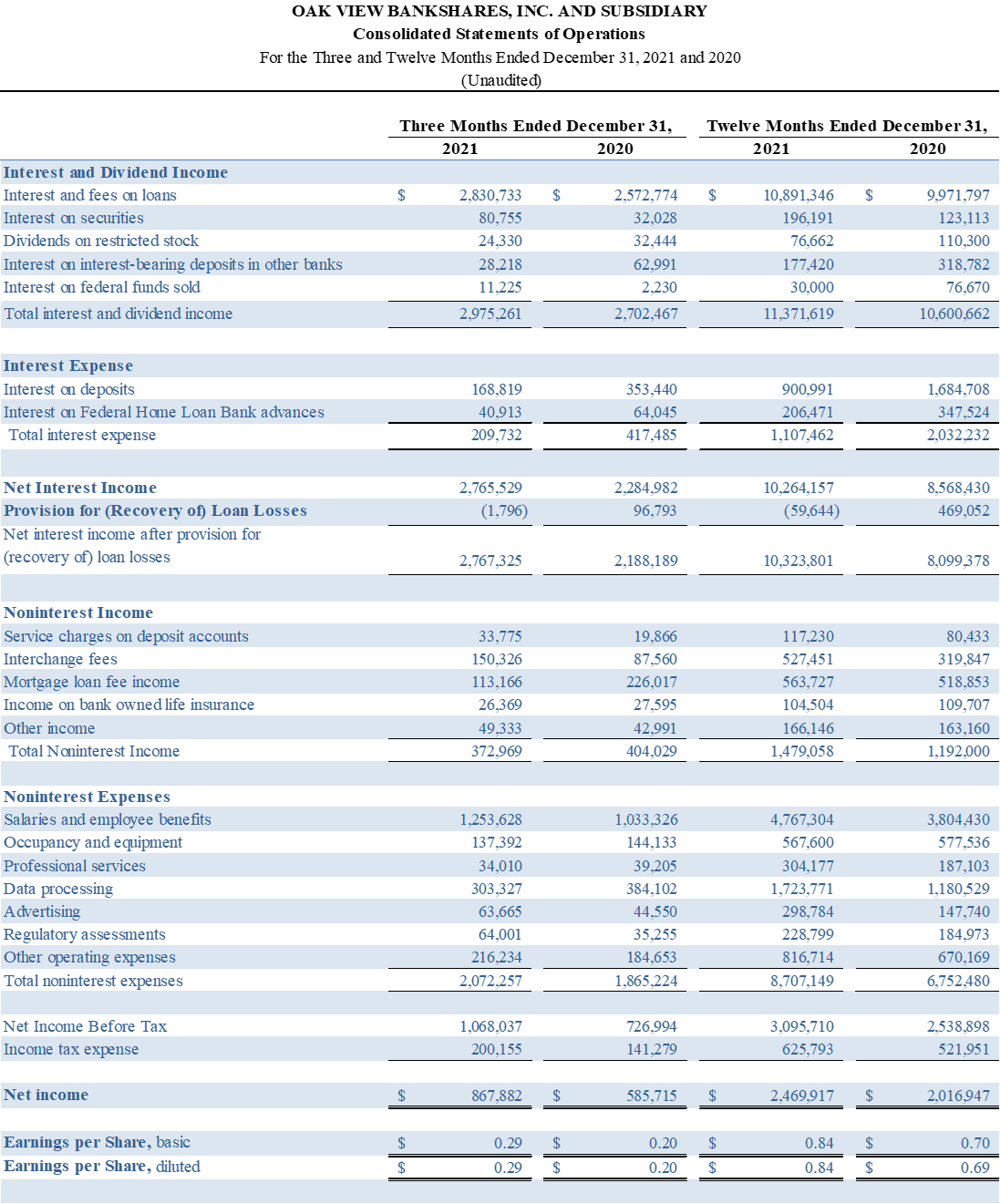

WARRENTON, VA / ACCESSWIRE / January 28, 2022 / Oak View Bankshares, Inc. (the "Company") (OTC Pink:OAKV), parent company of Oak View National Bank (the "Bank"), reported net income of $867,882 for the quarter ended December 31, 2021, compared to net income of $585,715 for the quarter ended December 31, 2020, an increase of 48.17%. Basic and diluted earnings per share for the fourth quarter were $0.29 compared to $0.20 per share for the fourth quarter of 2020.

Net income for the twelve months ended December 31, 2021, was $2.47 million, compared to $2.02 million for the twelve months ended December 31, 2020, an increase of 22.46%. Basic and diluted earnings per share for the twelve months ended December 31, 2021, were $0.84 compared to $0.70 per basic share and $0.69 per diluted share for the twelve months ended December 31, 2020.

On January 20, 2022, the Board of Directors of the Company declared an annual dividend of $0.05 per share to shareholders of record as of the close of business on January 31, 2022, payable on February 7, 2022.

Selected Highlights:

- The net interest margin was 3.35% for the quarter, compared to 3.28% and 3.32% for the prior quarter and the fourth quarter of 2020, respectively. Year to date net interest margin was 3.37%, compared to 3.16% for the twelve months ended December 31, 2020.

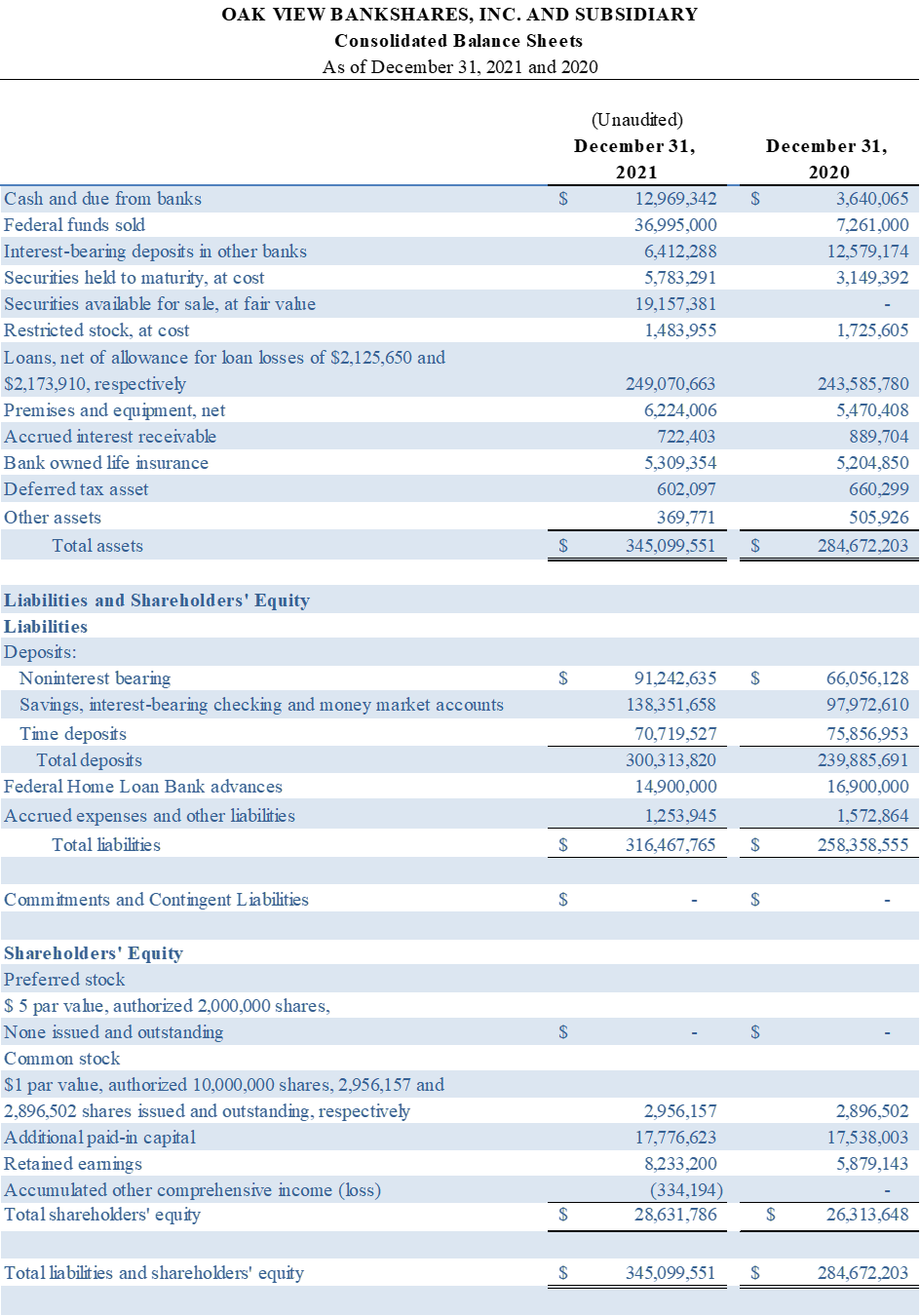

- Total assets were $345.10 million on December 31, 2021, an increase of $17.38 million and $60.43 million compared to September 30, 2021, and December 31, 2020, respectively.

- Total loans increased to $251.20 million on December 31, 2021, compared to $246.50 million on September 30, 2021, and $245.76 million on December 31, 2020. Excluding Paycheck Protection Program loans (PPP) which declined due to anticipated forgiveness by the SBA, loan growth was 4.77% and 13.13% compared to September 30, 2021, and December 31, 2020, respectively.

- Credit quality continues to be outstanding as the Bank had just one non-performing loan, totaling $2,385 and one loan totaling $9,148 that was thirty-four days past due on December 31, 2021.

- The Bank recorded a recovery in the provision for loan losses of $1,796 for the quarter, compared to a provision for loan losses of $9,695 for the prior quarter and $96,793 for the fourth quarter of 2020. Year to date recovery of provision for loan losses was $59,644, compared to a provision for loan losses of $469,052 for the twelve months ended December 31, 2020. While the Bank provided additional reserves for loan growth, these additional reserves were partially offset by reserve releases as previously anticipated credit deterioration at the onset of the pandemic has not been experienced.

- Total deposits increased to $300.31 million on December 31, 2021, compared to $283.73 million on September 30, 2021, and $239.89 million on December 31, 2020. This represents an increase of $16.59 million and $60.43 million compared to September 30, 2021, and December 31, 2020, respectively.

- Regulatory capital remains strong with ratios exceeding the well capitalized thresholds in all categories.

Michael Ewing, CEO and Chairman of the Board said, "We are thrilled to report another year of record earnings for the Company. Our Company had an exceptional year that was full of change and opportunity. We began the year preparing for and converting our core data processing system to a new, more scalable platform which will offer efficiencies in operations and added value and flexibility for our customers. Mid-year, we began our reorganization into a bank holding company and completed that transaction during the fourth quarter. While these two initiatives added approximately $677,000 in one-time expenses during 2021, we believe that both will enable our Company to better serve the needs of our customers and communities going forward." Mr. Ewing continued by stating, "We are extremely excited for the future. We have taken advantage of adding key employees to our team, we opened over 1,000 new deposit accounts with new and existing customers, our loan pipeline remains strong, and our new technology and holding company are in place, all of which will position us well for the future."

Earnings

Return on average assets was 1.01% and return on average equity was 12.19% for the quarter, compared to 0.76% and 8.87%, respectively, for the prior quarter and 0.81% and 8.92%, respectively, for the fourth quarter of 2020. Year to date return on average assets was 0.78% and return on average equity was 8.98%, compared to 0.71% and 8.00%, respectively, for the twelve months ended December 31, 2020.

Paycheck Protection Program Lending Update

The Bank originated a total of $38.10 million in PPP loans during 2020 and 2021. Of this amount, $2.89 million remain outstanding as of December 31, 2021. Total interest and fees, net of costs, recognized on these loans for the quarter totaled $301,388 and $1.11 million for the twelve months ended December 31, 2021.

Net Interest Margin

Increases in the net interest margin were impacted by changes in the yield on average earning assets, primarily higher yield on loans resulting from the acceleration of net deferred loan fees from the forgiveness of PPP loans. The yield on loans was 4.55% for the quarter, compared to 4.34% for the prior quarter and 4.20% for the fourth quarter of 2020. In addition, given the low interest rate environment and the maturity of higher yielding time deposits, cost of funds were 0.38%, a decline of nine basis points compared to the prior quarter of 0.47% and a decline of fifty basis points compared to 0.88% for the fourth quarter of 2020.

Year to date yield on loans was 4.45% compared to 4.39% for the twelve months ended December 31, 2020. Year to date cost of funds were 0.54% compared to 1.09% for the twelve months ended December 31, 2020.

Noninterest Income

Noninterest income was $372,969 for the quarter, compared to $466,459 for the prior quarter, and $404,029 for the fourth quarter of 2020. Debit card interchange fee income and mortgage loan fee income are the largest contributors of noninterest income. Debit card interchange fee income was $150,326 for the quarter, an increase of $7,201 and $62,766 when compared to the prior quarter and fourth quarter 2020, respectively. Mortgage loan fee income was $113,166 for the quarter, a decrease of $82,857 and $112,851compared to the prior quarter and fourth quarter of 2020, respectively.

Year to date noninterest income increased $287,058 to $1.48 million, compared to the twelve months ended December 31, 2020. Debit card interchange fee income was $527,451 and $319,847 for the twelve months ended December 31, 2021, and 2020, respectively. Mortgage loan fee income was $563,727 and $518,853 for the twelve months ended December 31, 2021, and 2020, respectively.

Noninterest Expense

Noninterest expense was $2.07 million for the quarter, compared to $2.20 million for the prior quarter and $1.87 million for the fourth quarter of 2020. Year to date noninterest expense was $8.71 million, compared to $6.75 million for the twelve months ended December 31, 2020.

Salaries and employee benefits represents the largest category of noninterest expense. Expenses related to salaries and benefits were $1.25 million for the quarter, compared to $1.38 million for the prior quarter and $1.03 million for the fourth quarter of 2020. Year to date salary and employee benefit expenses were $4.77 million compared to $3.80 million for the twelve months ended December 31, 2020. Increases to salaries and employee benefits are primarily related to newly added positions, taking advantage of growth opportunities in our markets.

Data processing expenses also contributed to the increase in noninterest expense. Data processing expenses were $303,327 for the quarter, compared to $262,872 for the prior quarter and $384,102 for the fourth quarter of 2020. Year to date data processing expenses were $1.72 million compared to $1.18 million for the twelve months ended December 31, 2020. During the second quarter of 2021, the Bank converted its core data processing platform, which added one-time additional expenses of $511,543.

The Bank reorganized into a bank holding company effective December 15, 2021. During the year, this reorganization added an additional $165,221 in one-time professional and shareholder related expenses. Professional and shareholder expenses were $35,640 for the quarter, compared to $101,813 for the prior quarter and $40,860 for the fourth quarter of 2020. Year to date professional and shareholder expenses were $359,114 compared to $196,774 for the twelve months ended December 31, 2020.

About Oak View Bankshares, Inc. and Oak View National Bank

Oak View Bankshares, Inc. is the parent bank holding company for Oak View National Bank, a locally owned and managed community bank serving Fauquier, Culpeper, Rappahannock, and surrounding Counties. For more information about Oak View Bankshares, Inc. and Oak View National Bank, please visit our website at www.oakviewbank.com. Member FDIC.

For additional information, contact Tammy Frazier, Executive Vice President & Chief Financial Officer, Oak View Bankshares, Inc., at 540-359-7155.

SOURCE: Oak View Bankshares, Inc.

View source version on accesswire.com:

https://www.accesswire.com/686105/Oak-View-Bankshares-Inc-Announces-Financial-Results-for-2021-and-the-Declaration-of-an-Annual-Dividend