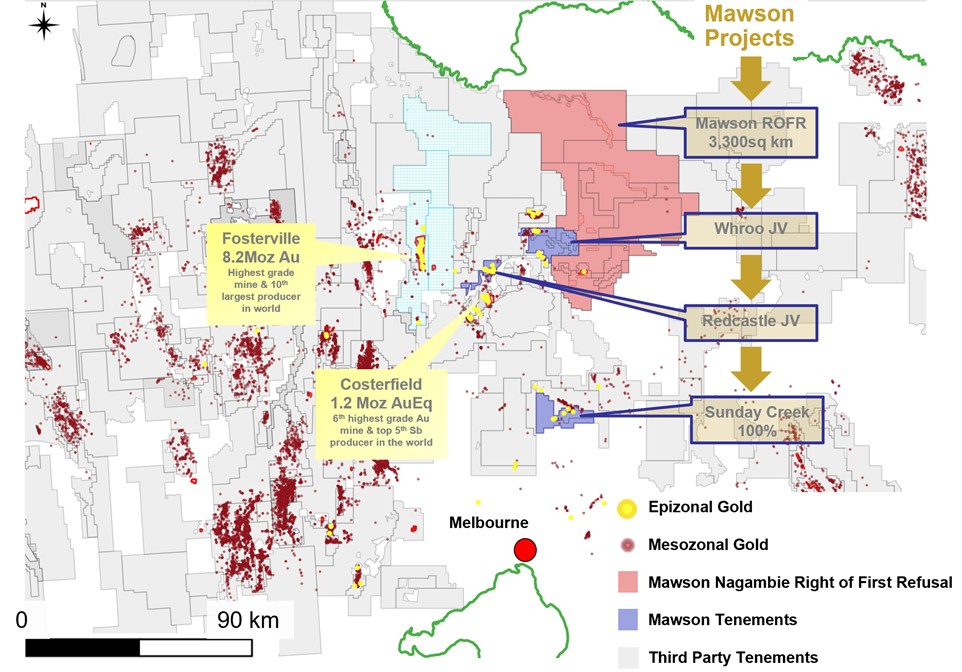

VANCOUVER, BC / ACCESSWIRE / November 15, 2021 / Mawson Gold Limited ("Mawson") or (the "Company") (TSX:MAW)(Frankfurt:MXR)(OTC PINK:MWSNF) is pleased to announce commencement of drilling at the Whroo Joint Venture project located 130 kilometres north of Melbourne within 199 square kilometres of exploration tenure in the Victorian Goldfields of Australia (Figure 1).

Key points:

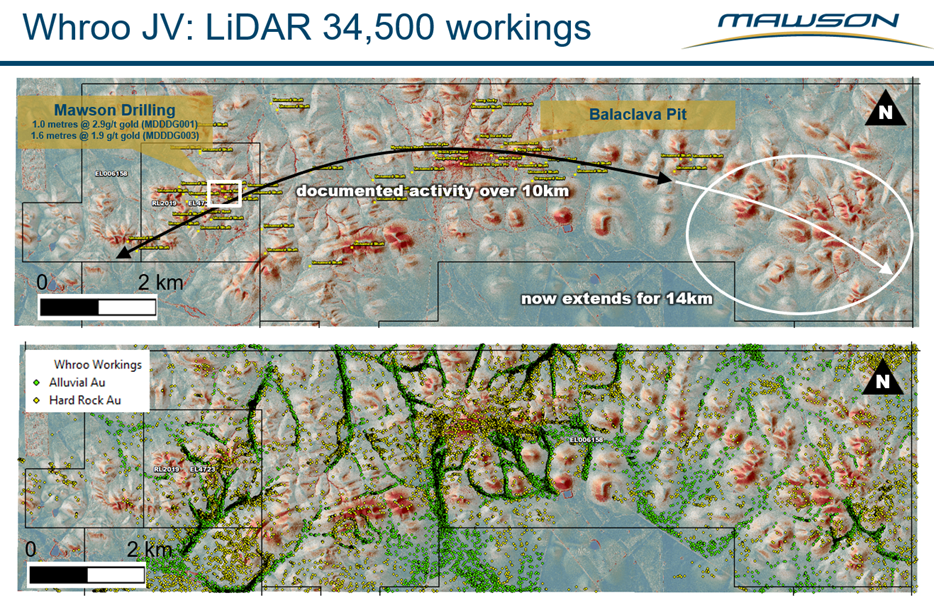

- The 14-kilometre long Whroo goldfield is one of the largest historic epizonal goldfields in Victoria, Australia and remains untested to depth (Figure 3);

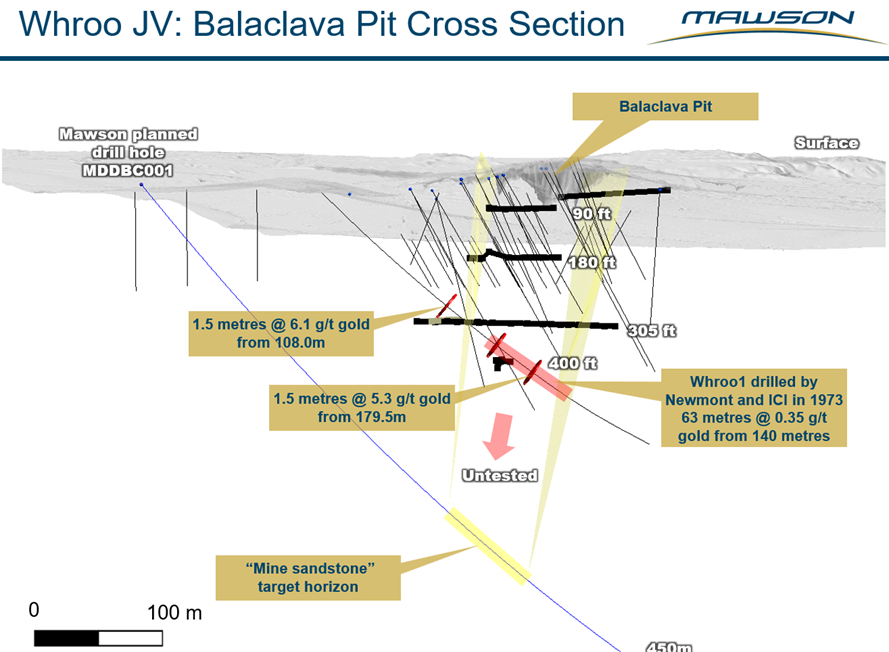

- Mawson plans to drill two deep diamond holes under the Balaclava open pit , which extracted 23,600 oz gold during the 1800s.

- In the only test of gold mineralization to moderate depth (110 metres vertically) along the entire Whroo goldfield, historic drilling by Newmont intersected 63 metres @ 0.35 g/t gold including 1.5 metre @ 6.1 g/t gold and 1.5 metres @ 5.3 g/t gold (Whroo1);

- The first drill hole, MDDBC001, is planned to intersect structurally-hosted gold within the pyritic "mine sandstone" 250 metres and 120 metres respectively vertically below the Balaclava pit and Whroo1 (Figure 2);

- The drill rig has been moved from Mawson's 100% owned Sunday Creek project to complete drilling at the Whroo JV for the next month. The rig will return to Sunday Creek after drilling has been completed;

- Mawson could earn up to 70% joint venture interest in the Whroo JV by incurring exploration expenditures of A$4.0 M over 6 years and making combined cash payments of A$250,000 over 4 years;

Michael Hudson, Executive Chairman states: " There remains a lot of gold to be found in Victoria. Mawson controls 3 of the 9 historic epizonal gold fields in Victoria. Two of these historic fields also form Fosterville and Costerfield, currently the highest and sixth highest grade gold mines globally. We have extended the Whroo goldfield to 14 kilometres length with LiDAR surveying and defined 34,500 surface workings within Mawson's tenure. Yet the deepest drillhole across the field was only 110 metres vertically deep. And despite intersecting significant mineralization in 1973, Whroo1 has never been followed up. We look forward to drilling below one of the largest historic epizonal mines in Victoria, while we take a short break from our successful drill program at Sunday Creek."

Mawson plans to drill two deep holes under the Balaclava open pit. The first planned drill hole, MDDBC001, will intersect structurally-hosted gold within the pyritic "mine sandstone" 250 metres vertically below the Balaclava pit and 120 metres vertically below the only drill hole previously drilled to test mineralization at depth (Whroo 1, by Newmont in 1973). The second drill hole will test the same depth as the first drill hole, approximately 100 metres along strike to the west or east (dependent on initial results) to target the intersection of the mine sandstone trend at depth. It will also provide another test of the main reef structure.

Over the last 10 months at Whroo, Mawson has completed a detailed LiDAR survey which extended the previously mapped Whroo historic mining field from 10 kilometres strike to 14 kilometres. GIS-based data analytics also identified 34,500 individual workings over 63 km 2 (~550 per km 2) and classified the data as alluvial vs hard rock in character (Figure 2). A gradient array IP geophysical survey was conducted 8.5 kilometres west of the Balaclava open pit at Doctors Gully over a 4 square kilometre area. Mawson also completed three reconnaissance diamond drill holes for 330.5 metres at Doctors Gully at the start of 2021, with better results including 1.0 metres @ 2.9 g/t gold from 45.3 metres in MDDDG001, 3.8 metres @ 0.7 g/t gold from 71.7 metres in MDDDG001 and 1.6 metres @ 1.9 g/t gold from 24.7 metres in MDDDG003 (Figure 2). Gold distribution suggests a high degree of mobility and re-concentration in the weathered zone.

The diamond drill rig has been moved from Mawson's 100% owned Sunday Creek project to complete drilling at the Whroo JV for the next month. Plans are for the rig to return to Sunday Creek after drilling has been completed at Whroo.

Whroo History

Alluvial gold mining commenced in Whroo during the initial gold boom of the 1850s and a settlement was quickly established. Significant alluvial workings are present throughout the field. Hard rock mining commenced in 1855. Whroo consists of the Balaclava Hill area which contains thirteen named reefs, while shallow workings extend the trend over 9 kilometres to the White Hills mining area. Total production from Balaclava was estimated at 40,000 oz gold, at grades varying from 5 g/t gold to >700 g/t gold from reefs and spurs within an E-W-striking pyritic sandstone.

The largest producers at Whroo were the Balaclava Open Pit (23,600 oz gold), Albert Reef (1,170 oz gold) and Carrs Reef (913 oz gold). Balaclava Hill, Albert Reef and Stockyard Reef are associated with stibnite veins. At Balaclava Hill, a 137 metre deep shaft and an open pit (80 x 40 metres across and 30 metres deep) were developed in 1855 and although the main stratigraphic and structural orientation was east-west, mineralization was observed in both E-W, NNE and flat veins with average widths of 3.5 metres. Outside of Balaclava, veins averaged 0.5 metres width and ran multiple ounces. The Mary Reef was 2.1 metres wide on average. The Peep-o'-Day Mine, a small antimony/gold mine had workings to 61 metres depth. The Happy-go-Lucky Mine averaged 128 g/t gold. The vertical Albert Reef ranged from 0.03-3.7 metres thickness and averaged over 94 g/t gold.

Since historic mining took place, modern exploration at Whroo has been relatively limited with few drill holes testing to below the level of oxidation, and a paucity of geophysical exploration. In the early 1970s ICI Australia and Newmont diamond drilled the only hole ever drilled (Whroo 1) at depth in the field and intersected 63 metres @ 0.35 g/t gold from 140 metres beneath the Balaclava open pit including 1.5 metre @ 6.1 g/t gold from 108.0 metres , 1.5 metres @ 1.8 g/t gold from 149.5 metres and 1.5 metres @ 5.3 g/t gold from 179.5 m. Visible stibnite was recorded but antimony and arsenic were not assayed (Figure 1). MDDBC001 will be drilled 120 metres vertically below Whroo 1.

Summary of the Whroo Joint Venture Agreement

The Amended and Restated Agreement, with an effective date of 2 December 2020, amends and restates the option agreement dated March 24, 2020, between Mawson and Nagambie Resources Limited ("Nagambie") relating to the Doctors Gully retention licence (the " Original Agreement "). The Whroo JV substantially expands the area under option from that contained in the Original Agreement from 4 square kilometres to 199 square kilometres of mineral tenure and includes the 9 kilometre long Whroo gold mineralized trend. The Whroo JV consists of four granted exploration licences - EL6158 (Rushworth, 46 sq km), EL6212 (Reedy Lake, 17 sq km), EL7205 (Angustown, 69 sq km) and EL7209 (Goulburn West, 34 sq km), two exploration licence applications ELA7237 (Kirwans North 1, 20 sq km) and ELA7238 (Kirwans North 2, 9 sq km), and one granted retention licence RL2019 (Doctors Gully, 4 sq km) (collectively, the " Optioned Property ").

Under the Amended and Restated Agreement, Mawson has the option to earn an up to 70% joint venture interest in the Optioned Property by:

1. incurring exploration expenditures of A$400,000 in year 1 and an additional A$500,000 in year 2, and making cash payments equal to A$150,000, to earn an initial 25% interest;

2. incurring additional exploration expenditures of A$1,600,000 on or before the end of year 4 (cumulative A$2.5M over 4 years) and making cash payments of A$50,000 in each of year 3 and 4, to earn a 60% interest.

Upon Mawson earning a 60% interest, either party may elect by notice to the other to form a joint venture (" JV ") under which the percentage ownership of each of Nagambie and Mawson will be 40% and 60%, respectively. Should the parties not elect to form a 40/60% JV, Mawson will then have the option to earn an additional 10% interest in the Optioned Property (for an aggregate 70% interest) by incurring an additional A$1.5M of exploration expenditures on or before the end of year 6 (cumulative A$4.0M in years 1 to 6). Once Mawson earns a 70% interest, a JV between the parties will be automatically formed. Nagambie may then contribute its 30% ownership with further exploration expenditures or, if it chooses to not contribute, dilute its interest. Should Nagambie's interest be reduced to less than 5.0%, it will be deemed to have forfeited its interest in the JV to Mawson in exchange for a 1.5% net smelter return royalty (" NSR ") on gold revenue. Should Nagambie be granted the NSR, Mawson will have the right to acquire the NSR for A$4,000,000.

Mawson will have the option to accelerate its spending to achieve its various percentage ownership interests in the Optioned Property. Mawson retains its right of first refusal to take up or match proposals being considered over the remainder of Nagambie's 3,300 square kilometre tenement package in Victoria.

ESG Background

Mawson has conducted all appropriate consultation and permitting with Parks Victoria, the Taungurung Land and Waters Council (TLaWC) and Heritage Victoria, and field visits were undertaken prior to drilling, to ensure that the proposed drill site were placed to minimise any environmental, cultural, or social impact. The proposed program will be carried out as Low Impact Exploration, as defined by Earth Resources Exploration Code of Conduct. All drilling will conform to the requirements and consents of all the relevant statutory bodies, including but not limited to, the Earth Resources Regulator (ERR), Parks Victoria, the Department of Environment, Land, Water and Planning (DELWP), the Taungurung Land and Waters Council (TLaWC), Victorian Heritage and the key stakeholders such as the Whroo Conservation Management Network (WCMN).

Technical Background

Tables 1 and 2 provide collar and assay data. The true thickness of the mineralized interval is interpreted to be approximately 70% of the sampled thickness. All drill results quoted have a lower cut of 0.5 g/t Au cut over a 1.0 metre width

A diamond drill rig from contractor Starwest Pty Ltd was used in the Doctors Gully program. Core diameter was HQ (63.5 mm) and oriented with excellent core recoveries averaging close to 100% in both oxidized and fresh rock. After photographing and logging in Mawson's core logging facilities in Nagambie, intervals were diamond sawn in half by Mawson personnel. Half core is retained for verification and reference purposes. Analytical samples are transported to On Site Laboratory Services' Bendigo facility which operates under both an ISO 9001 and NATA quality systems. Samples were prepared and analyzed for gold using the fire assay technique (PE01S method; 25 gram charge), followed by measuring the gold in solution with flame AAS equipment. Samples for multi-element analysis (BM011 and over-range methods as required) use aqua regia digestion and ICP-MS analysis. The QA/QC program of Mawson consists of the systematic insertion of certified standards of known gold content, blanks within interpreted mineralized rock and quarter core duplicates. In addition, On Site inserts blanks and standards into the analytical process.

Qualified Person

Mr. Michael Hudson (FAusIMM), Executive Chairman for the Company, is a qualified person as defined by National Instrument 43-101 - Standards of Disclosure or Mineral Projects and has prepared or reviewed the preparation of the scientific and technical information in this press release. None of the historic drill and mine data have been independently verified by Mawson at this time. The historical data pre-dates the implementation of NI 43-101 and are quoted for information purposes only.

About Mawson Gold Limited (TSX:MAW, FRANKFURT:MXR, OTCPINK:MWSNF)

Mawson Gold Limited is an exploration and development company. Mawson has distinguished itself as a leading Nordic Arctic exploration company with a focus on the flagship Rajapalot gold-cobalt project in Finland. Mawson also owns or is joint venturing into three high-grade, historic epizonal goldfields covering 470 square kilometres in Victoria, Australia and is well placed to add to its already significant gold-cobalt resource in Finland.

On behalf of the Board, | Further Information www.mawsongold.com Mariana Bermudez (Canada), Corporate Secretary, |

Forward-Looking Statement

This news release contains forward-looking statements or forward-looking information within the meaning of applicable Canadian securities laws (collectively, "forward-looking statements"). All statements herein, other than statements of historical fact, are forward-looking statements and are based upon various estimates and assumptions including, without limitation, the expectations and beliefs of management, including that the Company can access financing, appropriate equipment and sufficient labor. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate, and similar expressions, or are those, which, by their nature, refer to future events. Mawson cautions investors that any forward-looking statements are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as a result of various factors, including, but not limited to: capital and other costs varying significantly from estimates; changes in world metal markets; changes in equity markets; ability to achieve goals; that the political environment in which the Company operates will continue to support the development and operation of mining projects; the threat associated with outbreaks of viruses and infectious diseases, including the novel COVID-19 virus; risks related to negative publicity with respect to the Company or the mining industry in general; reliance on a single asset; planned drill programs and results varying from expectations; unexpected geological conditions; local community relations; dealings with non-governmental organizations; delays in operations due to permit grants; environmental and safety risks; and other risks and uncertainties disclosed under the heading "Risk Factors" in Mawson's most recent Annual Information Form filed on www.sedar.com. While these factors and assumptions are considered reasonable by Mawson, in light of management's experience and perception of current conditions and expected developments, Mawson can give no assurance that such expectations will prove to be correct. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Mawson disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

Figure 1: Plan of Mawson's Victorian tenements and joint venture areas, showing location of shallow orogenic (epizonal) Fosterville-style mineralization.

Figure 2: Cross section below the Whroo Open Pit showing planned hole MDDBC001 and historic drill hole Whroo1.

Figure 3: Plan showing detailed LiDAR survey which extended the previously mapped Whroo historic mining field from 10 kilometres strike to 14 kilometres. GIS based data analytics also identified 34.5k individual workings over 63km 2 (~550 per km 2 ) and classified the data as alluvial vs hard rock in character.

Table 1: Collar information from Mawson's drilling at the Doctor Gully Project

Coordinate Reference System GDA94, Zone 55 (EPSG:28355)

Area | Hole_ID | Easting | Northing | Dip | Azimuth | RL (m) | Depth (m) | Date Reported |

Doctors Gully | MDDDG001 | 319180 | 5942022 | -50 | 255 | 181 | 90.6 | Here |

Doctors Gully | MDDDG002 | 319144 | 5941919 | -50 | 75 | 188.7 | 98.1 | Here |

Doctors Gully | MDDDG003 | 319131 | 5941912 | -64 | 075 | 150 | 141.8 | Here |

Table 2: Intersections from Mawson's drilling from the Doctors Gully Project. Intersections are reported with a lower cut of 0.5 g/t Au cut over 1.0 metre width.

Hole_ID | From (m) | To (m) | Width (1) (m) | Au g/t |

MDDDG001 | 34.8 | 35.1 | 0.3 | 1.4 |

MDDDG001 | 36.1 | 37.1 | 1.0 | 1.1 |

MDDDG001 | 40.0 | 40.7 | 0.7 | 1.4 |

MDDDG001 | 45.3 | 46.3 | 1.0 | 2.9 |

MDDDG001 | 47.6 | 48.7 | 1.1 | 0.7 |

MDDDG001 | 66.7 | 67.7 | 1.0 | 0.5 |

MDDDG001 | 71.7 | 75.5 | 3.8 | 0.7 |

MDDDG003 | 8.4 | 9.4 | 1.0 | 0.8 |

MDDDG003 | 11.0 | 12.0 | 1.0 | 0.5 |

MDDDG003 | 24.7 | 26.2 | 1.6 | 1.9 |

SOURCE: Mawson Gold Limited

View source version on accesswire.com:

https://www.accesswire.com/672795/Mawson-Drilling-Under-the-Balaclava-Open-Pit-at-Whroo-Victoria-Australia