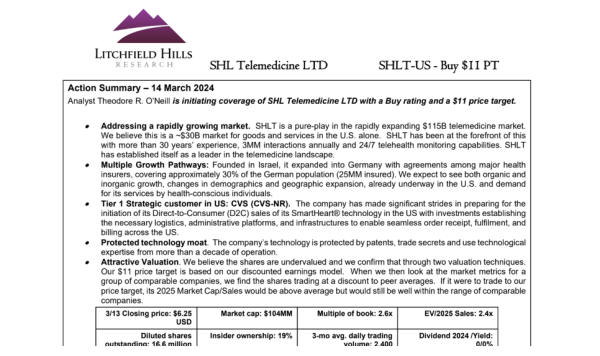

In a recent equity research report, Litchfield Hills Research LLC has initiated coverage on SHL Telemedicine Ltd. (NASDAQ: SHLT) (SIX: SHLTN) with a compelling 'Buy' rating and an ambitious $11.00 price target. This target suggests a significant upside potential of approximately 76% from the closing price of $6.25 on March 13, 2024. The report, authored by seasoned analyst Theodore R. O’Neill, highlights SHL Telemedicine's strong positioning in the rapidly growing telemedicine market, which is currently valued at an estimated $115 billion globally.

SHL Telemedicine, with over three decades of experience in the field, has established itself as a leader in providing advanced personal telemedicine solutions. The company boasts an impressive track record of 3 million interactions annually and offers 24/7 telehealth monitoring capabilities. Its expansion into the German market, covering approximately 30% of the population (25 million insured), underscores its strategic growth and the broad acceptance of its telemedicine solutions.

Recent announcements regarding steps and partnerships in in the United States represent SHL's significant strides in the direct-to-consumer (D2C) sales of its SmartHeart® technology. This move is part of SHL's broader strategy to penetrate the U.S. market, leveraging its innovative technology and comprehensive telemedicine solutions.

The report emphasizes SHL Telemedicine's robust technology moat, protected by patents, trade secrets, and over a decade of technological expertise. This competitive advantage is critical in the telemedicine industry, where innovation and data security are paramount.

Litchfield Hills Research's valuation of SHL Telemedicine is based on a discounted earnings model, reflecting the company's future earnings potential. The analysis suggests that SHL's shares are currently undervalued, presenting a lucrative opportunity for investors. The firm's $11 price target is supported by comparisons with a group of peer companies, indicating that SHL's shares are trading at a discount to peer averages.

The telemedicine market's growth is driven by several factors, including the rising demand for remote healthcare solutions, the prevalence of chronic diseases, an aging global population, and technological advancements. SHL Telemedicine's solutions are well-positioned to address these trends, offering remote monitoring and management for prevalent conditions such as cardiovascular diseases.

Despite the optimistic outlook, the report also acknowledges the risks associated with the highly regulated and competitive nature of the telemedicine industry. However, SHL Telemedicine's strategic initiatives, technological edge, and market positioning mitigate these risks, supporting the bullish price target.

Litchfield Hills Research's report on SHL Telemedicine Ltd. presents a strong case for the company's growth potential in the burgeoning telemedicine market. With a 'Buy' rating and a $11.00 price target, SHL Telemedicine represents an attractive investment opportunity, poised for significant upside in the coming months. Investors and stakeholders in the healthcare technology sector will undoubtedly watch SHL's progress closely, as it continues to innovate and expand its reach in the global telemedicine landscape.

The full report is available at the following link: https://bit.ly/shltinitiation

Disclaimer: The report is subject to FINRA and other disclaimers and disclosures provided by Litchfield Hills Research (LHR), which should be read alongside the full report. The information aforementioned it not intended to serve as financial or investment advice and may include inadvertent inaccuracies or mistakes. Automated AI systems may have been involved in the production of this content. This syndication of news is for informational purposes only and readers must do their own research and consult licensed professionals. Global market news syndication is a commercial news syndication and amplification service democratizing news around the world and is subject to conflicts of interest and compensation for its services. The report and this publication of it may include forward looking information which cannot be guaranteed and should not be construed as any form of guarantee, prediction or promise. Global Market News Syndication is a digital finance news syndication brand and holds no licenses and make no representation or warranties regarding the information above.

Media Contact

Company Name: Global Market News Syndication

Contact Person: Arnold Benjamin

Email: Send Email

Country: United Kingdom

Website: https://www.futuremarketsresearch.com/