Splash Beverage Group (NYSE: SBEV) stock is trading off its 52-week highs. But here's the interesting part of that statement: Despite its lower share price, SBEV is better positioned today compared to then to accelerate growth. In others words, those investors liking SBEV stock at higher prices should love it now. And that's not an overzealous commitment. On the contrary, plenty of evidence validates that SBEV is on the verge of a 2023 breakout.

Need proof. To start, SBEV is benefiting from a large number of signed distribution and retail placement agreements with many of the world's largest wholesalers and retailers, including several of the biggest Anheuser-Busch (NYSE: BUD) product distributorships and retail giants Walmart (NYSE: WMT), Target (NYSE: TGT), and many Walmart- owned Sam's Club locations. That's not all. While those deals are impressive, they are far from the only value drivers. Additional distribution and retail agreements leverage the strength of market-dominant broad-line partners, facilitating a pathway for Splash to penetrate other national and regional chains. Reaching into those channels can do more than accelerate SBEV's growth; they provide a competitive edge to assist SBEV in getting its products on more shelves across the country and tap more deeply into a beverage market expected to eclipse $1.8 trillion in 2024.

The most attractive part of SBEV's market opportunity- it's historically recession-proof. And that's especially true for companies and brands offering better products that are competitively positioned to maintain and build share. Splash Beverage Group checks those boxes, with brands like TapouT performance hydration and recovery drink, SALT, Copa Di Vino, and Pulpoloco offering more than premium quality; they are also produced, packaged, priced, and marketed in an eco-friendly way. In fact, some of SBEV's packaging technology - especially CartoCan, with its applications scalable across any beverage SKU - could be worth billions on its own.

Video Link: https://www.youtube.com/embed/Xajh4HAtrPs

An Award Winning Product Portfolio

Until then, and not discounting that packaging deals could come sooner than later, the focus is on the strength of SBEV's brands, any of which could deliver millions in sales per quarter. But appraising SBEV as a single shot on goal company is shortsighted. This company is pushing a multiple-product portfolio with combined potential putting transformational growth opportunities in SBEV's crosshairs.

That's not an overly exuberant assumption. Remember, SBEV and its brands are managed by members of the same development team that took the RedBull Energy drink from zero to billions. But here's the difference: SBEV is focused on bringing already-marketed brands under its management. In other words, while it took time for RedBull to get its market footing, SBEV's products have a running start and the potential to earn leadership positions in their respective segments. That's no coincidence.

It results from Splash Beverage Group earning its place as an innovator in the beverage industry by meticulously developing its growing portfolio of alcoholic and non-alcoholic beverage brands. But beyond the importance of brand strength, SBEV management knows how to monetize them through a proven strategy of rapidly developing early-stage brands, creating a national market, and then capitalizing on the high visibility of that brand and maximizing the market opportunity from products being innovators in their categories. They currently market four.

SALT Tequila is one, and it continues to accrue national deals allowing it to target a significant niche in the tequila markets, one expected to surge to an over $18.5 billion market by 2028. SBEV's SALT is a 100% agave, 80-proof tequila brand already attracting a substantial consumer base in a flavored spirits market experiencing double-digit growth. Offering premium chocolate, berry, and citrus-flavored tequila, SALT Tequila is ideally and uniquely positioned to do more than exploit that potential; it can dominate the category. Incidentally, a 42-store deal with Walmart's wholly-owned Sam's Club, among others, is making that a mission in progress.

SBEV Value Proposition: Product Strength And Innovative Packaging Technology

Other SBEV brands intend to deliver similar revenue-generating impacts. Copa Di Vino and Pulpoloco sangria are also changing the landscape in their respective segments. Single-serve Copa Di Vino wine earned national attention by being the only product featured twice on the popular investment show Shark Tank. A testament to Copa's taste, position, and potential, every "shark" wanted a piece of that deal. Notably, it was more than just the great taste they were after; its value as a leader in package sealing technology was also individually recognized for its potential to open near-limitless monetization opportunities for SBEV. Its eco-friendly specifications are so revolutionary that Copa Di Vino can remain fresh for up to a year, compared to competing brands having a sell-by date of months or even days.

Pulpoloco, SBEV's made in Madrid, Spain, sangria, is another. It, too, is earning an increasing share of attention and segment sales. But more than great taste, there's an inherent value kicker. This best-in-class product has an innovative and marketable packaging technology that many have called the most socially conscious and eco-friendly packaging on the market: CartoCan. SBEV holds exclusive rights to the unique packaging technology, which is excellent news as CartoCan has the potential to be the most sought-after packaging in the beverage industry. That's an ambitious but well-supported presumption. Why?

Because in addition to being 100% biodegradable, the innovative packaging technology is 30% more eco-friendly than aluminum or PET, uses 30% less total raw materials to create, and the raw materials used come entirely from renewable sources. That includes using only wood fibers from forests managed in an exemplary fashion, which has led to CartoCan packaging earning the exclusive right to bear the Forest Stewardship Council (FSC) label. And like Copa, the CartoCan keeps Pulpoloco shelf-stable for at least a year, keeping the vibrant character of its taste profile well-protected during that time.

A fourth asset is earning significant marketing traction: TapouT performance, hydration, and recovery drink.

TapouT Is a Sector Drink Game Changer

TapouT is accruing significant market traction as a true performance beverage focusing on active hydration that encompasses activation, electrolyte restoration during exercise, and complete recovery following a workout. Different than other marketed sports drinks, TapouT is formulated to provide an optimized mix of the vitamins, minerals, antioxidants, electrolytes, and sugars necessary to drive cellular hydration in the muscles and other body parts requiring fluids, fueling them during the activity and facilitating their replenishment during the body's recovery process. Similar to SBEV's other products, its differences are advantages.

The biggest is that TapouT performance drinks aren't formulated as protein drinks to help people bulk up or as caffeinated energy beverages giving a false boost at the start of a workout. Instead, TapouT performance drinks are consciously balanced to provide the optimal nutrients and hydration for best performance and recovery. Still, while different, it does fit into a billion-dollar market segment that expands its reach beyond the general water, fortified water beverages, protein drinks, and energy drinks categories.

While it may enjoy crossover sales, TapouT is marketed as a balanced performance beverage that boosts hydration, performance, and recovery from one drink source. Its primary target market is focused on earning business from the active consumer looking for a balanced blend of nutrients, such as electrolytes and vitamins, that will optimize performance and speed up recovery after intense physical exertion. In other words, SBEV is creating a category through marketing a better, more genuine product that provides beneficial results without gimmicky caffeine-induced side effects.

Having excellent products matters, but investors want proof they are as good as claimed. SBEV is delivering better than expected.

A Steepening Revenue Trajectory

In fact, its revenue streams are steepening. Revenues in 2021 were more than 2000% higher than those posted the prior year. They continued that trend in 2022, with SBEV posting record sales in Q2 and then besting them again in Q3 with a 73% increase over the same period in the prior year. Deals signed throughout 2022 and more in 2023 suggest revenue growth will continue. Proof of that could be shown through its imminent Q4 and full-year 2022 financials expected at the end of March.

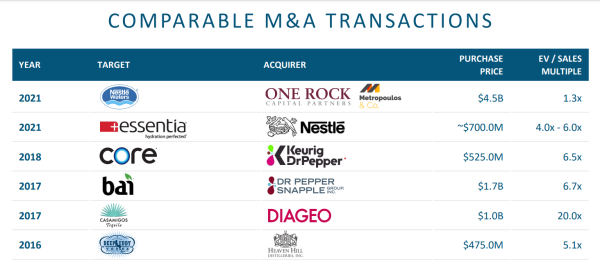

Keep this in mind: revenues matter from more than an income report standpoint. By continuing to develop its portfolio, acquiring new profitable brands, and inking distribution agreements, SBEV is doing more than adding potentially massive value to its balance sheet; its brands also become acquisition targets whereby SBEV could spin out assets at industry valuation multiples averaging about 7x revenue. In some cases, valuations went as high as 20x for those creating leadership positions in new categories. SBEV could be in the sweet spot of that opportunity, especially when potentially challenging markets lead to more disciplined investment decisions.

In other words, sector behemoths will turn to products already running to quench thirsty portfolios. With SBEV's assets meeting that criteria, they could have four beverage assets others want and need. Remember, a foot of shelf space lost can be worth millions in sales to a brand. Thus, with SBEV's retail footprint getting larger, and with that space finite, others are losing. And make no mistake, "big beverage" does not like to lose shelf space, which has led to years of promising upstart brands getting purchased at massive premiums.

That scenario could bode well for SBEV. During investor calls, management has said they are comfortable playing the role of brand incubator with an end-game to sell certain developed assets to the highest bidder. Knowing management pedigree, not just any size bid; precedent suggests they entertain the highest, keeping things interesting for themselves and investors as its innovative brand portfolio continue to score additional market share. Simply put, 2023 could be an exciting year for SBEV, and for those considering, its investors too.

Disclaimers: Shore Thing Media, LLC. (STM, Llc.) is responsible for the production and distribution of this content. STM, Llc. is not operated by a licensed broker, a dealer, or a registered investment adviser. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The information made available by STM, Llc. is not intended to be, nor does it constitute, investment advice or recommendations. The contributors may buy and sell securities before and after any particular article, report and publication. In no event shall STM, Llc. be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or made available by STM, Llc., including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information in this video, article, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. STM, Llc. strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. For some content, STM, Llc., its authors, contributors, or its agents, may be compensated for preparing research, video graphics, and editorial content. STM, LLC has been compensated up to ten-thousand-dollars cash via wire transfer by a third party to produce and syndicate content for Splash Beverage Group, Inc. for a period of one month ending on 4/15/23. As part of that content, readers, subscribers, and website viewers, are expected to read the full disclaimers and financial disclosures statement that can be found on our website. The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled.

Media Contact

Company Name: STM, LLC.

Contact Person: Michael Thomas

Email: contact@primetimeprofiles.com

Phone: 917-773-0072

Country: United States

Website: https://primetimeprofiles.com/