New High Grade Au Vein in the Northwest Extension and C4A Au-Ag Zone Extended

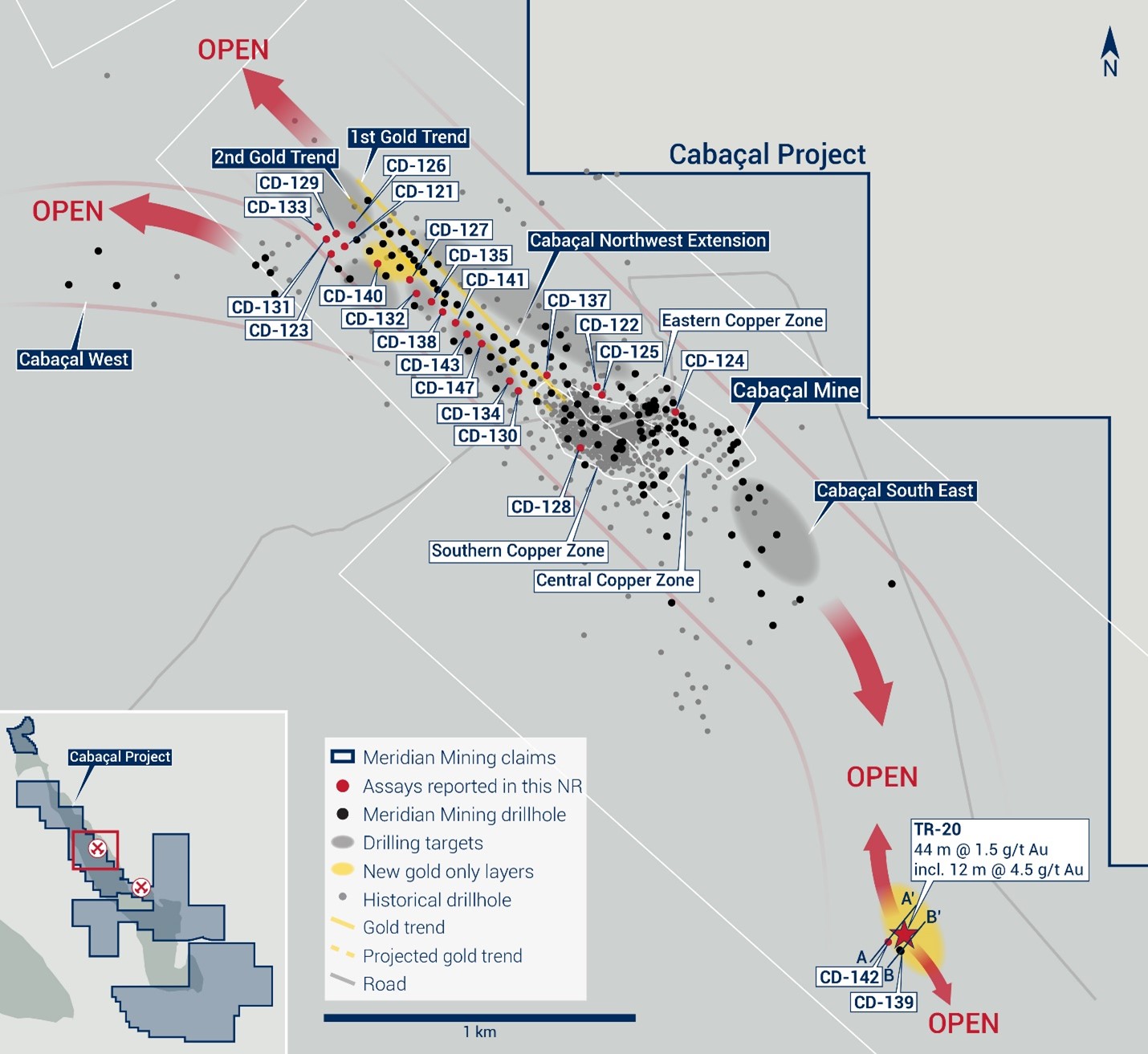

LONDON, UK / ACCESSWIRE / July 12, 2022 / Meridian Mining UK S (TSX:MNO)(Frankfurt/Tradegate:2MM)(OTCQB:MRRDF), ("Meridian" or the "Company") is pleased to announce that another high-grade gold vein set overprinting the VMS copper-gold layer of the Cabaçal Northwest Extension ("CNWE") has been delineated (Figure 1). CD-147's high-grade gold vein assayed 2.3m @ 16.7g/t Au, and provides yet another example of a new high-grade domain found within the prospective 1,250m strike length of the CNWE. Meridian is also pleased to report that its C4-A gold-silver discovery[1], has been extended from the discovery hole CD-139[2] by 50m to the northwest, with CD-142 returning 10.7m @ 1.8g/t Au & 33.7g/t Ag from 45.7m. The C4A gold-silver discovery is 2km from the Cabaçal mine and is open in all directions. The Company is also reporting further assay results from the ECZ, SCZ & CNWE zones[3] from its ongoing drill program at the Cabaçal copper-gold VMS project ("Cabaçal") located in Mato Grosso Brazil. Referenced images are presented at the end of this release as well as on the Company's website. Further results are pending.

Highlights Reported Today:

- Meridian intercepts another high-grade gold vein overprinting the Cabaçal Northwest Extension;

- 2.3m @ 2.2% Cu, 16.7g/t Au & 3.6g/t Ag from 21.0m (CD-147) -CNWE;

- Multiple high-grade sub-vertical gold veins now defined along the CNWE;

- Cabaçal's major new gold-silver discovery C4A, extended 50m along strike, remains open;

- 10.7m @ 1.8g/t Au & 33.7g/t Ag from 45.7m (CD-142) -C4A;

- Cabaçal's results continues to confirm, and extends layers of strong copper-gold mineralization;

- 54.2m @ 0.9% CuEq (0.4% Cu, 0.9g/t Au & 1.6g/t Ag) from 11.0m (CD-147) - CNWE;

- Including 2.3m @ 12.3% CuEq (2.2% Cu, 16.7g/t Au, 3.6g/t Ag) from 21.0m;

- Emerging strong copper zone from 58.3m;

- Assays 7.0m @ 1.1% CuEq (0.9% Cu, 0.3g/t Au & 5.9g/t Ag) from 58.0m;

- 19.2m @ 0.6% CuEq (0.3% Cu, 0.4g/t Au, 2.0g/t Ag & 0.1% Zn) from 58.3m (CD-143) - CNWE;

- Emerging strong copper zone from 58.3m;

- Assays 7.8m @ 1.1% CuEq (0.6% Cu, 0.8g/t Au & 3.5g/t Ag) from 58.3m;

- Emerging strong copper zone from 58.3m;

- Meridian expands locally gold dominate layer overlying the CNWE VMS system;

- 9.5m @ 0.2% Cu, 1.3g/t Au & 0.3g/t Ag from 63.2m (CD-127) -CNWE;

- 39.9m @ 0.5g/t Au & 0.1g/t Ag from 30.1m (CD-132) CNWE;

- 41.4m @ 0.8% CuEq (0.3% Cu, 0.8g/t Au & 0.9g/t Ag) from 62.4m (CD-128) - SCZ, and

- Including 6.6m @ 3.2% CuEq (0.6% Cu, 4.4g/t Au & 2.2g/t Ag) from 66.8m.

Dr Adrian McArthur, CEO and President comments: "The Cabaçal Northwest extension is now confirmed to host multiple vein sets of very high-grade gold overprinting the copper-gold VMS system, and we are confident more veins will be delineated. The strength of a new 2.3m gold vein grading at over half-an-ounce gold is significant, in being one of a new array of structures identified over the length of the CNWE. We will be releasing our first resource statement in September, and todays high grade veins, infill drilling and the emerging layer of gold dominate mineralisation, again in the CNWE, via CD-127 and CD-132 will all be contributing to Cabaçal's tonnage potential. C4-A, our major new precious metal discovery has a high-grade gold-silver core that has been extended 50m to the northwest and is open in all directions. C4-A's high grade precious metal zone found running along the surface has a large alteration zone in the footwall and we see further potential along strike and at depth to repeat or even intercept higher grades, potentially along the lines of those gold intercepts of the CNWE. The C4-A discovery has the footprint to potentially become a major contributor to the Cabaçal project's significant upside potential.

Today's results further confirm Cabaçal's incredible potential to deliver new discoveries in this under-explored greenstone belt."

Cabaçal Drilling Continues to Intersect Broad Widths, Hosting Robust Grades of Copper-Gold-Silver

Infill-drilling results reported today, continue to extend the footprint of copper-gold mineralization into sparely drilled areas. Three rigs continue to remain active, with a particular focus on extensions to the Cabaçal Mine area. Results continue to deliver broader than expected extensions of mineralization beyond historical resource[4] envelops, within which higher-grade structures continue to be encountered.

Across-strike drilling in the CNWE continued to define extensions to the gold-dominant trend previously reported CD-099, CD-110 and CD-113[5]. New results have extended this zone-dominant zone to 200m strike length:

- CD-127 intersected 54.4m @ 0.4% CuEq (0.1% Cu, 0.4g/t Au & 0.3g/t Ag) from 26.9m, including a gold-dominant layer of 9.5m @ 0.2% Cu, 1.3g/t Au & 0.3g/t Ag from 63.2m; and

- CD-132 intersected an upper gold-dominant layer of 39.9m @ 0.5g/t Au & 0.1g/t Ag from 30.1m, and a lower base metal - gold zone of 39.9m @ 0.4% CuEq (0.3% Cu, 0.1g/t Au, 1.7g/t Ag & 0.2% Zn) from 76.9m.

Extensions to the trend continue to the south, with broader intersections of gold-dominant or mixed copper-gold mineralization, amongst which further higher-grade intervals have been returned:

- CD-138 intersected 20m @ 0.5% CuEq (0.5% Cu, 0.1g/t Au & 0.5g/t Ag) from 31m, 19.6m @ 1.1% CuEq (0.8% Cu, 0.4g/t Au & 4.8g/t Ag) from 78.4m;

- CD-141 intersected 28.2m @ 0.2% CuEq (0.1% Cu, 0g/t Au & 0.2g/t Ag, 0% Zn) from 18.8m, 31.3m @ 0.3% CuEq (0.2% Cu, 0.1g/t Au & 1.0g/t Ag) from 55.0m, 23.2m @ 0.5% CuEq (0.3% Cu, 0.2g/t Au, 1.4g/t, Ag & 0.1% Zn) from 113.8m;

- CD-143 intersected 19.2m @ 0.6% CuEq (0.3% Cu, 0.4g/t Au, 2g/t Ag & 0.1% Zn) from 58.3m, including 7.8m @ 1.1% CuEq (0.6% Cu, 0.8g/t Au & 3.5g/t Ag) from 58.3m; and

- CD-147 intersected 54.2m @ 0.9% CuEq (0.4% Cu, 0.9g/t Au & 1.6g/t Ag) from 11.0m, including 2.3m @ 12.3% CuEq (2.2% Cu, 16.7g/t Au & 3.6g/t Ag) from 21.0m and 7.0m @ 1.1% CuEq (0.9% Cu, 0.3g/t Au & 5.9g/t Ag) from 50.0m.

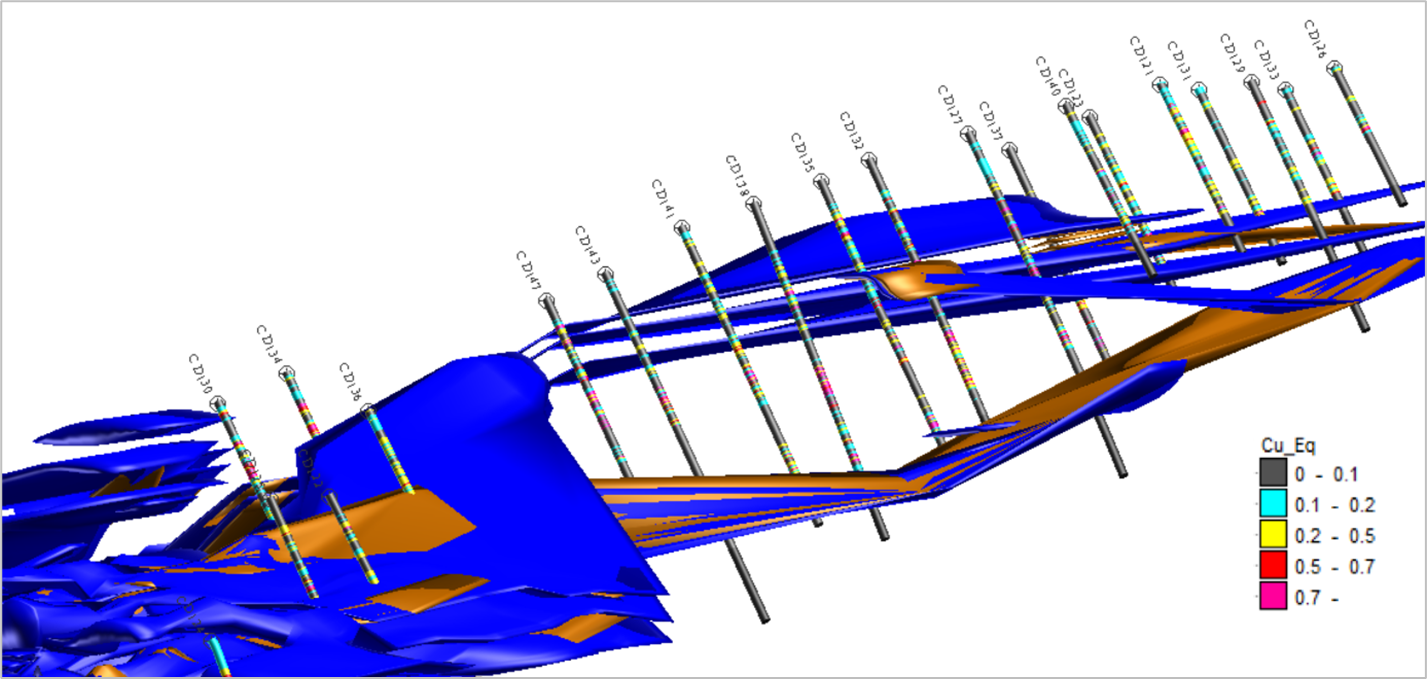

The broad intervals of Cu-Au mineralization encountered in the drilling is significantly in excess of the narrow mineral historical resource envelopes that were previously projected into these areas, or into areas where no historical resource envelopes where previously modelled, providing additional upside for Cabaçal's first resource definition program (Figure 2). Drilling is planned to continue and will necessarily need to include holes to close out the limit of mineralization to optimize the definition of resources accessible to potential open-pit development.

Within the immediate Cabaçal mine environment, CD-128 returned a strong interval of 41.4m @ 0.8% CuEq (0.3% Cu, 0.8g/t Au, 0.9g/t Ag) from 62.4m, including 6.6m @ 3.2% CuEq (0.6% Cu, 4.4g/t Au, 2.2g/t Ag) from 66.8m in the SCZ, from an area where historical records were incomplete. Final resource definition drilling in the Cabaçal area will include shallow drilling in unsampled areas. This drilling will continue past the planned September resource update and will be incorporated into a further update towards the end of Q1 in 2022.

Further Gold-Silver Mineralization Intersected at C4-A Discovery, Extended 5O to the Northwest

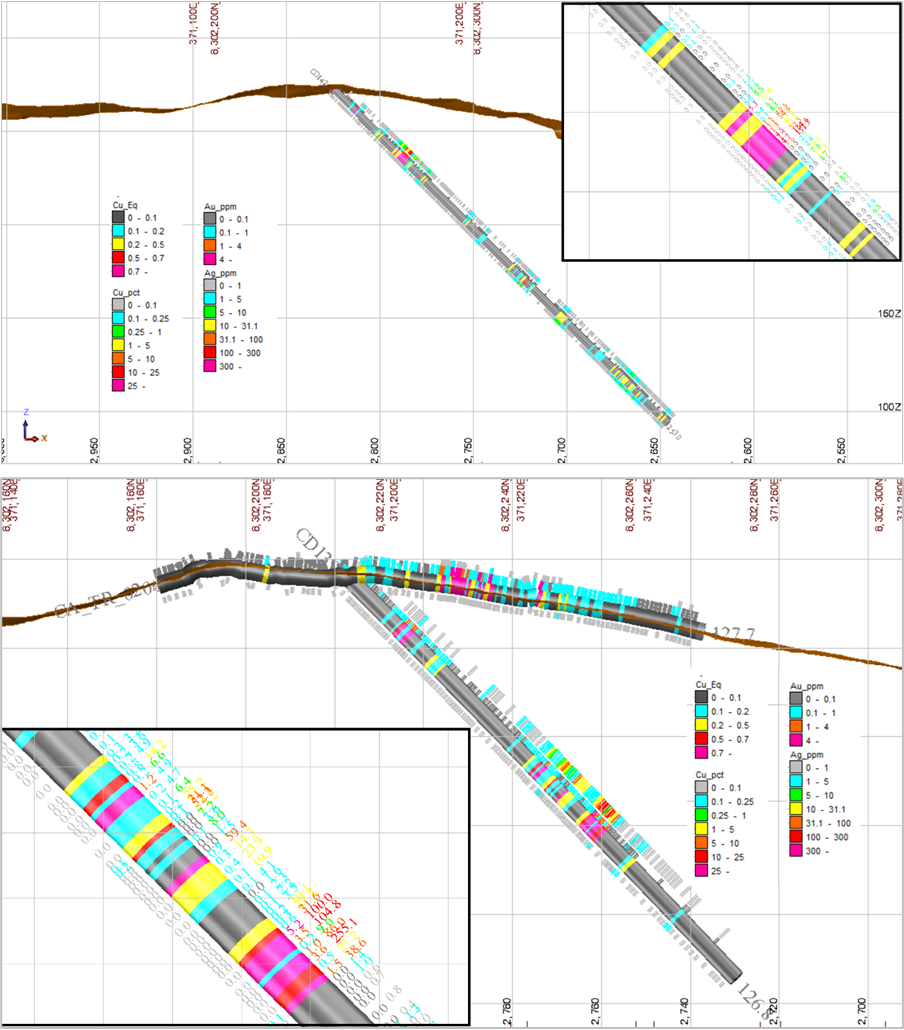

Diamond drill holes CD-139 and CD-142 were collared down dip and along strike from Trench 20's 44.0m @ 1.5g/t Au (Figure 1). CD-139 first confirmed a precious metal bedrock mineralization system, returning 26.4m @ 0.6g/t Au & 25.2g/t Ag from 56.2m. CD-142 was drilled as a 50m step-out hole to the northwest, with results now received confirming extensions to the precious metal discovery at shallow depths, returning 10.7m @ 1.8g/t Au, 33.7g/t Ag, 0.1% Zn from 45.7m. High silver assays coupled with the gold mineralization continued to characterize this new mineral system, with peak silver assays of 164.6 g/t Ag encountered[6]. CD-142 was extended to a depth of 253.0m, continuing to intersect strong alteration with periodic sulphide mineralization (Table 1; Figure 3). The results indicate a broad halo of base metal mineralization ("Halo"), which may point to the emergence of a new VMS centre requiring additional geological and geophysical follow-up. This gold-silver discovery is part of a larger 3.5km trend that hosts multiple soil geochemical and anomalies and coincident induced polarization geophysical anomalies[7]. This discovery, only 2km southeast of the Cabaçal Mine, reflecting the Project's upside and scalability and will be incorporated into Future resource development programs for the Cabaçal project, with mineralization open along strike and at depth. Additional geophysical surveys are being scheduled to extend coverage to the northwest of the CD-142 intersection.

About Cabaçal

In November 2020, Meridian signed a Purchase Agreement[8] to acquire 100% ownership certain tenements covering the historical Cabaçal and Santa Helena lines and the along strike tenements from two, private, Brazilian companies ("Vendors"). Subsequently, Meridian expanded its land tenure to today's 55km of strike length. Cabaçal had two historical, shallow, high-grade selectively mined underground mines that cumulatively produced ~34 million pounds of copper, ~170,108 ounces of gold, ~1,033,532 ounces of silver and ~103 million pounds of zinc via conventional flotation and gravity metallurgical processes.

Meridian has defined an open 2,000m trend of shallow copper-gold mineralization centred on the Cabaçal Mine. This mineralization trends northwest-southeast, sub-crops along its northeast limits and dips to the southwest at 26° and is up 90m thick; presenting excellent open-pit geometry and mineral endowment. Meridian is currently focused on infilling this 2,000m zone.

Cabaçal's base and precious metal-rich mineralization is hosted by volcanogenic type, massive, semi-massive, stringer, and disseminated sulphides within units of deformed metavolcanic-sedimentary rocks ("VMS"). A later stage sub-vertical gold overprint event has emplaced high-grade gold mineralization truncating the dipping VMS layers. It was explored and developed by BP Minerals/Rio-Tinto from 1983 to 1991 and then by the Vendors in the mid 2000's. This historical exploration database includes over 83,000 metres of drilling, extensive regional mapping, soil surveys, metallurgy from production reports and both surface and airborne geophysics. The majority of Cabaçal's prosects remain to be tested.

Cabaçal has excellent infrastructure with access by all-weather road, industrial electricity provided by the adjacent hydroelectric power station supplying this clean energy grid, and local communities provide a large population to draw employees from. Cabaçal consists of 1 mining license, 1 mining lease application and 4 exploration claims which total 28,324 hectares. A further three licences totalling 15,941 Ha are awaiting formal transfer from the ANM following the licence auction system.

About Meridian

Meridian Mining UK S is focused on the acquisition, exploration, and development activities in Brazil. The Company is currently focused on resource development of the Cabaçal VMS copper-gold project, exploration in the Jaurú & Araputanga Greenstone belts located in the state of Mato Grosso; exploring the Espigão polymetallic project and the Mirante da Serra manganese project in the State of Rondônia Brazil.

On behalf of the Board of Directors of Meridian Mining UK S

Dr. Adrian McArthur

CEO, President, and Director

Executive Chairman

Meridian Mining UK S

Email: info@meridianmining.net.br

Ph: +1 (778) 715-6410 (PST)

Qualified Person

Dr Adrian McArthur, B.Sc. Hons, PhD. FAusIMM., CEO and President of Meridian as well as a Qualified Person as defined by National Instrument 43-101, has supervised the preparation of the technical information in this news release.

Stay up to date by subscribing for news alerts here: https://meridianmining.co/subscribe/

Follow Meridian on Twitter: https://twitter.com/MeridianMining

Further information can be found at www.meridianmining.co

Figure 1: Location of drill holes reported in today

Figure 2: Perspective view filtered to show holes reported today from Cabaçal and the CNWE, in relation to mineralization envelopes of the historical resource.

Figure 3: Cross sections of CD-142 (top) and CD-139 / TR-020 (bottom). Traces are coloured by Cu-Eq (%), with Cu (%) grade plotted to the left and Au and Ag (ppm) grade plotted to the right

Table 1: Cabaçal Assays reported today.

Hole Id | Zone* | Intercept | Grade | From | |||||

CuEq | Cu | Au | Ag | Zn | Pb | ||||

| (m) | (%) | (%) | (g/t) | (g/t) | (%) | (%) | (m) | |

| CD-121 | CNWE | 58.7 | 0.3 | 0.2 | 0.1 | 0.6 | 0.0 | 0. 0 | 8.4 |

| |||||||||

| CD-122 | ECZ | 21.0 | 0.2 | 0.2 | 0.0 | 0.3 | 0.0 | 0.0 | 10.0 |

| 33.4 | 0.5 | 0.4 | 0.2 | 1.5 | 0.0 | 0.0 | 37.7 | |

| Including | 3.8 | 1.5 | 1.2 | 0.4 | 7.3 | 0.1 | 0.0 | 65.0 | |

| CD-123 | CNWE | 50.4 | 0.2 | 0.1 | 0.1 | 1.2 | 0.1 | 0.0 | 25.7 |

| CD-124 | ECZ | 34.0 | 0.4 | 0.3 | 0.2 | 1.4 | 0.0 | 0.0 | 14.0 |

Including | 1.3 | 1.7 | 0.3 | 2.3 | 3.5 | 0.0 | 0.0 | 18.2 | |

| 12.3 | 0.5 | 0.4 | 0.1 | 2.0 | 0.0 | 0.0 | 52.0 | |

| 8.1 | 0.7 | 0.5 | 0.2 | 2.8 | 0.2 | 0.0 | 70.1 | |

| CD-125 | ECZ | 70.3 | 0.3 | 0.3 | 0.1 | 0.8 | 0.0 | 0.0 | 13.5 |

Including | 3.1 | 1.5 | 1.1 | 0.5 | 6.0 | 0.0 | 0.0 | 58.0 | |

|

|

|

|

|

|

|

|

| |

| CD-126 | CNWE | 2.4 | 0.3 | 0.3 | 0.1 | 0.3 | 0.0 | 0.0 | 16.0 |

11.5 | 0.3 | 0.1 | 0.1 | 1.4 | 0.3 | 0.1 | 25.7 | ||

| CD-127 | CNWE | 54.4 | 0.4 | 0.1 | 0.4 | 0.3 | 0.0 | 0.0 | 26.9 |

Including | 9.5 | N/A | 0.2 | 1.3 | 0.3 | 0.0 | 0.0 | 63.2 | |

| 12.3 | 0.4 | 0.2 | 0.2 | 1.0 | 0.2 | 0.0 | 98.5 | |

| CD-128 | SCZ | 14.0 | 0.3 | 0.2 | 0.0 | 0.9 | 0.1 | 0.0 | 34.0 |

| 41.4 | 0.8 | 0.3 | 0.8 | 0.9 | 0.0 | 0.0 | 62.4 | |

Including | 13.2 | 1.9 | 0.5 | 2.3 | 1.5 | 0.0 | 0.0 | 66.8 | |

Including | 6.6 | 3.2 | 0.6 | 4.4 | 2.2 | 0.0 | 0.0 | 66.8 | |

| CD-129 | CNWE | 5.8 | 0.2 | 0.1 | 0.1 | 0.4 | 0.0 | 0.0 | 44.1 |

| 3.3 | 0.3 | 0.1 | 0.0 | 1.2 | 0.7 | 0.1 | 59.0 | |

| CD-130 | CNWE | 25.0 | 0.5 | 0.4 | 0.1 | 1.3 | 0.1 | 0.0 | 18.0 |

Including | 4.0 | 1.8 | 1.4 | 0.5 | 4.3 | 0.2 | 0.0 | 35.1 | |

| 18.0 | 0.3 | 0.3 | 0.1 | 1.3 | 0.0 | 0.0 | 54.0 | |

| CD-131 | CNWE | 5.5 | 0.2 | 0.1 | 0.1 | 0.1 | 0.0 | 0.0 | 36.8 |

| 11.2 | 0.2 | 0.1 | 0.0 | 1.2 | 0.5 | 0.1 | 55.0 | |

| CD-132 | CNWE | 11.1 | 0.2 | 0.2 | 0.0 | 0.2 | 0.0 | 0.0 | 16.4 |

| 39.9 | N/A | 0.0 | 0.5 | 0.1 | 0.0 | 0.0 | 30.1 | |

| 39.9 | 0.4 | 0.3 | 0.1 | 1.7 | 0.2 | 0.0 | 76.9 | |

Including | 5.7 | 1.2 | 1.1 | 0.2 | 2.8 | 0.0 | 0.0 | 87.0 | |

Hole Id | Zone* | Intercept | Grade | From | |||||

CuEq | Cu | Au | Ag | Zn | Pb | ||||

| (m) | (%) | (%) | (g/t) | (g/t) | (%) | (%) | (m) | |

|

|

|

|

|

|

|

|

| |

| CD-133 | CNWE | 15.4 | 0.2 | 0.1 | 0.1 | 0.5 | 0.2 | 0.0 | 24.5 |

| 7.7 | 0.3 | 0.1 | 0.0 | 3.7 | 0.6 | 0.1 | 46.8 | |

| CD-134 | CNWE | 25.0 | 0.4 | 0.3 | 0.0 | 1.3 | 0.0 | 0.0 | 10.0 |

Including | 1.6 | 1.5 | 1.4 | 0.1 | 4.7 | 0.0 | 0.0 | 16.4 | |

| 12.0 | 0.4 | 0.2 | 0.3 | 1.4 | 0.0 | 0.0 | 51.7 | |

| CD-135 | CNWE | 29.4 | 0.2 | 0.2 | 0.0 | 0.3 | 0.0 | 0.0 | 16.0 |

| 10.5 | 0.3 | 0.2 | 0.1 | 1.2 | 0.0 | 0.0 | 55.0 | |

| 21.7 | 0.2 | 0.1 | 0.2 | 0.7 | 0.0 | 0.0 | 72.0 | |

| 13.6 | 0.5 | 0.3 | 0.1 | 1.5 | 0.2 | 0.0 | 119.7 | |

| CD-136 | CNWE | 40.4 | 0.3 | 0.2 | 0.1 | 0.5 | 0.0 | 0.0 | 14.5 |

| 7.6 | 0.1 | 0.0 | 0.0 | 0.5 | 0.2 | 0.1 | 54.9 | |

| CD-137 | CNWE | 5.2 | 0.3 | 0.1 | 0.3 | 0.2 | 0.0 | 0.0 | 53.5 |

| 20.7 | 0.2 | 0.1 | 0.1 | 0.2 | 0.0 | 0.0 | 69.6 | |

| 4.7 | 0.6 | 0.4 | 0.1 | 3.9 | 0.1 | 0.0 | 95.6 | |

| CD-138 | CNWE | 20.0 | 0.5 | 0.5 | 0.1 | 0.5 | 0.0 | 0.0 | 31.0 |

| 19.6 | 1.1 | 0.8 | 0.4 | 4.8 | 0.0 | 0.0 | 78.4 | |

| 34.7 | 0.2 | 0.2 | 0.1 | 1.1 | 0.1 | 0.0 | 105.6 | |

| CD-140 | CNWE | 3.4 | 0.4 | 0.3 | 0.2 | 0.6 | 0.0 | 0.0 | 34.2 |

| 20.9 | 0.2 | 0.1 | 0.2 | 0.5 | 0.0 | 0.0 | 43.0 | |

| CD-141 | CNWE | 28.2 | 0.2 | 0.1 | 0.0 | 0.2 | 0.0 | 0.0 | 18.8 |

| 31.3 | 0.3 | 0.2 | 0.1 | 1.0 | 0.0 | 0.0 | 55.0 | |

| 23.2 | 0.5 | 0.3 | 0.2 | 1.4 | 0.1 | 0.0 | 113.8 | |

| CD-142 | C4-A | 6.6 | N/A | 0.0 | 0.5 | 0.3 | 0.0 | 0.0 | 12.4 |

| 4.0 | N/A | 0.0 | 0.3 | 0.7 | 0.0 | 0.0 | 32.0 | |

| 10.7 | N/A | 0.0 | 1.8 | 33.7 | 0.1 | 0.0 | 45.7 | |

Halo | 7.5 | N/A | 0.0 | 0.0 | 1.8 | 0.0 | 0.0 | 62.0 | |

Halo | 2.6 | N/A | 0.0 | 0.2 | 1.3 | 0.0 | 0.0 | 99.0 | |

Halo | 10.4 | N/A | 0.2 | 0.0 | 0.9 | 0.0 | 0.0 | 140.2 | |

Halo | 8.0 | N/A | 0.2 | 0.0 | 1.4 | 0.0 | 0.0 | 170.0 | |

Halo | 7.0 | N/A | 0.0 | 0.0 | 0.5 | 0.3 | 0.0 | 197.0 | |

Halo | 19.4 | N/A | 0.2 | 0.0 | 2.1 | 0.0 | 0.0 | 214.0 | |

Halo | 14.8 | N/A | 0.0 | 0.0 | 0.6 | 0.3 | 0.0 | 237.5 | |

Hole Id | Zone* | Intercept | Grade | From | |||||

CuEq | Cu | Au | Ag | Zn | Pb | ||||

| (m) | (%) | (%) | (g/t) | (g/t) | (%) | (%) | (m) | |

| CD-143 | CNWE | 19.2 | 0.6 | 0.3 | 0.4 | 2.0 | 0.1 | 0.0 | 58.3 |

Including | 7.8 | 1.1 | 0.6 | 0.8 | 3.5 | 0.0 | 0.0 | 58.3 | |

| CD-144 | Pending |

|

|

|

|

|

|

|

|

| CD-145 | Pending |

|

|

|

|

|

|

|

|

| CD-146 | Pending |

|

|

|

|

|

|

|

|

| CD-147 |

| 54.2 | 0.9 | 0.4 | 0.9 | 1.6 | 0.0 | 0.0 | 11.0 |

Including | 2.3 | 12.3 | 2.2 | 16.7 | 3.6 | 0.0 | 0.0 | 21.0 | |

Including | 7.0 | 1.1 | 0.9 | 0.3 | 5.9 | 0.0 | 0.0 | 50.0 | |

| 7.8 | 0.2 | 0.1 | 0.0 | 0.7 | 0.3 | 0.0 | 74.9 | |

NA: Not applicable

Drill Details |

| |||||||||

| Hole Id | Dip | Azimuth | EOH |

|

|

|

|

|

| |

| CD121 | -48.6 | 59.2 | 87.0 |

|

|

|

|

|

| |

| CD122 | -55.0 | 46.3 | 100.1 |

|

|

|

|

|

| |

| CD123 | -49.2 | 58.9 | 90.4 |

|

|

|

|

|

| |

| CD124 | -59.5 | 55.3 | 94.5 |

|

|

|

|

|

| |

| CD125 | -59.7 | 44.5 | 100.7 |

|

|

|

|

|

| |

| CD126 | -47.8 | 59.6 | 71.5 |

|

|

|

|

|

| |

| CD127 | -49.0 | 60.5 | 175.1 |

|

|

|

|

|

| |

| CD128 | -90.0 | 0.0 | 125.2 |

|

|

|

|

|

| |

| CD129 | -45.0 | 60.0 | 88.3 |

|

|

|

|

|

| |

| CD130 | -48.3 | 61.2 | 106.6 |

|

|

|

|

|

| |

| CD131 | -49.4 | 59.4 | 88.8 |

|

|

|

|

|

| |

| CD132 | -50.0 | 60.0 | 148.4 |

|

|

|

|

|

| |

| CD133 | -50.0 | 60.0 | 90.9 |

|

|

|

|

|

| |

| CD134 | -50.0 | 60.0 | 102.3 |

|

|

|

|

|

| |

| CD135 | -50.0 | 60.0 | 151.4 |

|

|

|

|

|

| |

| CD136 | -52.0 | 60.0 | 93.5 |

|

|

|

|

|

| |

| CD137 | -50.0 | 60.0 | 121.3 |

|

|

|

|

|

| |

| CD138 | -55.0 | 60.0 | 160.8 |

|

|

|

|

|

| |

| CD140 | -51.0 | 60.0 | 88.3 |

|

|

|

|

|

| |

| CD141 | -50.0 | 60.0 | 172.4 |

|

|

|

|

|

| |

| CD142 | -45.0 | 45.0 | 253.0 |

|

|

|

|

|

| |

| CD143 | -50.0 | 60.0 | 138.4 |

|

|

|

|

|

| |

Drill Details |

| |||||||||

| CD144 | -48.0 | 60.0 | 97.7 |

|

|

|

|

|

| |

| CD145 | -50.0 | 60.0 | 113.2 |

|

|

|

|

|

| |

| CD146 | -51.0 | 60.0 | 109.3 |

|

|

|

|

|

| |

| CD147 | -50.0 | 60.0 | 120.0 |

|

|

|

|

|

| |

Technical Notes

True widths are approximately 80-90% of downhole lengths and assay figures and intervals rounded to 1 decimal place. Holes have been drilled HQ through the saprolite and upper bedrock and then reduced to NQ. Mineralized intervals represent half HQ or NQ drill core. Samples have been analysed variably at the accredited ALS laboratory in Lima and SGS laboratory in Belo Horizonte. Gold analyses at ALS have been conducted by Au-AA23 (fire assay of a 30g charge with AAS finish). High-grade samples are repeated with a gravimetric finish (Au-GRA21). Base metal analysis is by methods four-acid digestion and ICP-AES finish (ME-ICP61a; Cu-OG62 for over-range samples). Gold analyses at SGS have been conducted by FAA505 (fire assay of a 50g charge), and base metal analysis by methods ICP40B and ICP40B_S (four acid digest with ICP-OES finish). Visible gold intervals are sampled by metallic screen fire assay method MET150-FAASCR.Samples are held in the Company's secure facilities until dispatched and delivered by staff and commercial couriers to the laboratory. The Company submits a range of quality control samples, including blanks and gold and polymetallic standards supplied by ITAK and OREAS, supplementing laboratory quality control procedures.

*Copper Equivalents ("CuEq") have been calculated using the formula CuEq = ((Cu%*Cu price 1% per tonne) + (Au ppm*Au price per g/t) + (Ag ppm*Ag price per g/t) + (Zn%*Zn price 1% per tonne)) / (Cu price 1 % per tonne). Commodity Prices: Copper and Zinc ("Zn") prices from LME Official Settlement Price dated April 23, 2021 USD per Tonne: Cu = USD 9,545.50 and Zn = USD 2,802.50. Gold & Silver prices from LBMA Precious Metal Prices USD per Troy ounce: Au = USD 1781.80 (PM) and Ag = USD 26.125 (Daily). The CuEq values are for exploration purposes only and include no assumptions for metallurgical recovery

FORWARD-LOOKING STATEMENTS

Some statements in this news release contain forward-looking information or forward-looking statements for the purposes of applicable securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed under the heading "Risk Factors" in under the heading "Risk Factors" in Meridian's most recent Annual Information Form filed on www.sedar.com. While these factors and assumptions are considered reasonable by Meridian, in light of management's experience and perception of current conditions and expected developments, Meridian can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Meridian disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events, or results or otherwise.

--

[1] Meridian news release April 5, 2022

[2] Meridian news release June 21, 2022

[3] ECZ: Eastern Copper Zone, CCZ: Central Copper Zone, and SCZ: Southern Copper Zone.

[4] Meridian news release August 26, 2020

[5] Meridian news releases March 22, 2022, April 26, 2022, 11 May 2022,

[6] Sample CBDS19295 (164.6 g/t Ag, 4.7 g/t Au, 0.0% Cu, 0.2% Zn over 0.5m from 53.0m)

[7] Meridian news release June 28, 2022

[8] Meridian news release November 9, 2020

SOURCE: Meridian Mining UK S

View source version on accesswire.com:

https://www.accesswire.com/708227/Meridian-Reports-Further-Significant-Copper-Gold-Silver-Results-From-Cabaal