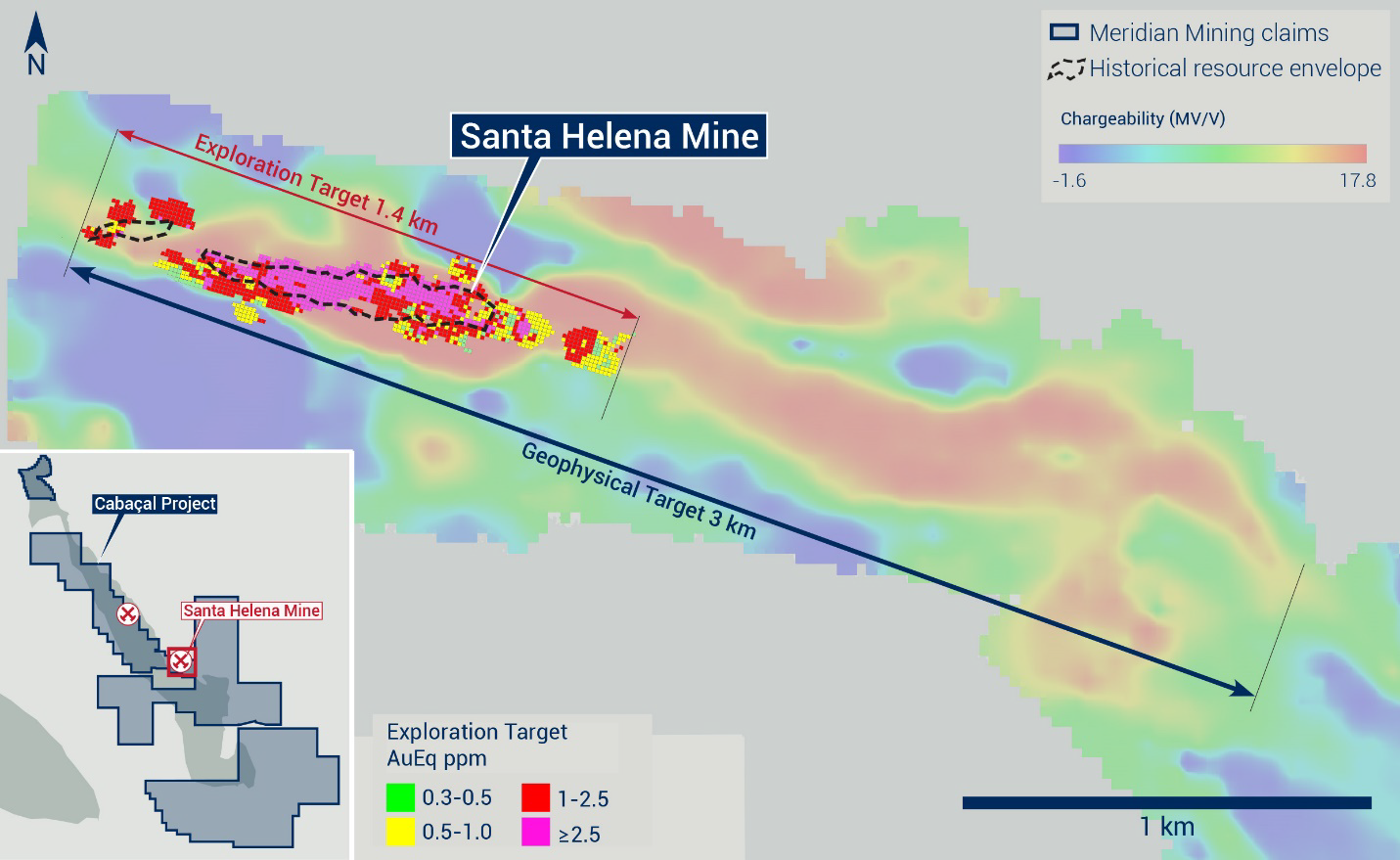

Exploration Target is contained within only 1.4km of the ~3km prospective trend

LONDON, UK / ACCESSWIRE / December 5, 2023 / Accesswire / Meridian Mining UK S (TSX:MNO)(OTCQX:MRRDF)(Frankfurt:2MM)(Tradegate:2MM) ("Meridian" or the "Company") is pleased to report that it has assessed the geological potential of the Santa Helena mine area ("Santa Helena") based on new and historical data, generating an initial Exploration Target with a tonnage range of 3.2 -7.2 Mt grading between 3.0 - 3.2g/t AuEq* , which gives a potential high-grade metal inventory range of between 306,000 to 763,000 AuEq ounces, located within 10km of the proposed Cabaçal mill site 1 .

The Company is also reporting further strong intercepts at Santa Helena including CD-359: 36.6m @ 1.3g/t AuEq from 13.0m; and CD-378: 5.9m @ 5.5g/t AuEq from 38.3m. These follow early positive results 2 from the Company's verification and extensional drilling program, and now highlight an expansion of Santa Helena's mineralization across strike, and at depths suitable to open pit development potential. Further drill results remain pending.

Highlights Reported Today

- Meridian reports Exploration Target for Santa Helena mine area of 3.2 - 7.2 Mt @ 3.0 - 3.2g/t AuEq ;

- Exploration Target's contained metal is between 306,000 to 763,000 AuEq ounces ;

- Mineralization grades 1.0 - 1.1g/t Au, 0.7 - 0.8 % Cu, 20.0 - 26.3 g/t Ag and 2.8 - 3.0 % Zn;

- Exploration target restricted to 1.4km of the ~3km prospective trend;

- Santa Helena's drilling expands and confirms shallow VMS Au, Cu, Ag and Zn mineralization;

- CD-359: 36.6m @ 1.3g/t AuEq (0.6g/t Au, 0.4% Cu, 8.4g/t Ag & 0.8% Zn) from 13.0m;

Including :

-

9.4m @ 1.9g/t AuEq (1.3g/t Au, 0.6% Cu, 15.1g/t Ag & 0.5% Zn) from 13.0m;

- CD-378: 5.9m @ 5.5g/t AuEq (1.9g/t Au, 1.3% Cu, 33.5g/t Ag & 5.6% Zn) from 38.3m; and

- Expansion of drilling into Santa Helena's prospective ~2km eastern extension is planned for 2024.

* The potential quantity and grade of an Exploration Target is conceptual in nature. There has been insufficient exploration to define a mineral resource, and it is uncertain if further exploration will result in the target being delineated as a mineral resource. The metal equivalence formula is based on the historical Santa Helena resource report 3 , calculated as AuEq based on gold being the dominant metal of the Cabaçal VMS camp, as the expectation is that Santa Helena's mineralization will be evaluated for processing through a centralized facility at the Cabaçal mill with the addition of a zinc circuit. True width is considered to be 80 to 90% of intersection width.

Mr. Gilbert Clark, CEO, comments: "Today Meridian continues to confirm the tremendous value upside opportunity that the Cabaçal belt presents. Santa Helena's high-grade Exploration Target of 306,000 to 763,000 ounces of gold equivalent, within a small tonnage and high-grade ranges, presents a very exciting upside opportunity for both the Cabaçal belt and for Meridian's shareholders."

"Looking to the medium term growth plans, utilizing a robust Exploration Target and continuing strong drill results, we will evaluate Santa Helena's potential for contributing additional high-grade mineralization to Cabaçal's future. Being within ten km of the advanced Cabaçal Mine project, if ongoing work at Santa Helena proves successful, future economic studies will not need to carry the capital expenditure of building a stand-alone mill. After a great year of advancement of the Cabaçal belt in 2023, including the submission of the Cabaçal mine's Preliminary Licence Application, we look forward to the further strong progress in 2024."

Santa Helena Initial Exploration Target

The Santa Helena mine area provides for the continuation of Meridian's low-risk investment model of targeting prospects with a high degree of potential and untested upside. A robust geological and mineralization model has been achieved by incorporating the results from historical drill campaigns, geology, and mining records, with Merdian's recent results from diamond drilling, trenching, mapping and geophysical surveys. This, with the removal of the limited mined areas, was then used as the basis for the reasonable ranges of tonnes and contained metals defined within the Exploration Target.

The VMS mineralization has been modelled and the plan view ("Figure 1") shows a strong correlation to the historical geological maps and reports. The long sections indicate that the mineralization again strongly follows the known geology of a continuous mineralized trend ("Figure 2").

Figure 1: Upper Range Santa Helena Upper Range Exploration target footprint in relation to the historical resource outline.

The Santa Helena database consists of data generated from multiple campaigns of surface and underground drilling and sampling, summarized as follows:

| Campaign | Code |

Number |

Meterage |

Average Depth (m) |

| Historical DDH (BP Minerals) | JUCHD |

80 |

8,301.42 |

103.77 |

| Meridian DDH | CD |

14 |

731.1 |

52.22 |

| Historical DDH (Prometálica) | FS |

35 |

1,170.81 |

33.45 |

PM |

39 |

2,487.98 |

63.79 |

|

| Historical Channels/Trenches (BPM/RTZ) | C2C_TR |

14 |

707.66 |

50.55 |

| Grand Total | 182 |

13,398.97 |

73.62 |

|

| Campaign | Code |

Number |

Meterage |

Average Length (m) |

| Grade Control (Prometálica) | FP |

249 |

793.61 |

3.19 |

CAN / M |

90 |

129.4 |

1.44 |

|

| Grand Total | 339 |

923.01 |

2.72 |

|

Table 1: Summary of Santa Helena Exploration Target database.

Surface drilling and locally trenching to the east was historically conducted on nominally 50 x 25 m spaced sections along a strike length of ~ 1,350m, with a cross-strike footprint of ~130 -220m, with some outlying holes. Spacing was not always regular, and a combination of vertical and inclined holes were drilled. Sectional azimuth varied from 10 to 35 degrees across the deposit. Meridian has since concluded 1,258m of drilling including 6 twin holes and 18 resource delineation holes within and outside the historical resource envelope. The model utilizes 14 of Meridian's holes (731.1 m of drilling) for which results were available.

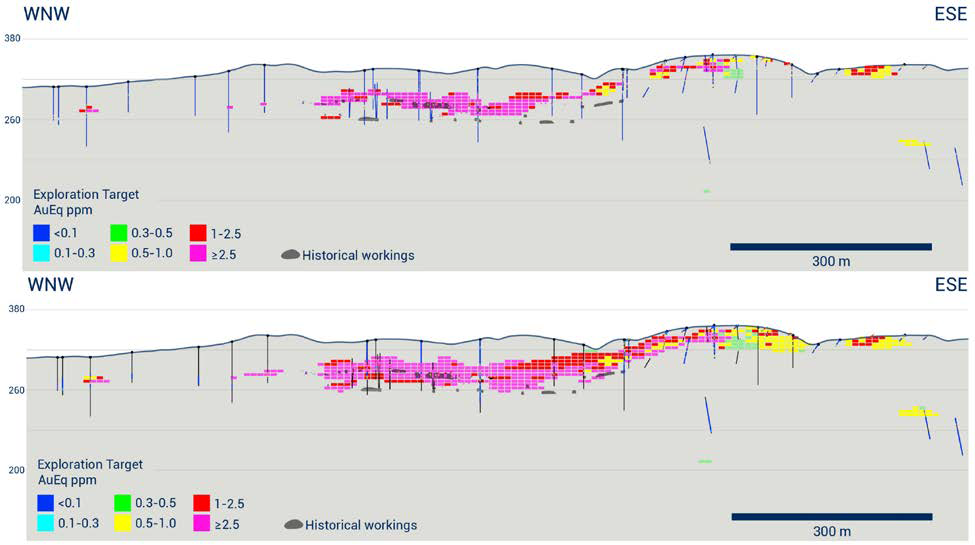

Figure 2: Top: long section looking north of Lower Range Exploration Target (after depletion), Bottom long section looking north of Upper Range Exploration Target (after depletion).

Geological modelling was completed generating a mineralization wireframe at a 0.3g/t AuEq cut-off grade, consistent with the resource cut-off grade of the Cabaçal deposit. Modelling of key lithologies included bounding post-mineralization gabbro sills which are present in the footwall and hangingwall of the deposit. A block model constrained by the interpreted mineralized bodies was constructed with the parent cell size of 10 mE x 10 mN x 5 mRL. Drillhole sample intervals have been composited to 1 m length and were used to interpolate all main modelled grades (Zn, Pb, Cu, Au, Ag) into the block model using inverse distance 2 and ordinary kriging (OK) interpolation techniques. Block grades were validated both visually and statistically and all modelling was completed using Leapfrog software.

To estimate the grades inside of the 0.3g/t AuEq cut-off grade wireframe, 1,644 samples of Au, 1,715 of Cu, 1,606 of Ag, 1,745 of Zn and 1,714 of Pb were used. For the lower limit of the exploration target, the unsampled drilling intervals were replaced by zero grade. Meridian's drilling indicates that like at the Cabaçal mine, areas of mineralization were left unsampled due to a particular commodity or development focus. For the upper limit, the unsampled intervals were omitted and the wireframe projected along a trend considered reasonable based on geometry and geological logging.

The search radius used was 70m x 70m x 10m for the major, semi-major and minor axes respectively, the same used to classify inferred resources in the Cabaçal deposit, with restrictions of a minimum of 2 and a maximum of 10 samples. For the interpolation of the grades, dynamic anisotropy was used with the geometry of a synclinal fold plunging up-plunge towards the east-south-east.

To evaluate the reconciliation of the Exploration Target with historical mining production of the vendors, Prometálica, the block model was resized to 4 mE x 4 mN x 2 mRL to better adhere to the geometry of the mining void. The difference in the estimated tonnage was -0.6%, and for the grades the variation was, +9.3% for Au, +4.5% for Cu, -2.9% for Ag, and -5.7% for Zn ("Table 2"). Lead production was not reported and is currently not contributing to the metal equivalence formula. Production is based on the historical digital archives of the Run-of-Mine monthly records of the Prometálica geology department, from October 2006 to August 2008. These Run-of-Mine production figures closely align with the modelled estimate, providing confidence in the Exploration Target's potential. The estimated range in tonnage and grade for the Exploration Target after mining depletion are 3.2 -7.2 Mt @ 3.0 - 3.2 g/t AuEq / 2.0 - 2.2% CuEq (1.0 - 1.1 g/t Au, 0.7 - 0.8% Cu, 20.0 - 26.3 g/t Ag & 2.8 - 3.0 % Zn; "Table 3"; "Table 4"). Metal equivalence is based on the historical SRK resource report, with metal prices applied from the Meridian's Cabaçal PEA dated March 6, 2023 (AuEq = (Au(g/t) * 65%Recovery) + (1.492Cu% * 89%Recovery) + (0.474Zn% * 89%Recovery)) + (0.008Ag(g/t) * 61%Recovery)). Recovery formulas will be updated with future testwork programs.

Reconciliation | |||||

Item |

Mass (t) |

Zn_pct |

Cu_pct |

Au ppm |

Ag ppm |

| Historical Prometálica Production Report | 439,813 |

6.65 |

1.62 |

1.77 |

43.02 |

| Meridian Estimation - Void Model | 437,290 |

6.27 |

1.69 |

1.94 |

41.79 |

Difference |

-0.6% |

-5.7% |

4.5% |

9.3% |

-2.9% |

Table 2: Comparison of the model with Run of Mine production records of Santa Helena.

Exploration Target | ||||||||||

Item |

Mt |

Au |

Ag |

Cu |

Zn |

Pb |

AuEq |

AuEq |

CuEq |

CuEq |

(g/t) |

(g/t) |

(pct) |

(pct) |

(pct) |

(g/t) |

(koz) |

(pct) |

(Mlbs) |

||

| Pre-Mining - Upper Range Exploration Target | 7.8 |

1.2 |

27.2 |

0.8 |

3.2 |

0.7 |

3.4 |

854 |

2.3 |

393 |

| Pre-Mining - Lower Range Exploration Target | 3.6 |

1.1 |

22.7 |

0.9 |

3.3 |

0.6 |

3.4 |

397 |

2.3 |

183 |

| Mining Depletion | 0.4 |

1.8 |

43.0 |

1.6 |

6.7 |

1.0* |

6.4 |

91 |

4.3 |

42 |

|

Upper Range Exploration Target (after depletion) |

7.3 |

1.1 |

26.3 |

0.8 |

3.0 |

0.7 |

3.2 |

763 |

2.2 |

351 |

|

Lower Range Exploration Target (after depletion) |

3.2 |

1.0 |

20.0 |

0.7 |

2.8 |

0 .6 |

3.0 |

306 |

2.0 |

141 |

Table 3: Exploration Target for the Santa Helena Deposit, with recovery-factored gold equivalent and copper equivalent content. Individual metal grades are pre-recovery.

* Lead production was not officially reported, but figures indicated based on metallurgical feed reports aligning well with modeled calculation. Lead does not contribute to the metal equivalence formula.

Item |

Mt |

Au |

Au_rec |

Ag |

Ag_rec |

Cu |

Cu_rec |

Zn |

Zn_rec |

(koz) |

(koz) |

(koz ) |

(koz ) |

(Mlbs) |

(Mlbs) |

(Mlbs) |

(Mlbs) |

||

| Pre-Mining - Upper Range Exploration Target | 7.8 |

291 |

189 |

6793 |

4144 |

143 |

127 |

544 |

484 |

| Pre-Mining - Lower Range Exploration Target | 3.6 |

123 |

80 |

2666 |

1626 |

69 |

61 |

264 |

235 |

| Mining Depletion | 0.4 |

25 |

16 |

608 |

371 |

16 |

14 |

64 |

57 |

| Upper Range Exploration Target after depletion | 7.3 |

266 |

173 |

6185 |

3773 |

127 |

113 |

480 |

427 |

| Lower Range Exploration Target after depletion | 3.2 |

98 |

64 |

2058 |

1255 |

53 |

47 |

200 |

178 |

Table 4: Exploration Target metal contents, before and after metallurgical recovery factoring.

An average bulk density values of 2.94 - 2.97 t/m3 was derived for the deposit, based on interpolation of 267 density readings on drill core. Values were derived by immersion techniques in Meridian and historical campaigns of drilling.

The estimated potential quantity of tonnes and grades are conceptual in nature as there has been insufficient data and evaluation to support estimation of a Mineral Resource. Tonnages and grades are expressed as ranges that are considered appropriate for the Exploration Target. There is no certainty that further exploration, verification drilling, or twinned drilling will result in the estimation of a Mineral Resource. The Exploration Target is not to be considered in any way to represent a Mineral Resource or Ore Reserve.

Steps being taken to update the Exploration Target to a resource include:

- Independent QP review - field checks completed by H&SC associate, Marcello Batelochi. Full review of database to be conducted after receipt of additional assay results;

- Update of surface relief topographic model for open pit development assessment - completed with high-precision Lidar survey flown by Brazilian Contractor, Embratop;

- Resampling checks on available historical drill core - completed;

- Maximizing collar surveys of all historical holes that can be located at surface (over 50% confirmed);

- Assess spatial shift between modern surfaces and historical theodolite-based surfaces (Current reconciliation of coordinates based on drill holes, mine entrance and ventilation shaft indicate a shift of x-3.3m, y-3.6m, z+12.9m between mine database records and SIRGAS200 grid;

- Resampling umpire checks on available historical pulps - in progress;

- Compilation of historical records - completed for assays and geological coding; compilation of recovery data and geotechnical data in progress;

- Addition of more density data into the database - proceeding in parallel with Meridian drilling;

- Completion of 50 x 50m infill check and extensional cross-strike drilling, with 25 x 25m infill test area - objectives of current program and continuing into 2024 campaign;

- Final spatial review of collar and void underground data integrity;

- Review metallurgical recovery assumptions with new testwork program, including the assessment of potential for Pb concentrate with precious metal credits, and assessment of oxide - transition zone recoveries which affect ~20% of the exploration target: scheduled for 2024; and

- Checks of historical records of plant throughput and tailings grade to compare against the geology department run-of-mine production records - ongoing.

Scope remains to test further potential for extension to the mineralized system, along the geophysical anomalies projecting along strike from Santa Helena.

Opportunities to recover a lead concentrate will be assessed as part of the future metallurgical test programs. The historical processing facility did also not include a gravity circuit. Gravity recoverable gold is anticipated at least in the oxide zone, with past surface geochemical surveys identifying a surface gold in soil anomaly at Santa Helena by pan concentrate methods.

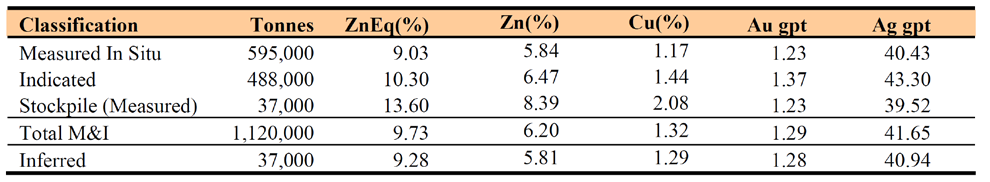

Santa Helena Historical Resource Estimate

SRK was previously commissioned by the Cabaçal Vendors to undertake a resource study on the Monte Cristo (Santa Helena) Zn Deposit in 2007 ("Table 5"). This estimate was last updated in a report dated 30 May 2007. The estimation procedure used three iterations of the inverse distance squared method on composited drillhole data with progressively longer search ranges. A Zn Equivalent % calculation was applied for reporting the estimates (ZnEq % = Zn% + (2.14 * Cu%) + (0.39 * Au ppm)+ (0.007* Ag_ppm); Metallurgical Recovery = 89% Zn, 89% Cu, 65% Au, 61% Ag; Au price USD 570 / oz; Ag price USD 11 / oz, Cu price USD 3.36/ lb; Zn price = 1.57 / lb). A qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves; and the issuer is not treating the historical estimate as current mineral resources or mineral reserves. The 2007 historical resource does not account for final depletion.

Table 5: Historical Santa Helena 2007 Resource Estimate.

The historical resource had a number of limitations reducing its tonnage compared to the current Exploration Target range:

- The historical resource was quoted at a 3% Zinc Equivalent cut-off grade, reducing the amount of lower grade mineralization at reasonable grades that could alternatively be considered for open-pit development;

- The historical resource estimate did not incorporate data from mineralization intersected in BP trenching and drilling programs at the eastern end of the deposit;

- Checks against original BP maps and reports retrieved from historical archives, coupled with field checks, indicated than a number of holes were wrongly placed in the database; and

- New drilling indicates a greater cross-strike footprint of mineralization than originally modelled.

Santa Helena Drill Program

Santa Helena is a Cu-Au-Ag & Zn VMS deposit located ~9km to the southeast of the Cabaçal Mine in Mato Grosso Brazil. It has over 10,000m of historical drilling and is one of a series of exploration targets along the 11km Cabaçal Mine Corridor. The Company commenced initial drilling in August 2023 as part of a verification program, to validate the historical data in line with NI43-101 requirements, and to initiate scout drilling for potential extensions defined by geophysics. The Company's compilation of historical drill data indicated that many past holes were not completely sampled, that reconciliation of surveyed drilled positions and mine workings suggested that the high-grade massive sulphide mineralization was only partially mined. and that extensions of near-surface mineralization to the south and to the east were also not integrated into the historical resource calculations 4 . The Company has concluded that this historical resource area is considered open.

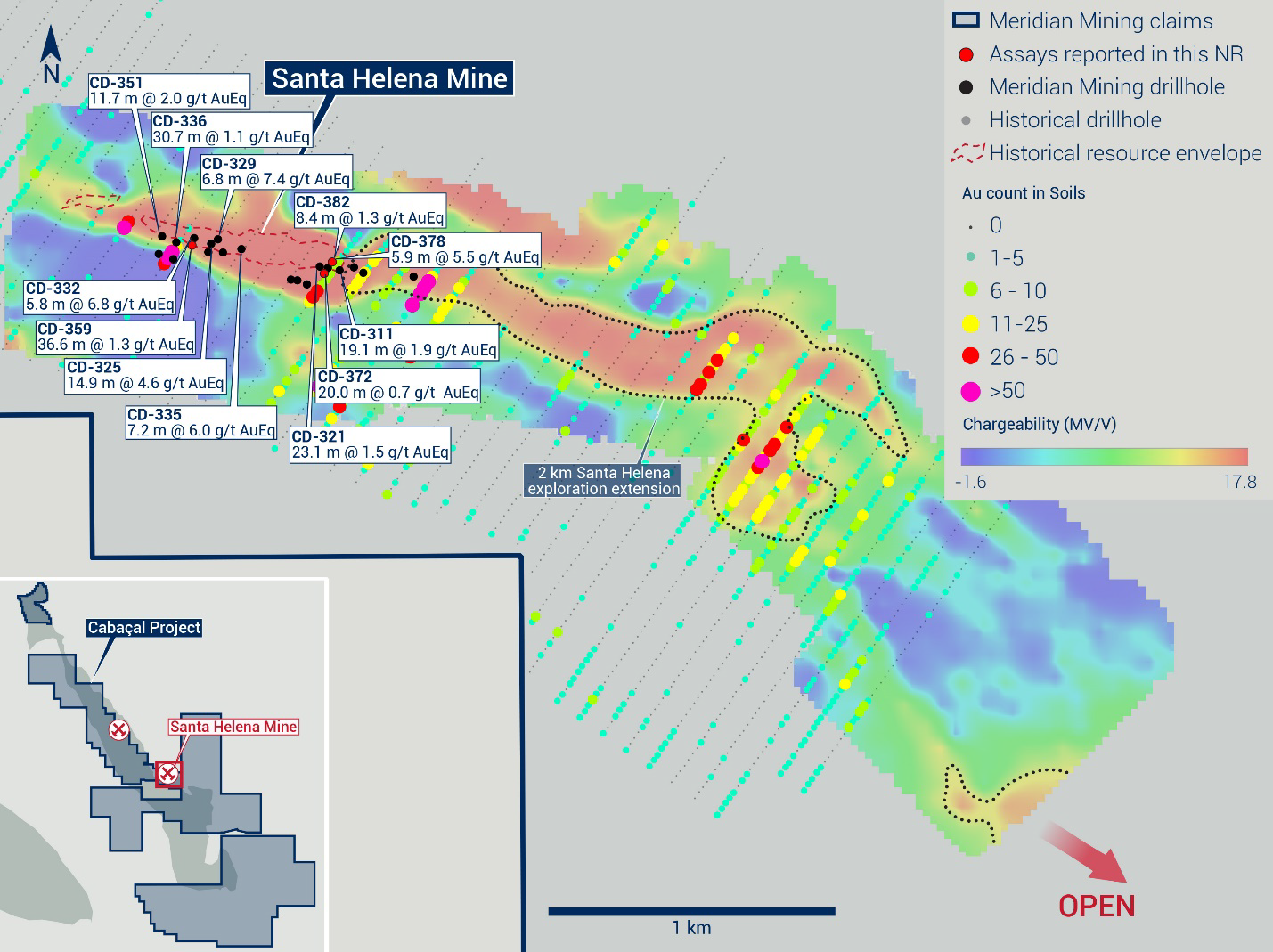

Figure 3: Santa Helena drill results, with 2.0km eastern exploration extension, and newly emerging target area remaining open to the southeast.

The Company has completed twenty-four holes to date. Initial results from holes drilled along the main trend for resource verification were very positive, confirming high-grade massive to semi massive near-surface mineralization 5 . Further drilling across strike into a geochemical anomaly located south of the historical resource also confirmed strong mineralization, locally increasing the cross-strike footprint of mineralization by up to 300% 6 . These results have included:

- CD-311: 19.1m @ 1.9g/t AuEq from 8.0m; including 4.9m @ 6.8g/t AuEq from 22.2m;

- CD-321: 23.1m @ 1.5 g/t AuEq from 6.1m, including 3.6m @ 4.9 g/t AuEq from 10.0m;

- CD-325: 14.9m @ 4.6 g/t AuEq from 26.3m;

- CD-329: 6.8m @ 7.4g/t AuEq from 38.7m;

- CD-332: 5.8m @ 6.8g/t AuEq from 32.2m;

- CD-335: 7.2m @ 6.0g/t AuEq from 35.5m;

- CD-336: 30.7m @ 1.1g/t AuEq from 6.0m, including: 5.7m @ 2.2g/t AuEq ; and

- CD-351: 11.7m @ 2.0g/t AuEq from 27.0m, including 5.4m @ 2.8g/t AuEq from 27.0m.

The latest results ("Table 6"; "Figure 3") have been returned from a range of positions throughout the deposit.

Additional drilling across strike from the historical resource has returned further shallow mineralization with a wide zone intersected in CD-359, located 55m along strike from CD-336. Further drilling is in progress to extend this position eastwards along strike.

- CD-359: 36.6m @ 1.3g/t AuEq (0.6g/t Au, 0.4% Cu, 8.4g/t Ag & 0.8% Zn) from 13.0m;

including:

- 9.4m @ 1.9g/t AuEq (1.3g/t Au, 0.6% Cu, 15.1g/t Ag & 0.5% Zn) from 13.0m, and

- 5.6m @ 1.7g/t AuEq (0.9g/t Au, 0.4% Cu, 10.8g/t Ag & 1.4% Zn) from 29.7m.

Drilling further to the east confirmed shallow mineralization both within the historical resource envelope aligned with expectations (CD-378, CD-382), and mineralization to the south of the projected resource envelope, below historical surface trenching of BP Minerals (CD-372):

- CD-372 20.0m @ 0.7g/t AuEq (0.2g/t Au, 0.2% Cu, 8.9g/t Ag & 0.3% Zn) from 0.0m;

including:

- 7.6m @ 1.2 g/t AuEq (0.4g/t Au, 0.6% Cu, 5.4g/t Ag & 0.5% Zn) from 0.0m;

- 4.9m @ 0.8g/t AuEq (0.1g/t Au, 0.2% Cu, 6.7g/t Ag & 1.3% Zn) from 31.4m;

- CD-378: 5.9m @ 5.5g/t AuEq (1.9g/t Au, 1.3% Cu, 33.5g/t Ag & 5.6% Zn) from 38.3m; and

- CD-382: 8.4m @ 1.3g/t AuEq (0.5g/t Au, 0.3% Cu, 12.6g/t Ag & 1.3% Zn) from 41.0m.

The growing confidence in the data combined with historical compilations has allowed the Company to nominate the Exploration Target for the Santa Helena Deposit. The Company aims to continue the program with the objective of defining a Mineral Resource, and we look forward to further results.

About Meridian

Meridian Mining UK S is focused on:

- The development and exploration of the advanced stage Cabaçal VMS gold‐copper project;

- Regional scale exploration of the Cabaçal VMS belt; and

- Exploration in the Jaurú & Araputanga Greenstone belts (the above all located in the State of Mato Grosso, Brazil).

Cabaçal is a gold-copper-silver rich VMS deposit with the potential to be a standalone mine within the 50km VMS belt. Cabaçal's base and precious metal-rich mineralization is hosted by volcanogenic type, massive, semi-massive, stringer, and disseminated sulphides within deformed metavolcanic-sedimentary rocks. A later-stage gold overprint event has emplaced high-grade gold mineralization.

The Preliminary Economic Assessment technical report (the "PEA Technical Report") dated March 30, 2023, entitled: "Cabaçal Gold-Copper Project NI 43-101 Technical Report and Preliminary Economic Assessment, Mato Grosso, Brazil" outlines a base case after-tax NPV5 of USD 573 million and 58.4% IRR from a pre-production capital cost of USD 180 million, leading to capital repayment in 10.6 months (assuming metals price scenario of USD 1,650 per ounces of gold, USD 3.59 per pound of copper, and USD 21.35 per ounce of silver). Cabaçal has a low All-in-Sustaining-Cost of USD 671 per ounce gold equivalent for the first five years, driven by high metallurgical recovery, a low life-of-mine strip ratio of 2.1:1, and the low operating cost environment of Brazil (see press release dated March 6, 2023).

The Cabaçal Mineral Resource estimate consists of Indicated resources of 52.9 million tonnes at 0.6g/t gold, 0.3% copper and 1.4g/t silver and Inferred resources of 10.3 million tonnes at 0.7g/t gold, 0.2% copper & 1.1g/t silver (at a 0.3 g/t gold equivalent cut-off grade), including a higher-grade near-surface zone supporting a starter pit.

Readers are encouraged to read the PEA Technical Report in its entirety. The PEA Technical Report may be found on the Company's website at www.meridianmining.co and under the Company's profile on SEDAR+ at http://www.sedarplus.ca/ .

The qualified persons for the PEA Technical Report are: Robert Raponi (P. Eng), Principal Metallurgist with Ausenco Engineering), Scott Elfen (P. E.), Global Lead Geotechnical and Civil Services with Ausenco Engineering), Simon Tear (PGeo, EurGeol), Principal Geological Consultant of H&SC, Marcelo Batelochi, (MAusIMM, CP Geo), Geological Consultant of MB Geologia Ltda, Joseph Keane (Mineral Processing Engineer; P.E), of SGS, and Guilherme Gomides Ferreira (Mine Engineer MAIG) of GE21 Consultoria Mineral.

On behalf of the Board of Directors of Meridian Mining UK S

Mr. Gilbert Clark - CEO and Director

Meridian Mining UK S

Email: info@meridianmining.co

Ph: +1 778 715-6410 (PST)

Stay up to date by subscribing for news alerts here: https://meridianmining.co/contact/

Follow Meridian on Twitter: https://twitter.com/MeridianMining

Further information can be found at: www.meridianmining.co

Technical Notes

Samples have been analysed at SGS laboratory in Belo Horizonte. Samples are dried, crushed with 75% passing <3 mm, split to give a mass of 250-300g, pulverized with 95% passing 150#. Gold analyses are conducted by FAA505 (fire assay of a 50g charge), and base metal analysis by methods ICP40B and ICP40B_S (four acid digest with ICP-OES finish). Visible gold intervals are sampled by metallic screen fire assay method MET150-FAASCR. Samples are held in the Company's secure facilities until dispatched and delivered by staff and commercial couriers to the laboratory. Pulps and coarse rejects are retained and returned to the Company for storage. The Company submits a range of quality control samples, including blanks and gold and polymetallic standards supplied by Rocklabs, ITAK and OREAS, supplementing laboratory quality control procedures. Approximately 5% of archived samples are sent for umpire laboratory analysis, including any lots exhibiting QAQC outliers after discussion with the laboratory. In BP Minerals sampling, gold was analysed historically by fire assay and base metals by three acid digest and ICP finish at the Nomos laboratory in Rio de Janeiro. Silver was analysed by aqua regia digest with an atomic absorption finish. True width is considered to be 80-90% of intersection width. Assay figures and intervals are rounded to 1 decimal place. Gold equivalents for Cabaçal are calculated as: AuEq(g/t) = (Au(g/t) * %Recovery) + (1.492*(Cu% * %Recovery)) + (0.013*(Ag(g/t) * %Recovery)), where:

- Au_recovery_ppm = 5.4368ln(Au_Grade_ppm)+88.856

- Cu_recovery_pct = 2.0006ln(Cu_Grade_pct)+94.686

- Ag_recovery_ppm = 13.342ln(Ag_Grade_ppm)+71.037

Recoveries based on 2022 metallurgical testwork on core submitted to SGS Lakefield

Copper equivalents for Santa Helena are based on metallurgical recoveries from the historical resource calculation, updated with pricing forecasts aligned with the Cabaçal PEA. The metal equivalent formula s presented as a copper equivalent rather than a zinc equivalent, based on the Companies current assessment of the metal balance after the past zinc-focussed extraction. CuEq% = (Cu% * 89%Recovery) + (0.67Au(g/t) * 65%Recovery) + (0.318Zn% * 89%Recovery)) + (0.009Ag(g/t) * 61%Recovery)). Recovery formulas will be updated with future testwork programs.

The Gradient Array IP survey is being conducted using the Company's in-house team, utilizing its GDD GRx8‐16c receiver and 5000W‐2400‐15A transmitter. Data is processed by the Company's independent consultancy Core Geophysics. Geophysical and geochemical exploration targets are preliminary in nature and not conclusive evidence of the likelihood of a mineral deposit.

Qualified Person

Mr. Erich Marques, B.Sc., MAIG, Chief Geologist of Meridian Mining and a Qualified Person as defined by National Instrument 43-101, has reviewed, and verified the technical information in this news release.

FORWARD-LOOKING STATEMENTS

Some statements in this news release contain forward-looking information or forward-looking statements for the purposes of applicable securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed under the heading "Risk Factors" in Meridian's most recent Annual Information Form filed on www.sedar.com. While these factors and assumptions are considered reasonable by Meridian, in light of management's experience and perception of current conditions and expected developments, Meridian can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Meridian disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events, or results or otherwise.

Table 6: Results Reported

Santa Helena

Hole-ID |

Dip |

Azi |

EOH (m) |

Zone |

Int (m) |

AuEq (g/t) |

CuEq (%) |

Au (g/t) |

Cu (%) |

Ag (g/t) |

Zn (%) |

Pb (%) |

From (m) |

CD-382 |

-90 |

000 |

66.5 |

SHM |

|||||||||

8.4 |

1.3 |

0.9 |

0.5 |

0.3 |

12.6 |

1.3 |

0.2 |

41.0 |

|||||

Including |

3.4 |

2.1 |

1.4 |

0.7 |

0.3 |

21.2 |

2.6 |

0.5 |

46.0 |

||||

1.2 |

0.8 |

0.6 |

0.2 |

0.1 |

6.2 |

1.4 |

0.3 |

59.0 |

|||||

1.6 |

0.3 |

0.2 |

0.1 |

0.0 |

4.1 |

0.4 |

0.2 |

63.9 |

|||||

CD378 |

-60 |

216 |

70.6 |

SHM |

|||||||||

5.9 |

5.5 |

3.7 |

1.9 |

1.3 |

33.5 |

5.6 |

1.0 |

38.3 |

|||||

Including |

4.0 |

7.5 |

5.0 |

2.7 |

1.8 |

45.1 |

7.1 |

1.2 |

39.4 |

||||

CD372 |

60 |

213 |

50.1 |

SHM |

|||||||||

20.0 |

0.7 |

0.4 |

0.2 |

0.2 |

8.9 |

0.3 |

0.3 |

0.0 |

|||||

Including |

7.6 |

1.2 |

0.8 |

0.4 |

0.6 |

5.4 |

0.5 |

0.3 |

0.0 |

||||

4.9 |

0.8 |

0.6 |

0.1 |

0.2 |

6.7 |

1.3 |

0.2 |

31.4 |

|||||

CD359 |

45 |

188 |

70.6 |

SHM |

|||||||||

36.6 |

1.3 |

0.9 |

0.6 |

0.4 |

8.4 |

0.8 |

0.5 |

13.0 |

|||||

Including |

9.4 |

1.9 |

1.3 |

1.3 |

0.6 |

15.1 |

0.5 |

1.2 |

13.0 |

||||

Including |

5.6 |

1.7 |

1.2 |

0.9 |

0.4 |

10.8 |

1.4 |

0.6 |

29.7 |

1 Meridian Mining news release dated March 6, 2023

2 See Meridian Mining news releases of: November 14, October 23 and September 27, 2023.

3 Monte Cristo Mine. State of Mato Grosso, Brazil. Report by SRK Consulting, Project Number 164802. Compiled by Nick Michael, Clay Taylor, Alva Kuestermeyer. A qualified person has not done sufficient work to classify the historical estimate as current mineral resources or mineral reserves. Meridian has not treated the resource and reserve stated in this report as a current mineral resource or reserves for purposes of National Instrument 43‐101.

4 Meridian Mining News Release of March 29, 2022.

5 Meridian Mining News Release of September 12, 2023.

6 Meridian Mining News Release of November 14, 2023.

SOURCE: Meridian Mining UK S

View source version on accesswire.com:

https://www.accesswire.com/813161/meridian-defines-initial-exploration-target-of-32--73-mt-30--32-gt-aueq-at-santa-helena