principal Geological Consultant of H&SC, Marcelo Batelochi, (MAusIMM, CP Geo), Geological Consultant of MB Geologia Ltda, Joseph Keane (Mineral Processing Engineer; P.E), of SGS, and Guilherme Gomides Ferreira (Mine Engineer MAIG) of GE21 Consultoria Mineral.

On behalf of the Board of Directors of Meridian Mining UK S

Mr. Gilbert Clark

CEO and Director

Meridian Mining UK S

Email: info@meridianmining.net.br

Ph: +1 (778) 715-6410 (PST)

Stay up to date by subscribing for news alerts here: https://meridianmining.co/contact/

Follow Meridian on Twitter: https://twitter.com/MeridianMining

Further information can be found at: www.meridianmining.co

Technical Notes

Samples have been analysed at SGS laboratory in Belo Horizonte. Samples are dried, crushed with 75% passing <3 mm, split to give a mass of 250-300g, pulverized with 95% passing 150#. Gold analyses are conducted by FAA505 (fire assay of a 50g charge), and base metal analysis by methods ICP40B and ICP40B_S (four acid digest with ICP-OES finish). Visible gold intervals are sampled by metallic screen fire assay method MET150-FAASCR. Samples are held in the Company's secure facilities until dispatched and delivered by staff and commercial couriers to the laboratory. Pulps and coarse rejects are retained and returned to the Company for storage. The Company submits a range of quality control samples, including blanks and gold and polymetallic standards supplied by Rocklabs, ITAK and OREAS, supplementing laboratory quality control procedures. Approximately 5% of archived samples are sent for umpire laboratory analysis, including any lotes exhibiting QAQC outliers after discussion with the laboratory. In BP Minerals sampling, gold was analysed historically by fire assay and base metals by three acid digest and ICP finish at the Nomos laboratory in Rio de Janeiro. Silver was analysed by aqua regia digest with an atomic absorption finish. True width is considered to be 80-90% of intersection width. Assay figures and intervals are rounded to 1 decimal place. Gold equivalents for Cabaçal are calculated as: AuEq(g/t) = (Au(g/t) * %Recovery) + (1.492*(Cu% * %Recovery)) + (0.013*(Ag(g/t) * %Recovery)), where:

• Au_recovery_ppm = 5.4368 ln (Au_Grade_ppm) + 88.856;

• Cu_recovery_pct = 2.0006 ln (Cu_Grade_pct) + 94.686;

• Ag_recovery_ppm = 13.342 ln (Ag_Grade_ppm) + 71.037.

Recoveries based on 2022 metallurgical testwork on core submitted to SGS Lakefield,

Copper equivalents for Santa Helena are based on metallurgical recoveries from the historical resource calculation, updated with pricing forecasts aligned with the Cabaçal PEA. The metal equivalent formula s presented as a copper equivalent rather than a zinc equivalent, based on the Companies current assessment of the metal balance after the past zinc-focussed extraction. CuEq% = (Cu% * 89%Recovery) + (0.67Au(g/t) * 65%Recovery) + (0.318Zn% * 89%Recovery) + (0.009Ag(g/t) * 61%Recovery).

The Gradient Array IP survey is being conducted using the Company's in-house team, utilizing its GDD GRx8‐16c receiver and 5000W‐2400‐15A transmitter. Data is processed by the Company's independent consultancy Core Geophysics. Geophysical and geochemical exploration targets are preliminary in nature and not conclusive evidence of the likelihood of a mineral deposit.

Qualified Person

Mr. Erich Marques, B.Sc., MAIG, Chief Geologist of Meridian Mining and a Qualified Person as defined by National Instrument 43-101, has reviewed, and verified the technical information in this news release.

FORWARD-LOOKING STATEMENTS

Some statements in this news release contain forward-looking information or forward-looking statements for the purposes of applicable securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed under the heading "Risk Factors" in under the heading "Risk Factors" in Meridian's most recent Annual Information Form filed on www.sedar.com. While these factors and assumptions are considered reasonable by Meridian, in light of management's experience and perception of current conditions and expected developments, Meridian can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Meridian disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events, or results or otherwise.

Table 1: Results Reported

Santa Helena

Hole-id |

Dip |

Azi |

EOH (m) |

Zone |

Int (m) |

CuEq (g/t) |

AuEq (%) |

Cu (%) |

Au (g/t) |

Ag (g/t) |

Zn (%) |

Pb (%) |

From (m) |

CD-311 |

-90 |

000 |

50.0 |

SHM |

|||||||||

19.1 |

1.3 |

1.9 |

0.5 |

0.5 |

12.0 |

2.0 |

0.3 |

8.0 |

|||||

Including |

4.9 |

4.6 |

6.8 |

1.7 |

1.6 |

43.3 |

7.6 |

0.9 |

22.2 |

||||

3.8 |

0.3 |

0.5 |

0.0 |

0.0 |

4.9 |

1.0 |

0.4 |

33.6 |

|||||

3.9 |

0.4 |

0.5 |

0.0 |

0.1 |

6.0 |

1.0 |

0.4 |

44.0 |

|||||

CD-325 |

-90 |

000 |

46.4 |

SHM |

|||||||||

14.9 |

3.1 |

4.6 |

1.2 |

1.6 |

37.4 |

3.8 |

0.7 |

26.3 |

|||||

Including |

6.7 |

4.3 |

6.4 |

1.6 |

2.6 |

56.9 |

5.1 |

1.0 |

27.5 |

||||

Including |

1.8 |

6.5 |

9.8 |

3.5 |

2.1 |

68.2 |

7.6 |

1.1 |

39.4 |

Cabaçal

| Hole-id | Dip |

Azi |

EOH (m) |

Zone |

Int (m) |

AuEq (g/t) |

CuEq (%) |

Au (g/t) |

Cu (%) |

Ag (g/t) |

From |

|---|---|---|---|---|---|---|---|---|---|---|---|

CD-312 |

-50 |

060 |

28.5 |

CWNE |

|||||||

2.0 |

0.3 |

0.2 |

0.3 |

0.0 |

0.6 |

3.0 |

|||||

CD-309 |

-50 |

058 |

90.4 |

CWNE |

|||||||

5.6 |

0.9 |

0.6 |

0.8 |

0.1 |

0.8 |

51.0 |

|||||

Including |

1.6 |

2.7 |

1.8 |

2.5 |

0.2 |

1.7 |

55.0 |

||||

2.1 |

0.7 |

0.4 |

0.1 |

0.4 |

1.7 |

62.9 |

|||||

CD-308 |

-49 |

046 |

67.5 |

CWNE |

|||||||

4.0 |

2.3 |

1.6 |

2.3 |

0.1 |

0.2 |

25.0 |

|||||

Including |

2.0 |

4.5 |

3.0 |

4.4 |

0.1 |

0.5 |

25.0 |

||||

CD-307 |

-50 |

055 |

69.7 |

CWNE |

|||||||

13.7 |

0.3 |

0.2 |

0.2 |

0.1 |

0.3 |

9.8 |

|||||

7.3 |

0.5 |

0.3 |

0.1 |

0.3 |

0.8 |

44.7 |

|||||

CD-306 |

-49 |

040 |

146.4 |

CWNE |

|||||||

18.3 |

0.5 |

0.3 |

0.2 |

0.2 |

0.8 |

21.7 |

|||||

23.9 |

0.6 |

0.4 |

0.3 |

0.2 |

0.5 |

52.3 |

|||||

49.8 |

0.9 |

0.6 |

0.3 |

0.5 |

2.1 |

82.2 |

|||||

Including |

7.9 |

2.2 |

1.5 |

0.7 |

1.1 |

5.6 |

91.5 |

||||

Including |

5.4 |

1.5 |

1.0 |

0.4 |

0.8 |

3.9 |

105.4 |

||||

CD-305 |

-52 |

046 |

115.4 |

CWNE |

|||||||

6.9 |

0.3 |

0.2 |

0.1 |

0.1 |

0.6 |

74.7 |

|||||

2.3 |

0.3 |

0.2 |

0.0 |

0.2 |

3.3 |

90.7 |

|||||

CD-304 |

-50 |

060 |

71.1 |

CWNE |

|||||||

6.9 |

0.3 |

0.2 |

0.1 |

0.1 |

0.2 |

27.7 |

|||||

3.9 |

2.0 |

1.4 |

1.4 |

0.4 |

1.0 |

39.1 |

|||||

CD-303 |

-47 |

048 |

150.3 |

CWNE |

|||||||

15.1 |

1.1 |

0.7 |

0.6 |

0.4 |

1.4 |

38.0 |

|||||

Including |

4.1 |

2.6 |

1.8 |

1.7 |

0.7 |

2.7 |

46.5 |

||||

18.3 |

0.8 |

0.5 |

0.5 |

0.2 |

0.8 |

68.1 |

|||||

Including |

1.9 |

3.6 |

2.4 |

1.9 |

1.2 |

3.5 |

71.3 |

||||

CD-302 |

-49 |

044 |

100.4 |

CWNE |

|||||||

1.6 |

0.4 |

0.3 |

0.0 |

0.3 |

0.2 |

32.0 |

|||||

4.5 |

0.2 |

0.2 |

0.1 |

0.1 |

0.5 |

64.6 |

|||||

CD-301 |

-50 |

059 |

115.4 |

CWNE |

|||||||

2.1 |

0.9 |

0.6 |

0.1 |

0.5 |

1.2 |

14.5 |

|||||

10.0 |

0.5 |

0.3 |

0.1 |

0.3 |

1.0 |

50.0 |

|||||

23.2 |

1.2 |

0.8 |

1.0 |

0.2 |

1.0 |

71.2 |

|||||

Including |

3.8 |

6.5 |

4.3 |

5.8 |

0.5 |

2.3 |

85.5 |

||||

CD-300 |

-62 |

043 |

93.6 |

ECZ |

|||||||

21.5 |

0.5 |

0.3 |

0.2 |

0.2 |

1.2 |

21.8 |

|||||

17.4 |

0.6 |

0.4 |

0.2 |

0.4 |

1.5 |

57.0 |

|||||

1.9 |

1.8 |

1.2 |

0.4 |

1.0 |

5.1 |

77.7 |

|||||

CD-299 |

-50 |

049 |

113.9 |

CWNE |

|||||||

11.0 |

0.3 |

0.2 |

0.1 |

0.1 |

0.4 |

76.0 |

|||||

1.1 |

3.7 |

2.5 |

0.8 |

1.9 |

18.2 |

92.1 |

|||||

CD-298 |

-52 |

057 |

115.0 |

CWNE |

|||||||

9.5 |

0.4 |

0.3 |

0.0 |

0.3 |

0.2 |

26.7 |

|||||

30.0 |

1.2 |

0.8 |

0.3 |

0.6 |

3.9 |

59.0 |

|||||

Including |

6.4 |

3.9 |

2.6 |

0.7 |

2.1 |

16.4 |

78.7 |

||||

CD-297 |

-61 |

059 |

43.5 |

ECZ |

Pending |

||||||

CD-296 |

-51 |

043 |

91.5 |

CWNE |

|||||||

9.4 |

1.0 |

0.7 |

0.1 |

0.7 |

0.5 |

13.8 |

|||||

1.9 |

1.1 |

0.5 |

0.4 |

0.3 |

0.4 |

32.1 |

|||||

23.1 |

0.5 |

0.3 |

0.2 |

0.2 |

1.2 |

42.0 |

|||||

CD-295 |

-50 |

040 |

33.0 |

CWNE |

NSI |

||||||

CD-294 |

-51 |

058 |

111.1 |

ECZ |

|||||||

46.0 |

0.7 |

0.5 |

0.1 |

0.4 |

2.0 |

15.0 |

|||||

Including |

8.0 |

1.4 |

1.0 |

0.1 |

0.9 |

5.9 |

45.0 |

||||

24.7 |

1.1 |

0.7 |

0.5 |

0.5 |

2.4 |

71.0 |

|||||

Including |

3.9 |

2.7 |

1.8 |

1.8 |

0.7 |

3.3 |

72.5 |

||||

Including |

1.9 |

2.7 |

1.8 |

0.4 |

1.6 |

5.4 |

93.7 |

||||

CD-293 |

-50 |

058 |

43.8 |

CWNE |

NSI |

||||||

CD-292 |

-65 |

045 |

181.4 |

SCZ |

|||||||

22.6 |

0.5 |

0.3 |

0.0 |

0.3 |

0.8 |

71.5 |

|||||

3.8 |

0.3 |

0.2 |

0.2 |

0.1 |

0.3 |

121.5 |

|||||

10.3 |

0.4 |

0.3 |

0.1 |

0.2 |

1.4 |

136.8 |

|||||

CD-291 |

-54 |

062 |

112.3 |

ECZ |

|||||||

47.3 |

0.6 |

0.4 |

0.1 |

0.4 |

1.4 |

17.0 |

|||||

Including |

4.0 |

1.9 |

1.2 |

0.3 |

1.1 |

4.7 |

29.8 |

||||

13.7 |

0.8 |

0.5 |

0.3 |

0.3 |

1.2 |

86.7 |

|||||

CD-290 |

-51 |

060 |

115.2 |

CWNE |

|||||||

2.0 |

0.4 |

0.3 |

0.1 |

0.2 |

0.4 |

47.1 |

|||||

1.3 |

0.7 |

0.5 |

0.2 |

0.4 |

0.6 |

58.7 |

|||||

2.6 |

0.7 |

0.5 |

0.6 |

0.1 |

0.2 |

75.6 |

|||||

3.3 |

3.6 |

2.4 |

1.8 |

1.3 |

4.7 |

90.1 |

|||||

CD-289 |

-49 |

043 |

97.0 |

CSEE |

|||||||

1.7 |

0.3 |

0.2 |

0.1 |

0.2 |

1.4 |

80.6 |

|||||

CD-288 |

-48 |

042 |

130.3 |

CCZ |

|||||||

51.6 |

0.8 |

0.5 |

0.3 |

0.4 |

1.6 |

26.0 |

|||||

Including |

5.8 |

1.6 |

1.1 |

1.4 |

0.2 |

1.1 |

55.3 |

||||

2.2 |

0.6 |

0.4 |

0.4 |

0.1 |

1.5 |

90.0 |

|||||

13.8 |

1.1 |

0.8 |

0.3 |

0.6 |

2.2 |

100.7 |

|||||

Including |

3.2 |

2.2 |

1.5 |

0.7 |

1.1 |

4.6 |

104.5 |

||||

CD-287 |

-52 |

059 |

118.0 |

CWNE |

|||||||

20.6 |

0.5 |

0.3 |

0.1 |

0.2 |

0.1 |

16.3 |

|||||

46.0 |

0.5 |

0.3 |

0.1 |

0.2 |

1.0 |

45.2 |

|||||

Including |

0.7 |

9.6 |

6.4 |

2.5 |

4.7 |

26.6 |

79.5 |

||||

CD-286 |

-58 |

042 |

48.5 |

ECZ |

|||||||

10.1 |

0.5 |

0.3 |

0.2 |

0.3 |

1.1 |

24.1 |

|||||

CD-285 |

-49 |

059 |

135.5 |

CWNE |

|||||||

50.2 |

0.4 |

0.3 |

0.4 |

0.1 |

0.1 |

35.6 |

|||||

21.6 |

0.9 |

0.6 |

0.2 |

0.5 |

2.5 |

93.4 |

|||||

Including |

7.4 |

1.6 |

1.0 |

0.2 |

0.9 |

6.2 |

107.6 |

||||

CD-284 |

-59 |

066 |

45.4 |

ECZ |

|||||||

14.4 |

0.4 |

0.3 |

0.1 |

0.2 |

0.9 |

13.7 |

|||||

CD-283 |

-50 |

060 |

100.2 |

SCZ |

|||||||

8.5 |

0.6 |

0.4 |

0.2 |

0.3 |

1.2 |

35.3 |

|||||

27.0 |

0.7 |

0.4 |

0.2 |

0.4 |

2.0 |

51.0 |

|||||

Including |

8.9 |

1.3 |

0.9 |

0.3 |

0.7 |

4.5 |

64.1 |

||||

CD-282 |

-48 |

044 |

124.7 |

CWNE |

|||||||

20.6 |

0.3 |

0.2 |

0.0 |

0.2 |

0.4 |

19.3 |

|||||

2.0 |

0.7 |

0.5 |

0.2 |

0.4 |

0.8 |

47.0 |

|||||

13.2 |

1.7 |

1.1 |

0.9 |

0.6 |

1.8 |

95.4 |

|||||

Including |

3.0 |

6.5 |

4.4 |

3.5 |

2.1 |

5.9 |

103.1 |

||||

CD-281 |

-58 |

044 |

58.6 |

ECZ |

|||||||

12.3 |

1.0 |

0.7 |

0.2 |

0.6 |

2.2 |

29.4 |

|||||

CD-280 |

-48 |

060 |

77.1 |

CWNE |

|||||||

2.2 |

0.7 |

0.4 |

0.1 |

0.4 |

0.8 |

20.8 |

|||||

22.0 |

0.4 |

0.2 |

0.3 |

0.1 |

0.3 |

38.0 |

|||||

CD-279 |

-50 |

047 |

105.1 |

CWNE |

|||||||

9.0 |

0.4 |

0.2 |

0.0 |

0.3 |

0.2 |

41.0 |

|||||

2.8 |

3.6 |

2.4 |

2.5 |

0.8 |

2.1 |

78.3 |

|||||

CD-278 |

-59 |

058 |

75.7 |

ECZ |

|||||||

4.8 |

0.4 |

0.3 |

0.1 |

0.2 |

0.8 |

19.0 |

|||||

18.2 |

0.8 |

0.5 |

0.2 |

0.4 |

1.7 |

35.0 |

|||||

Including |

1.7 |

3.3 |

2.2 |

0.7 |

1.8 |

9.6 |

45.0 |

||||

1.3 |

0.5 |

0.3 |

0.1 |

0.3 |

1.1 |

59.0 |

|||||

CD-277 |

-58 |

059 |

86.0 |

CCZ |

|||||||

9.8 |

0.3 |

0.2 |

0.0 |

0.2 |

0.5 |

10.6 |

|||||

10.3 |

0.8 |

0.6 |

0.3 |

0.4 |

0.9 |

25.5 |

|||||

Including |

2.1 |

2.9 |

1.9 |

1.2 |

1.2 |

3.3 |

27.1 |

||||

15.7 |

0.4 |

0.2 |

0.1 |

0.2 |

0.6 |

40.2 |

|||||

4.4 |

1.3 |

0.9 |

0.3 |

0.7 |

3.2 |

67.7 |

|||||

CD-276 |

-50 |

060 |

89.4 |

CWNE |

|||||||

27.0 |

0.3 |

0.2 |

0.0 |

0.2 |

0.3 |

23.0 |

|||||

12.6 |

1.2 |

0.8 |

0.8 |

0.3 |

0.7 |

62.0 |

|||||

Including |

1.0 |

6.1 |

4.1 |

5.3 |

0.6 |

1.8 |

62.0 |

||||

Including |

1.3 |

4.6 |

3.1 |

2.9 |

1.2 |

2.6 |

72.3 |

||||

CD-275 |

-49 |

059 |

95.0 |

CWNE |

|||||||

4.7 |

0.7 |

0.5 |

0.6 |

0.1 |

0.2 |

43.8 |

|||||

13.0 |

0.6 |

0.4 |

0.1 |

0.3 |

0.8 |

66.6 |

|||||

3.3 |

1.3 |

0.9 |

0.2 |

0.8 |

2.1 |

75.9 |

|||||

CD-274 |

-58 |

058 |

135.2 |

SCZ |

|||||||

11.6 |

0.9 |

0.6 |

0.5 |

0.3 |

0.8 |

69.0 |

|||||

5.3 |

0.5 |

0.4 |

0.1 |

0.3 |

0.7 |

92.4 |

|||||

7.4 |

0.6 |

0.4 |

0.2 |

0.3 |

0.6 |

104.8 |

|||||

CD-273 |

-59 |

031 |

136.4 |

SCZ |

|||||||

1.2 |

1.3 |

0.8 |

0.2 |

0.7 |

3.1 |

26.6 |

|||||

3.1 |

0.4 |

0.3 |

0.1 |

0.3 |

0.9 |

46.7 |

|||||

30.8 |

1.4 |

0.9 |

1.0 |

0.3 |

1.2 |

54.6 |

|||||

Including |

6.1 |

3.9 |

2.6 |

4.0 |

0.0 |

1.1 |

54.9 |

||||

8.9 |

1.3 |

0.9 |

0.3 |

0.7 |

2.2 |

108.1 |

|||||

CD-272 |

-51 |

057 |

86.3 |

CWNE |

|||||||

27.5 |

0.4 |

0.3 |

0.2 |

0.2 |

0.2 |

16.6 |

|||||

19.3 |

0.4 |

0.3 |

0.1 |

0.2 |

1.5 |

49.7 |

|||||

CD-271 |

-57 |

058 |

36.1 |

ECZ |

|||||||

11.1 |

1.0 |

0.7 |

0.0 |

0.7 |

3.5 |

2.9 |

|||||

6.0 |

1.2 |

0.8 |

0.0 |

0.9 |

0.3 |

23.0 |

|||||

CD-270 |

-63 |

058 |

72.7 |

SCZ |

|||||||

7.0 |

0.5 |

0.4 |

0.0 |

0.4 |

1.6 |

41.0 |

|||||

2.4 |

0.5 |

0.3 |

0.4 |

0.1 |

0.9 |

60.7 |

|||||

CD-269 |

-49 |

058 |

82.3 |

CWNE |

|||||||

4.7 |

0.3 |

0.2 |

0.2 |

0.1 |

0.0 |

4.5 |

|||||

10.7 |

0.2 |

0.2 |

0.1 |

0.1 |

0.2 |

19.0 |

|||||

7.6 |

0.4 |

0.3 |

0.1 |

0.2 |

0.7 |

52.7 |

|||||

CD-268 |

-58 |

058 |

118.7 |

SCZ |

|||||||

3.0 |

0.5 |

0.3 |

0.0 |

0.3 |

1.1 |

30.0 |

|||||

4.3 |

0.3 |

0.2 |

0.0 |

0.2 |

0.9 |

41.4 |

|||||

44.7 |

1.1 |

0.7 |

0.5 |

0.5 |

1.9 |

51.9 |

|||||

Including |

1.8 |

3.3 |

2.2 |

1.7 |

1.1 |

3.4 |

51.9 |

||||

Including |

6.3 |

3.5 |

2.3 |

1.0 |

1.7 |

8.4 |

86.0 |

||||

CD-267 |

-60 |

056 |

98.2 |

SCZ |

|||||||

3.0 |

0.2 |

0.2 |

0.0 |

0.2 |

0.8 |

16.7 |

|||||

42.0 |

1.5 |

1.0 |

1.3 |

0.2 |

0.9 |

29.5 |

|||||

Including |

1.8 |

13.4 |

9.0 |

13.5 |

0.0 |

0.6 |

40.6 |

||||

Including |

6.1 |

4.0 |

2.7 |

4.0 |

0.1 |

0.7 |

56.7 |

||||

2.1 |

1.7 |

1.1 |

0.2 |

1.0 |

4.6 |

79.7 |

|||||

CD-266 |

-47 |

060 |

97.1 |

CWNE |

|||||||

4.1 |

2.3 |

1.6 |

1.5 |

0.6 |

2.4 |

49.2 |

|||||

3.0 |

3.9 |

2.6 |

3.3 |

0.4 |

0.9 |

63.4 |

|||||

Including |

0.8 |

12.2 |

8.2 |

11.5 |

0.5 |

1.3 |

63.4 |

||||

CD-265 |

-44 |

058 |

86.4 |

ECZ / Gabbro |

NSI |

SOURCE: Meridian Mining UK S

View source version on accesswire.com:

https://www.accesswire.com/783088/meridian-intercepts-shallow-high-grade-cu-au-ag-zn-massive-sulphides-at-santa-helena