CALGARY, AB / ACCESSWIRE / April 28, 2023 / Avila Energy Corporation (CSE:VIK) ("Avila" or the "Company") is pleased to announce the results of its Independent Reserves Evaluation and the Acquisition Completed November 1st, 2022, in East Central Alberta.

The Company's independent reserves evaluation (the "Evaluation), which was completed by Deloitte LLP, the Company's Qualified Reserve Evaluator ("Deloitte" or "QRE") of Calgary, Alberta, which was conducted in accordance with the definitions, standards and procedures contained in the Canadian Oil and Gas Evaluators Handbook ("COGEH") and National Instrument 51-101 - Standards for Disclosure of Oil and Gas Activities ("NI 51-101"). The reserve volumes are inclusive of 100% of the Company's recent and acquisitions and represents the corporate reserve volumes as of January 1, 2023.

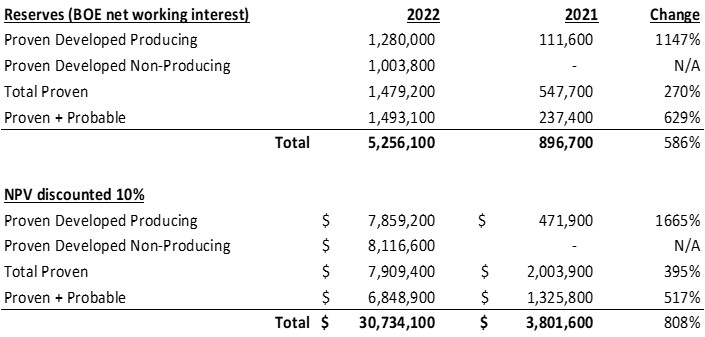

Reserves Highlights

Avila Energy's reserves on a Proven + Probable basis (2P) for the Company is 5,256,100 BOE valued at $30.734 million future cash flows based on a net present value discounted 10% before income taxes (NPV10% BT). The $30.734 million is an estimate of future cash flows and do not necessarily represent fair market value and is supported by a sustainable capital program of CAD $10.432 million for proved reserves and CAD $17.517 million for proved plus probable reserves.

The Company's reserves year over year, before income tax increased as follows.

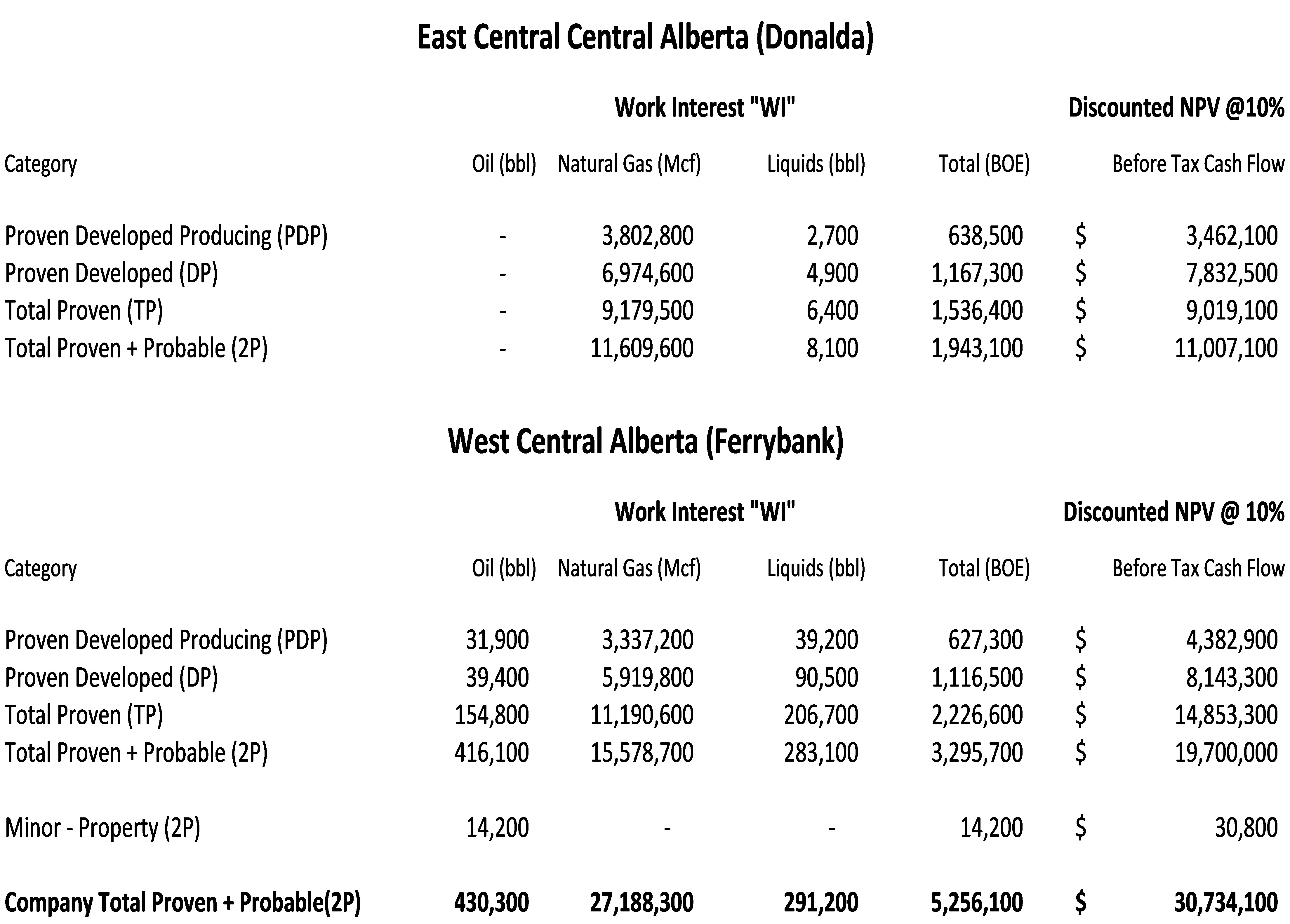

The Company's Reserves Evaluation before income tax by regions is as follows.**

**Notes

Based on the QRE (Deloitte LLP) published Price Deck dated December 31, 2022.

- The QRE prepared an independent evaluation of reserves and future net revenues derived from, the Petroleum and Natural Gas assets interests of Avila according to the Canadian Oil and Gas Evaluation Handbook ("COGE Handbook"); and

- As required, these reserves and future net revenues were estimated using forecast prices and costs (before and after income taxes) according to the requirements of National Instrument 51-101 ("NI 51-101"). The effective date of this evaluation is January 1, 2023. Both acquisitions, WCA and ECA properties closed prior to the effective date of this report. The closing date of the WCA acquisition was September 1, 2022, and the ECA acquisition closed on November 1, 2022.

- For further information, the reader is encouraged to look to additional documentation filed on SEDAR.

- The inflation rate is 0% in 2023, 2.3% per year in 2024 and 2% per year starting in 2025.

- Estimated future undiscounted development costs, in dollars, at April 1, 2023, were CAD $10.432 million for proved reserves and CAD $17.517 million for proved plus probable reserves.

- Well abandonment and reclamation costs for existing wells with reserves assigned and locations are included at the well level. These costs vary between $10,000 and $75,000 per well, based on the vertical depth of the zone and product type. These costs are based on area averages taken from the Alberta Energy Regulator (AER) Directive 011 called the "Alberta Regional Well Abandonment Table". Reclamation costs are taken from the AER Directive 011 section called "Alberta Regional Well Reclamation Table". At the request of the Company, a $2,000 salvage cost has been applied to CBM wells and $5,000 to all other wells at the end of the life of the forecast. The Company consider this position to be inline with the assessed values for all of the Company's wells and facilities estimated net present value of decommissioning liabilities, of $3,334,487 as at December 31, 2022 (2021- $282,594), based on an undiscounted total future liability of $7,620,706 (2021 - $178,897). These payments are expected to be incurred over a period of 1 to 50 years with most costs to be incurred in 2038. At December 31, 2022, this was based on a credit-adjusted risk-free rate 5.39% (2021 - 1.66%) and an inflation rate of 2.0% (2021 - 3.4%) were used to calculate the net present value of the decommissioning liabilities.

- The net present values disclosed may not represent fair market value.

- Totals may not add exactly due to rounding.

Upon the deliver of the evaluation and taking into consideration the condition of the assets and the facilities at the time of the acquisition was recorded as follows.

On November 1, 2022, the Company acquired 100% interest in oil and gas properties in East Central Alberta the Donalda Area. The transaction was accounted for as business combination under IFRS 3 - "Business Combinations" as the assets met the definition of a business. The total purchase is comprised of $1,800,000 in the form of a promissory note.

The following purchase price allocation is based on management's best estimate of the fair value assigned to the Assets acquired and the liabilities assumed. Management determined the fair value of the oil and gas properties to be $11,007,129, which was based on the NPV of 10% discounted cash flows created by an independent QRE. The assumption of $981,744 in discounted decommissioning liabilities and asset retirement obligation was based on the future value of $3,772,618, an inflation rate of 2.0%, credit adjusted risk free rate of 5.39% and life of the asset of 9 to 50 years.

Net assets acquired |

|

||||||

Petroleum and natural gas properties and equipment |

9,376,563 | ||||||

Asset Retirement Obligation |

981,744 | ||||||

Exploration and evaluation assets |

1,630,566 | ||||||

Facilities |

1,920,600 | ||||||

Pipelines |

7,474,440 | ||||||

Deferred Tax Liability |

(4,582,333) | ||||||

Decommissioning liabilities |

(981,744) | ||||||

Fair Value of Net Assets Acquired |

15,819,836 | ||||||

Less: Total consideration to be paid in Cash |

(1,800,000) | ||||||

Gain on acquisition |

14,019,836 | ||||||

Best, estimates were determined based on available information at the time of preparation of these Financial Statements. The Company continued its review to determine the identification of intangible assets, assumption of liabilities, identification of contingent liabilities and working capital adjustments during the allowable measurement period, which shall not exceed one year from the Closing.

Acquisition Cost

The Company did not incur any acquisition cost.

Revenue and operating income

The acquisition contributed $874,852 in revenue, royalty expense of $84,916 and $560,070 in direct operating expenses, in the two months, from November 1 to December 31, 2022, resulting in $229,866 of net operating income.

About, Avila Energy Corporation (CSE:VIK) ("Avila" or the "Company")

The Company is an emerging CSE listed corporation trading under the symbol (‘VIK'), and in combination with an expanding portfolio of 100% Owned and Operated oil and natural gas production, pipelines and facilities is a licensed producer, explorer, and developer of energy in Canada. The Company, through the implementation of a closed system of carbon capture and sequestration anticipated to be approved for construction in 2024 and an established path underway towards the material reduction of Tier 1, Tier 2, and Tier 3 emissions, continues to work towards becoming a Vertically Integrated low-cost Carbon Neutral Energy Producer. The Company continues to grow and achieve its results by focusing on the application of a combination of proven geological, geophysical, engineering, and production techniques.

For further information, please contact: | ||

Ronnie Shporer, Investor Relations, North America or | ||

Peter Nesveda, Investor Relations, International or | ||

Leonard B. Van Betuw, President & CEO of Avila Energy Corporation. | ||

Emails: |

Ronnie Shporer: |

|

|

Peter Nesveda: |

|

|

Leonard B. Van Betuw: |

|

ON BEHALF OF THE BOARD

Leonard B. Van Betuw

President & CEO

Contact phone number: (403) 451-2786

Cautionary and Forward-Looking Statements

Certain information set forth in this news release contains "forward-looking statements" with respect to the proposed business combination between the Company and IAC. Forward-looking statements may generally be identified by the use of words such as "believe," "may," "will," "estimate," "continue," "anticipate," "intend," "expect," "should," "would," "plan," "project," "forecast," "predict," "potential," "seem," "seek," "future," "outlook," "target" or other similar expressions (or the negative versions of such words or expressions) that predict or indicate future events or trends or that are not statements of historical matters. Forward-looking statements are predictions, projections, and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties that could cause the actual results to differ materially from the expected results. These statements are based on various assumptions, whether or not identified in this communication. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on by an investor as, a guarantee, an assurance, a prediction, or a definitive statement of fact or probability. Many actual events and circumstances are beyond the control of the Company and IAC.

All statements in this news release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements, including, but not limited to entrance into a Business Combination Agreement, the occurrence of and the anticipated date of closing of the Transaction, the availability of financing for the Transaction and IAC at the time of signing, the anticipated price per share post-closing of the Transaction, and the post-Closing governance of the Resulting Company. By their nature, forward-looking statements are subject to numerous risks and uncertainties, some of which are beyond the Company's and IAC's control, including completion of customary due diligence with respect to the Transaction, negotiation of the definitive documentation including the Business Combination Agreement, approval of the Transaction by Company and IAC shareholders, approval by the IAC shareholders of an extension of the time by which they must consummate an initial business combination, listing approval by a United States exchange and the impact of general economic conditions, industry conditions, the regulatory environment, volatility of commodity prices, currency fluctuations, environmental risks, operational risks, competition from other industry participants and stock market volatility. Although the Company and IAC believe that the expectations in its forward-looking statements are reasonable, its forward-looking statements have been based on factors and assumptions concerning future events which may prove to be inaccurate. Those factors and assumptions are based upon currently available information. Such statements are subject to known and unknown risks, uncertainties and other factors that could influence actual results or events and cause actual results or events to differ materially from those stated, anticipated, or implied in the forward-looking statements. Accordingly, readers are cautioned not to place undue reliance on the forward-looking statements, as no assurance can be provided as to future results, levels of activity or achievements. Risks, uncertainties, material assumptions and other factors that could affect actual results are discussed in the Company's public disclosure documents available at www.sedar.com and IAC's public disclosure documents available through the EDGAR filing system at www.sec.gov. Furthermore, the forward-looking statements contained in this document are made as of the date of this document and, except as required by applicable law, neither the Company nor IAC undertake any obligation to publicly update or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise. The forward-looking statements contained in this document are expressly qualified by this cautionary statement.

Abbreviations

bbls/d - barrels per day

BOE/d - barrels oil equivalent per day

NGLs - Natural Gas Liquids

Mboe - Thousands of barrels of oil equivalent

MMboe - Millions of barrels of oil equivalent

PDP - Proved Developed Producing

TP - Total Proved Reserves

TPP - Total Proved and Probable Reserves

IFRS - International Financial Reporting Standards as issued by the International Accounting Standards Board

WTI - West Texas Intermediate, the reference price paid in U.S. dollars at Cushing, Oklahoma for the crude oil standard grade

Certain information in this news release, including the operations at the Company's properties, constitute forward-looking statements under applicable securities laws. Although Avila Energy Corporation believes that the expectations reflected in these forward-looking statements are reasonable, undue reliance should not be placed on them because Avila Energy Corporation can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. The forward-looking statements contained in this news release are made as at the date of this news release and the Company does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by applicable securities laws. This release includes certain statements that may be deemed "forward-looking statements." All statements in this release, other than statements of historical facts, that address future production, reserve potential, exploration drilling, exploitation activities and events or developments that the Company expects are forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include market prices, exploitation, and exploration successes, continued availability of capital and financing, and general economic, market or business conditions. It should not be assumed that the estimates of net present value of future net revenue attributable to the Company's reserves presented above represent the fair market value of the reserves. The recovery and reserve estimates of the Company's oil, NGL, and natural gas reserves provided herein are estimates only and there is no guarantee that the estimated reserves will be recovered. Further, there is no assurance that the forecast prices and costs assumptions will be attained, and variances could be material. Investors are cautioned that any such statements are not guarantees of future performance and those actual results or developments may differ materially from those projected in the forward-looking statements. Barrel ("bbl") of oil equivalent ("boe") amounts may be misleading particularly if used in isolation. All boe conversions in this report are calculated using a conversion of six thousand cubic feet of natural gas to one equivalent barrel of oil (6 mcf=1 bbl) and is based on an energy conversion method primarily applicable at the burner tip and does not represent a value equivalency at the well head. This news release shall not constitute an offer to sell or the solicitation of any offer to buy, nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful. The securities offered have not been and will not be registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or applicable exemption from the registration requirements of the U.S. Securities Act and applicable state securities laws. Trading in the securities of Avila Energy Corporation should be considered highly speculative. Neither the Canadian Stock Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Stock Exchange) accepts responsibility for the adequacy or accuracy of this release. For more information on the Company, Investors should review the Company's registered filings which are available at www.sedar.com.

SOURCE: Avila Energy Corporation

View source version on accesswire.com:

https://www.accesswire.com/752039/Avila-Energy-Corporation-Is-Pleased-to-Annouce-the-Results-of-Its-Independent-Reserves-Evaluation-and-the-Acquisition-Completed-November-1-2022-in-East-Central-Alberta